Question: Problem 7 During 2 0 2 4 , Peter had a long - term capital gain on the sale of a vacant lot in the

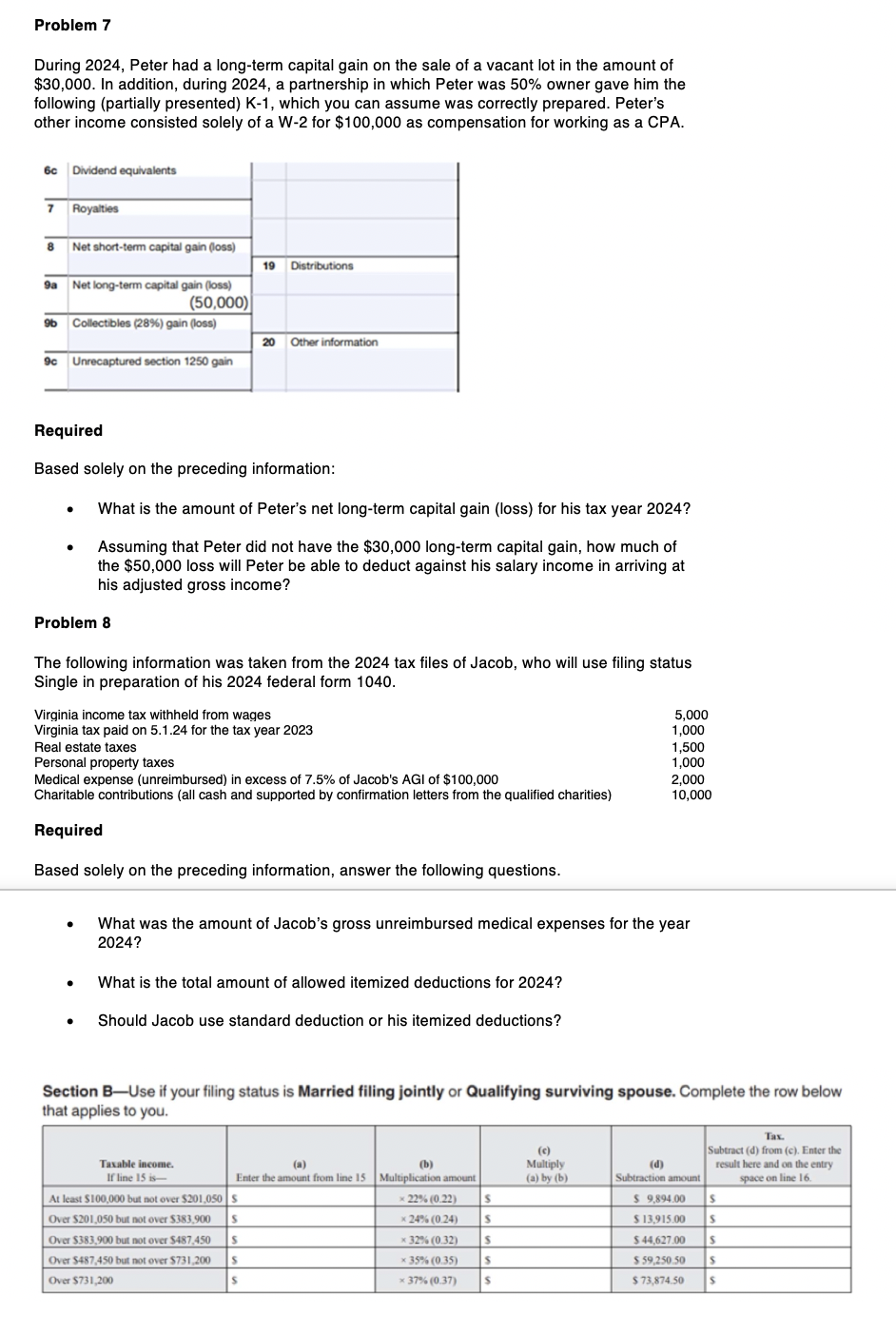

Problem During Peter had a longterm capital gain on the sale of a vacant lot in the amount of $ In addition, during a partnership in which Peter was owner gave him the following partially presented K which you can assume was correctly prepared. Peters other income consisted solely of a W for $ as compensation for working as a CPA. Required Based solely on the preceding information: What is the amount of Peters net longterm capital gain loss for his tax year Assuming that Peter did not have the $ longterm capital gain, how much of the $ loss will Peter be able to deduct against his salary income in arriving at his adjusted gross income? Problem The following information was taken from the tax files of Jacob, who will use filing status Single in preparation of his federal form Virginia income tax withheld from wages Virginia tax paid on for the tax year Real estate taxes Personal property taxes Medical expense unreimbursed in excess of of Jacob's AGI of $ Charitable contributions all cash and supported by confirmation letters from the qualified charities Required Based solely on the preceding information, answer the following questions. What was the amount of Jacobs gross unreimbursed medical expenses for the year What is the total amount of allowed itemized deductions for Should Jacob use standard deduction or his itemized deductions?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock