Question: Problem 7. Consider a market maker in a call option written on a stock with the following information under the Black-Scholes framework (as per Chapter

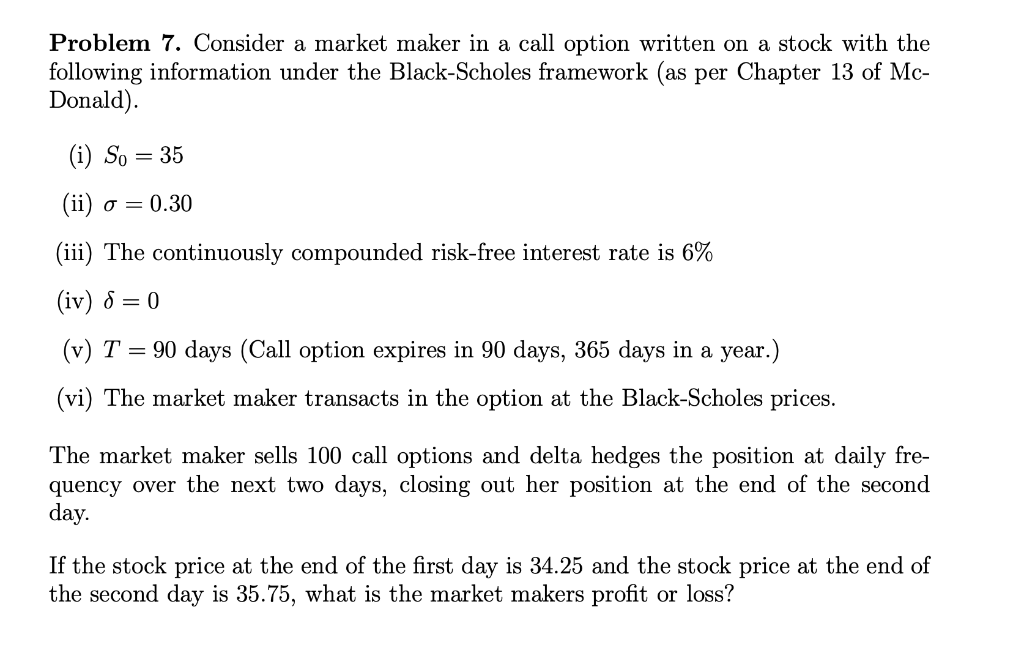

Problem 7. Consider a market maker in a call option written on a stock with the following information under the Black-Scholes framework (as per Chapter 13 of Mc- Donald). (i) So = 35 (ii) 0 = 0.30 (iii) The continuously compounded risk-free interest rate is 6% (iv) S = 0 (v) T = 90 days (Call option expires in 90 days, 365 days in a year.) (vi) The market maker transacts in the option at the Black-Scholes prices. The market maker sells 100 call options and delta hedges the position at daily fre- quency over the next two days, closing out her position at the end of the second day. If the stock price at the end of the first day is 34.25 and the stock price at the end of the second day is 35.75, what is the market makers profit or loss? Problem 7. Consider a market maker in a call option written on a stock with the following information under the Black-Scholes framework (as per Chapter 13 of Mc- Donald). (i) So = 35 (ii) 0 = 0.30 (iii) The continuously compounded risk-free interest rate is 6% (iv) S = 0 (v) T = 90 days (Call option expires in 90 days, 365 days in a year.) (vi) The market maker transacts in the option at the Black-Scholes prices. The market maker sells 100 call options and delta hedges the position at daily fre- quency over the next two days, closing out her position at the end of the second day. If the stock price at the end of the first day is 34.25 and the stock price at the end of the second day is 35.75, what is the market makers profit or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts