Question: Problem 7) Ratios (you should be able to interpret ratios) a) Based on the following table, discuss the firm's liquidity position (2-3 sentences). 2016 (forecasted)

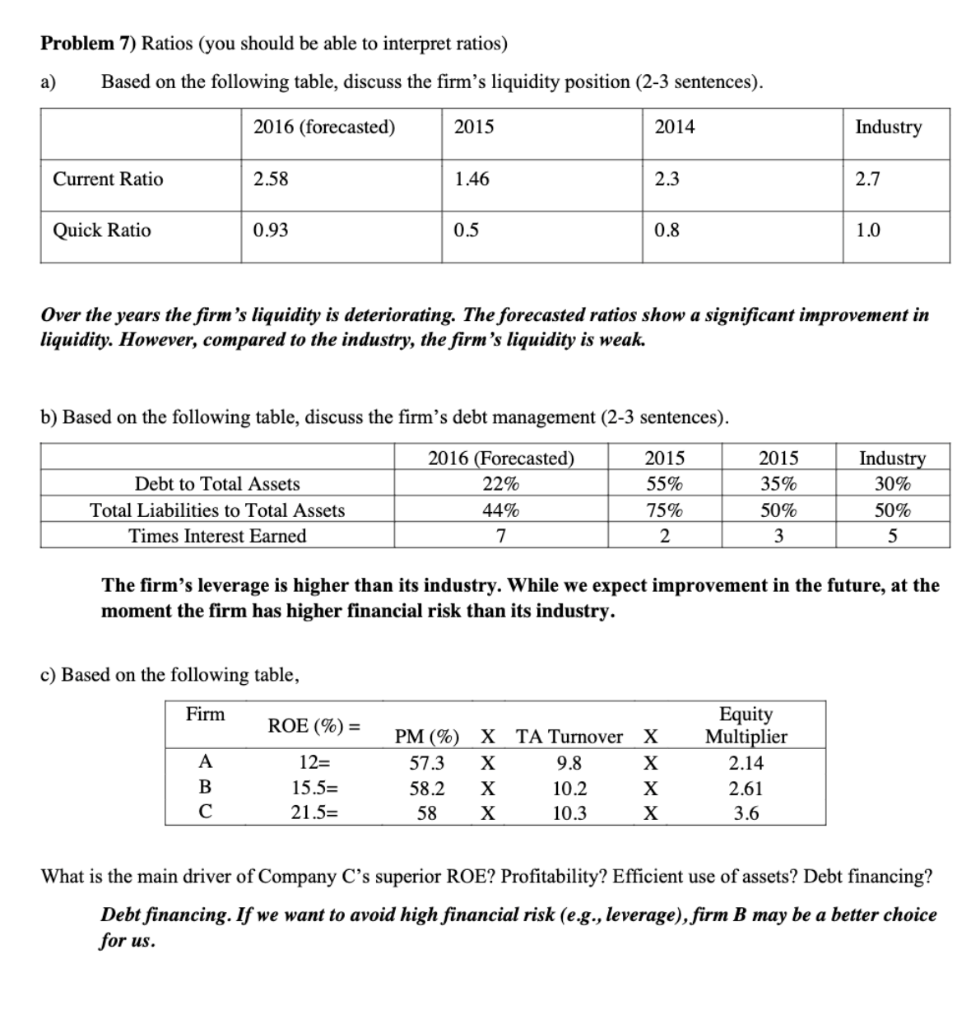

Problem 7) Ratios (you should be able to interpret ratios) a) Based on the following table, discuss the firm's liquidity position (2-3 sentences). 2016 (forecasted) 2015 2014 Industry Current Ratio 2.58 1.46 2.3 2.7 Quick Ratio 0.93 0.5 0.8 1.0 Over the years the firm's liquidity is deteriorating. The forecasted ratios show a significant improvement in liquidity. However, compared to the industry, the firm's liquidity is weak. b) Based on the following table, discuss the firm's debt management (2-3 sentences). 2016 (Forecasted) 2015 Debt to Total Assets 22% 55% Total Liabilities to Total Assets 44% 75% Times Interest Earned 7 2 2015 35% 50% 3 Industry 30% 50% 5 The firm's leverage is higher than its industry. While we expect improvement in the future, at the moment the firm has higher financial risk than its industry. c) Based on the following table, Firm ROE (%) = A B 12= 15.5= 21.5= PM (%) X TA Turnover X 57.3 X 9.8 X 58.2 X 10.2 X 58 X 10.3 X Equity Multiplier 2.14 2.61 3.6 What is the main driver of Company C's superior ROE? Profitability? Efficient use of assets? Debt financing? Debt financing. If we want to avoid high financial risk (e.g., leverage), firm B may be a better choice for us

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts