Question: Problem 7 : On January 1 , 2 0 x 1 , Mute Construction Corp. with a customer to The following are the data available

Problem : On January x Mute Construction Corp. with a customer to The following are the data available of the contract:

Compute the realized gross profit loss profit in :

a

c

b

d

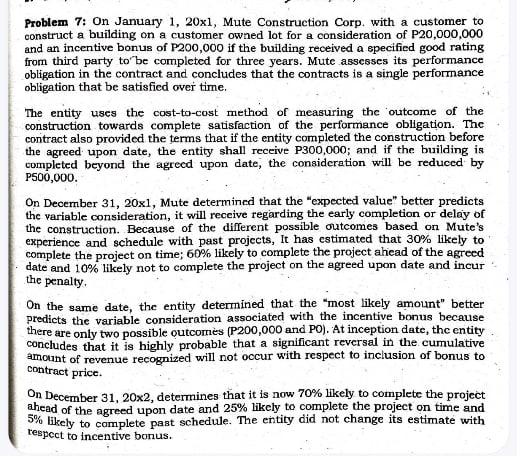

construct a building on a customer owned lot for a consideration of P

and an incentive bonus of P if the building received a specified good rating

from third party to'be completed for three years. Mute assesses its performance

obligation in the contract and concludes that the contracts is a single performance

obligation that be satisfied over time.

The entity uses the costtocost method of measuring the outcome of the

construction towards complete satisfaction of the performance obligation. The

contract also provided the terms that if the entity completed the construction before

the agreed upon date, the entity shall receive ; and if the building is

completed beyond the agreed upon date, the consideration will be reduced by

PSO

On December Mute determined that the "expected value" better predicts

the variable consideration, it will receive regarding the early completion or delay of

the construction. Because of the different possible outcomes based on Mute's

experience and schedule with past projects, It has estimated that likely to

complete the project on time; likely to complete the project ahead of the agreed

date and likely not to complete the project on the agreed upon date and incur

the penalty.

On the same date, the entity determined that the "most likely amount" better

predicts the variable consideration associated with the incentive bonus because

there are only two possible outcomes and PO At inception date, the entity

concludes that it is highly probable that a significant reversal in the cumulative

amount of revenue recognized will not occur with respect to inclusion of bonus to

contract price.

On December times determines that it is now likely to complete the project

ahead of the agreed upon date and likely to complete the project on time and

likely to complete past schedule. The entity did not change its estimate with

respect to incentive bonus.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock