Question: Problem 7 - 4 9 ( LO 7 - 2 ) ( Algo ) In 2 0 2 4 , Tom and Alejandro Jackson (

Problem LO Algo

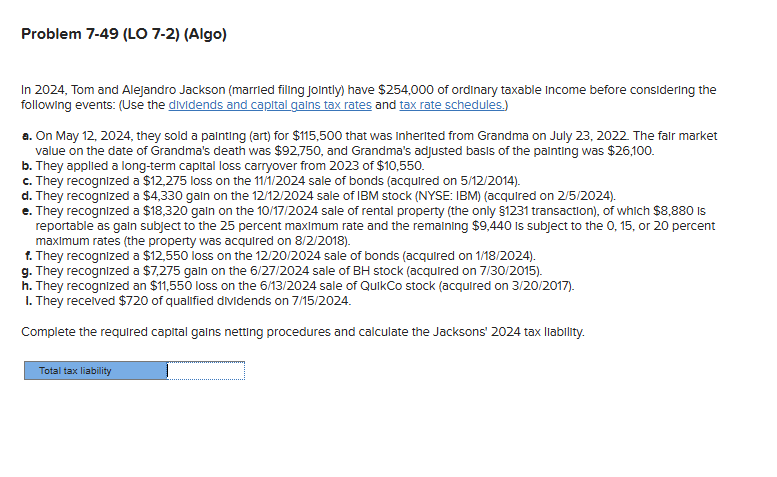

In Tom and Alejandro Jackson married filing Jointly have $ of ordinary taxable income before considering the

following events: Use the dividends and capital galns tax rates and tax rate schedules.

a On May they sold a painting art for $ that was Inherited from Grandma on July The fair market

value on the date of Grandma's death was $ and Grandma's adjusted basis of the palnting was $

b They appled a longterm capital loss carryover from of $

c They recognized a $ loss on the sale of bonds acquired on

d They recognized a $ gain on the $ gain on the $ transaction$ is

reportable as gain subject to the percent maximum rate and the remaining $ $ loss on the sale of bonds acquired on

g They recognized a $ gain on the $ loss on the $ of qualified dividends on

Complete the required capital galns netting procedures and calculate the Jacksons' tax Ilability. Tax Rates for Net Capital Gains and Qualified Dividends

This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table net capital gains and qualified dividends are included in taxable income last for this purpose Tax Rate Schedules

Individuals

Schedule XSingle

Schedule YMarried Filing Jointly or Qualifying surviving spouse

Schedule ZHead of Household

Schedule YMarried Filing Separately

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock