Question: Problem 7 - Capital Budgeting Cash Flow Analysis for Proposed Equipment Investment Business Solutions Cash Flow Analysis - Equipment Investment Expected Expected Net Accrual Figures

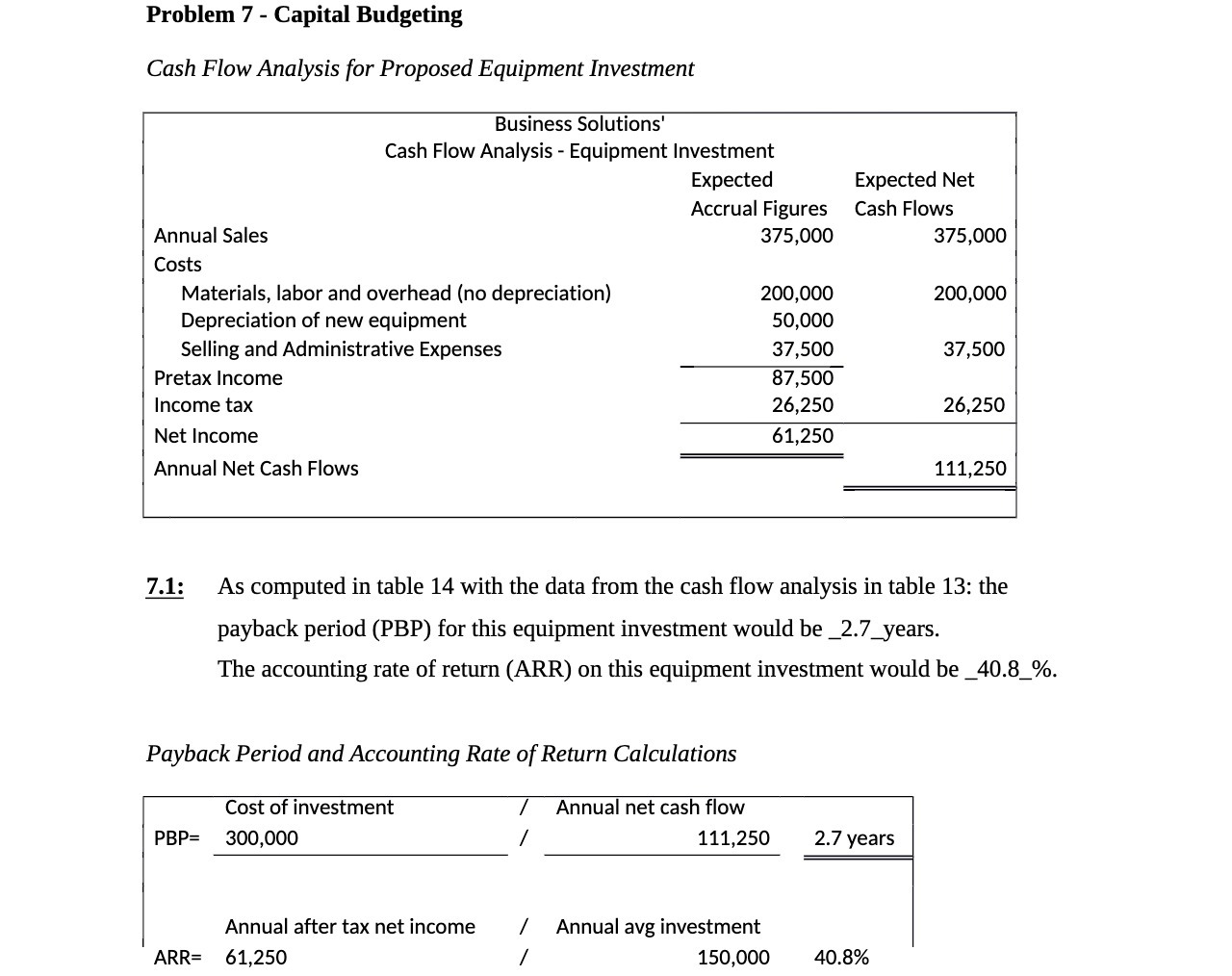

Problem 7 - Capital Budgeting Cash Flow Analysis for Proposed Equipment Investment Business Solutions Cash Flow Analysis - Equipment Investment Expected Expected Net Accrual Figures Cash Flows Annual Sales 375,000 375,000 Costs Materials, labor and overhead (no depreciation) 200,000 200,000 Depreciation of new equipment 50,000 Selling and Administrative Expenses 37,500 37,500 Pretax Income 87,500 Income tax 26,250 26,250 Net Income 61,250 Annual Net Cash Flows 111,250 7.1: As computed in table 14 with the data from the cash flow analysis in table 13: the payback period (PBP) for this equipment investment would be _2.7_years. The accounting rate of return (ARR) on this equipment investment would be _40.8_%. Payback Period and Accounting Rate of Return Calculations Cost of investment Annual net cash flow PBP= 300,000 111,250 2.7 years Annual after tax net income Annual avg investment ARR= 61,250 150,000 40.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts