Question: Problem 7. Assume that the expected return on the market is 12% and the risk-free rate of return is 3%. Your broker tells you that

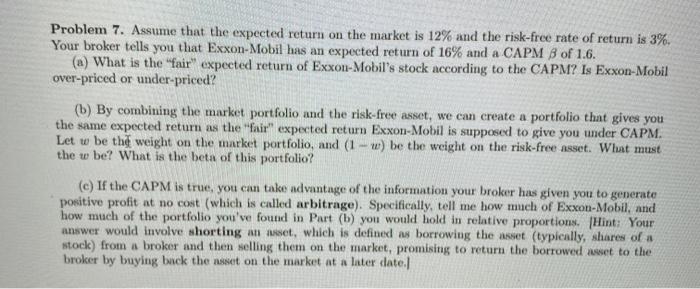

Problem 7. Assume that the expected return on the market is 12% and the risk-free rate of return is 3%. Your broker tells you that Exxon-Mobil has an expected return of 16% and a CAPM 8 of 1.6. (a) What is the "fair" expected return of Exxon-Mobil's stock according to the CAPM? Is Exxon Mobil over-priced or under-priced? (b) By combining the market portfolio and the risk-free assot, we can create a portfolio that gives you the same expected return as the "fair" expected return ExxonMobil is supposed to give you under CAPM. Let w be the weight on the market portfolio, and (1 - w) be the weight on the risk-free asset. What must the w be? What is the beta of this portfolio? (e) If the CAPM is true, you can take advantage of the information your broker has given you to generate positive profit at no cost (which is called arbitrage). Specifically, tell me how much of Exxon-Mobil, and how much of the portfolio you've found in Part (b) you would hold in relative proportions. (Hint: Your answer would involve shorting an awet, which is defined as borrowing the asset (typically, shares of a stock) from a broker and then selling them on the market, promising to return the borrowed wwet to the broker by buying back the asset on the market at a later date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts