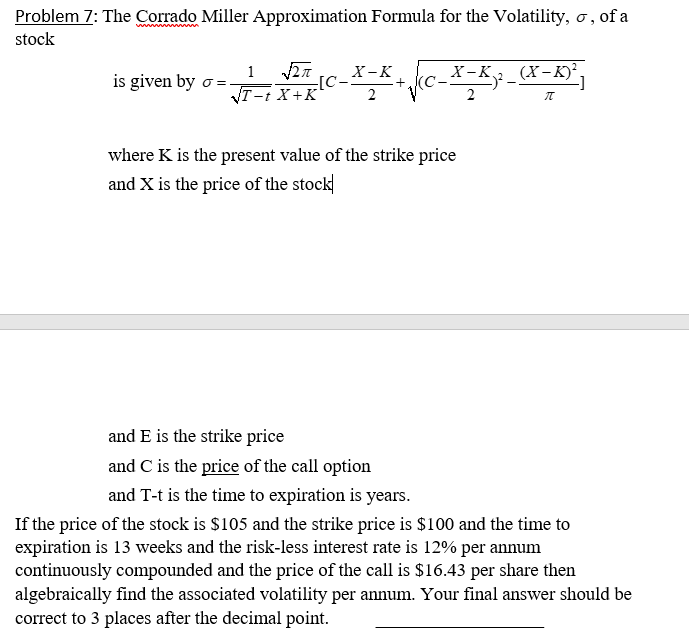

Question: Problem 7: The Corrado Miller Approximation Formula for the Volatility, , of a stock is given by =Tt1X+K2[C2XK+(C2XK)2(XK)2] where K is the present value of

Problem 7: The Corrado Miller Approximation Formula for the Volatility, , of a stock is given by =Tt1X+K2[C2XK+(C2XK)2(XK)2] where K is the present value of the strike price and X is the price of the stock and E is the strike price and C is the price of the call option and T-t is the time to expiration is years. If the price of the stock is $105 and the strike price is $100 and the time to expiration is 13 weeks and the risk-less interest rate is 12% per annum continuously compounded and the price of the call is $16.43 per share then algebraically find the associated volatility per annum. Your final answer should be correct to 3 places after the decimal point. Problem 7: The Corrado Miller Approximation Formula for the Volatility, , of a stock is given by =Tt1X+K2[C2XK+(C2XK)2(XK)2] where K is the present value of the strike price and X is the price of the stock and E is the strike price and C is the price of the call option and T-t is the time to expiration is years. If the price of the stock is $105 and the strike price is $100 and the time to expiration is 13 weeks and the risk-less interest rate is 12% per annum continuously compounded and the price of the call is $16.43 per share then algebraically find the associated volatility per annum. Your final answer should be correct to 3 places after the decimal point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts