Question: Problem 7: Using a dividend discount model, what is the true value of a stock that will pay a dividend of $3.00 one year from

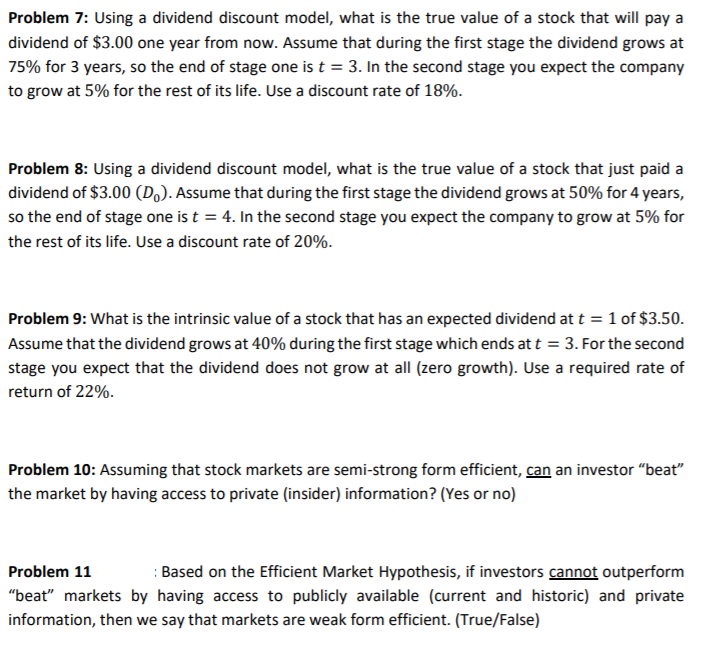

Problem 7: Using a dividend discount model, what is the true value of a stock that will pay a dividend of $3.00 one year from now. Assume that during the first stage the dividend grows at 75% for 3 years, so the end of stage one is t-3. In the second stage you expect the company to grow at 5% for the rest of its life. Use a discount rate of 18%. Problem 8: Using a dividend discount model, what is the true value of a stock that just paid a dividend of $3.00 (D. Assume that during the first stage the dividend grows at 50% for 4 years, so the end of stage one is t-4. In the second stage you expect the company to grow at 5% for the rest of its life. Use a discount rate of 20%. Problem 9: what is the intrinsic value of a stock that has an expected dividend at t = 1 of $3.50. Assume that the dividend grows at 40% during the first stage which ends at t-3. For the second stage you expect that the dividend does not grow at all (zero growth). Use a required rate of return of 22%. Problem 10: Assuming that stock markets are semi-strong form efficient, can an investor "beat" the market by having access to private (insider) information? (Yes or no) Based on the Efficient Market Hypothesis, if investors cannot outperform Problem 11 "beat" markets by having access to publicly available (current and historic) and private information, then we say that markets are weak form efficient. (True/False)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts