Question: Problem 7) Consider the following five mutually exclusive alternatives that have 10-year useful lives and no salvage value. If MARR is 9%, which alternative should

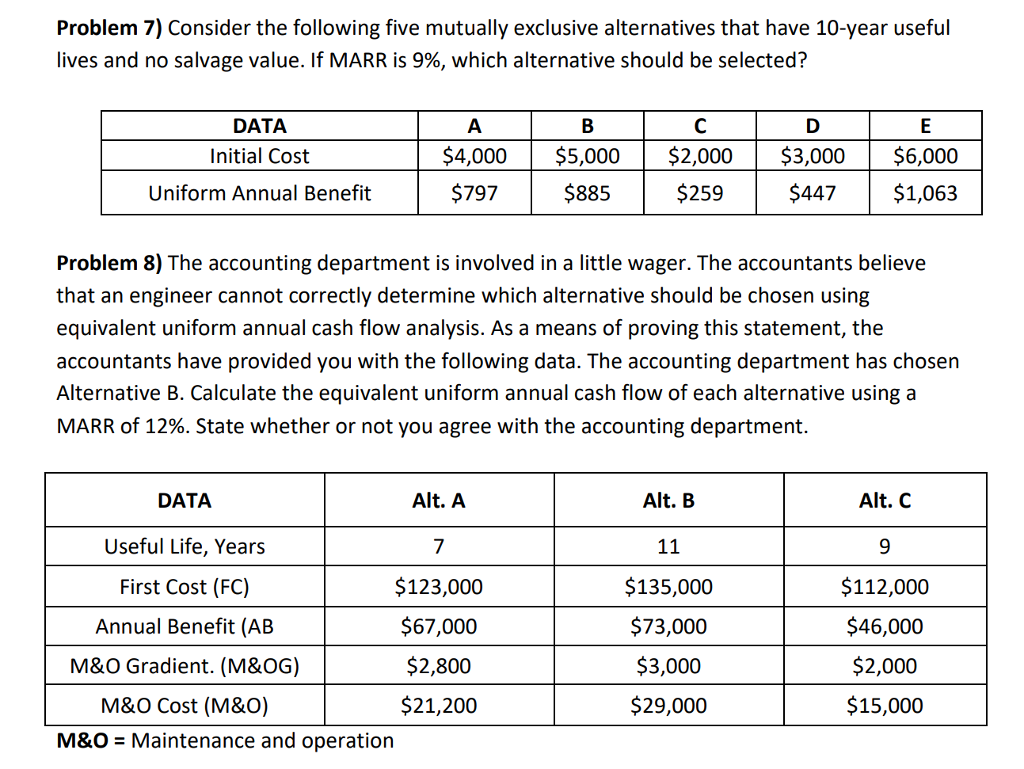

Problem 7) Consider the following five mutually exclusive alternatives that have 10-year useful lives and no salvage value. If MARR is 9%, which alternative should be selected? DATA Initial Cost Uniform Annual Benefit $4,000 $5,000 $2,000$3,000 $6,000 $259 $797 $885 $447$1,063 Problem 8) The accounting department is involved in a little wager. The accountants believe that an engineer cannot correctly determine which alternative should be chosen using equivalent uniform annual cash flow analysis. As a means of proving this statement, the accountants have provided you with the following data. The accounting department has chosen Alternative B. Calculate the equivalent uniform annual cash flow of each alternative using a MARR of 12%. State whether or not you agree with the accounting department. Alt. A Alt. B Alt. C DATA Useful Life, Years First Cost (FC) Annual Benefit (AB M&O Gradient. (M&OG) M&O Cost (M&O) $123,000 $67,000 $2,800 $21,200 $135,000 $73,000 $3,000 $29,000 $112,000 $46,000 $2,000 $15,000 M&O = Maintenance and operation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts