Question: Problem 7 . What will be the price per share of the combined firm assuming the market is fooled by the growth in EPS? a

Problem What will be the price per share of the combined firm assuming the market is fooled by the growth in EPS? a $ b $ $ d $ e None of the above

Problem What will be the new P E ratio of the combined firm if the NPV of the acquisition is zero and the market knows it a b c d e None of the abovePlease use the following information to answer the next TWO problems.

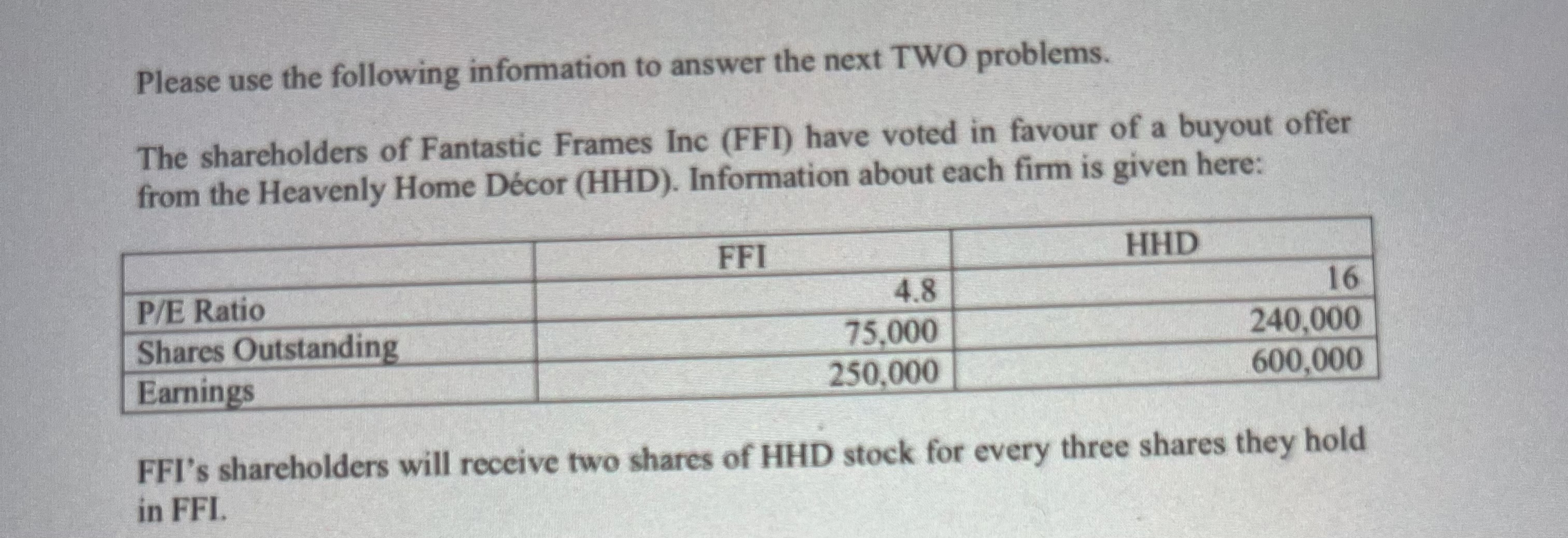

The shareholders of Fantastic Frames Inc FFI have voted in favour of a buyout offer from the Heavenly Home Dcor HHD Information about each firm is given here:

tableFFI,HHDPE Ratio,Shares Outstanding,Earnings

FFI's shareholders will receive two shares of HHD stock for every three shares they hold in FFL

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock