Question: Problem 7. Boeing is considering undertaking a new investment project in a new airplane. The cost of the initial investment is $7 million in year

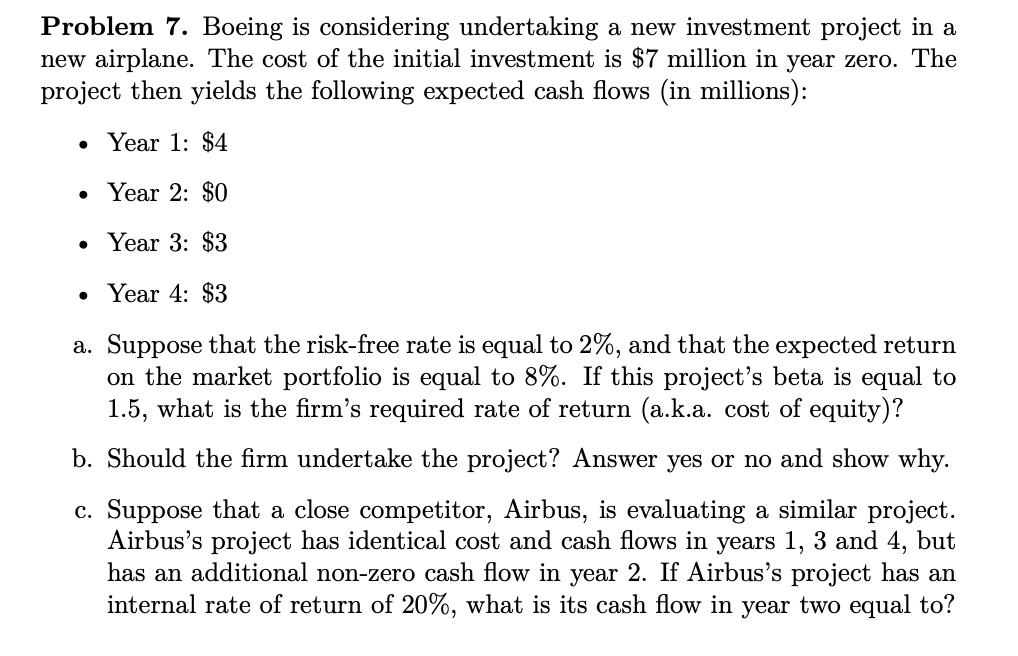

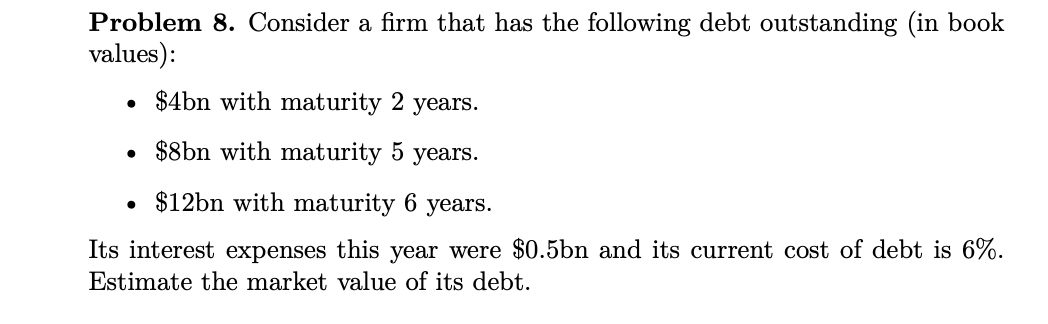

Problem 7. Boeing is considering undertaking a new investment project in a new airplane. The cost of the initial investment is $7 million in year zero. The project then yields the following expected cash flows (in millions): - Year 1: $4 - Year 2: \$0 - Year 3: $3 - Year 4: \$3 a. Suppose that the risk-free rate is equal to 2%, and that the expected return on the market portfolio is equal to 8%. If this project's beta is equal to 1.5, what is the firm's required rate of return (a.k.a. cost of equity)? b. Should the firm undertake the project? Answer yes or no and show why. c. Suppose that a close competitor, Airbus, is evaluating a similar project. Airbus's project has identical cost and cash flows in years 1,3 and 4 , but has an additional non-zero cash flow in year 2. If Airbus's project has an internal rate of return of 20%, what is its cash flow in year two equal to? Problem 8. Consider a firm that has the following debt outstanding (in book values): - \$4bn with maturity 2 years. - \$8bn with maturity 5 years. - $12 bn with maturity 6 years. Its interest expenses this year were $0.5bn and its current cost of debt is 6%. Estimate the market value of its debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts