Question: Problem 7 A machine that was purchased 4 years ago was expected to be kept in service for its projected 9 year life, but a

Problem

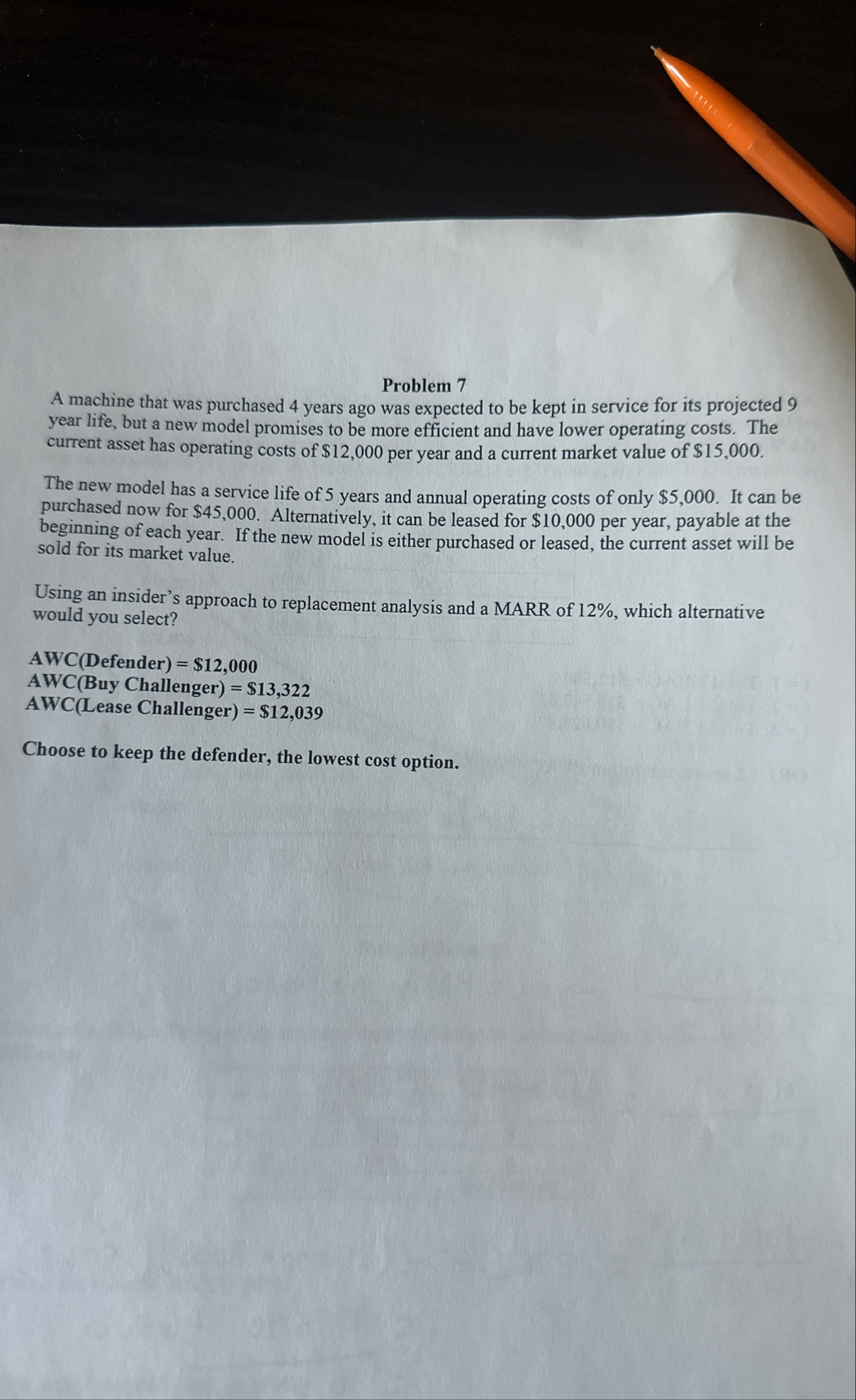

A machine that was purchased years ago was expected to be kept in service for its projected year life, but a new model promises to be more efficient and have lower operating costs. The current asset has operating costs of $ per year and a current market value of $

The new model has a service life of years and annual operating costs of only $ It can be purchased now for $ Alternatively, it can be leased for $ per year, payable at the beginning of each year. If the new model is either purchased or leased, the current asset will be sold for its market value.

Using an insider's approach to replacement analysis and a MARR of which alternative would you select?

AWCDefender

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock