Question: Problem # 7 You establish a straddle on Walmart using September call and put options with a strike price of $54. The call premium is

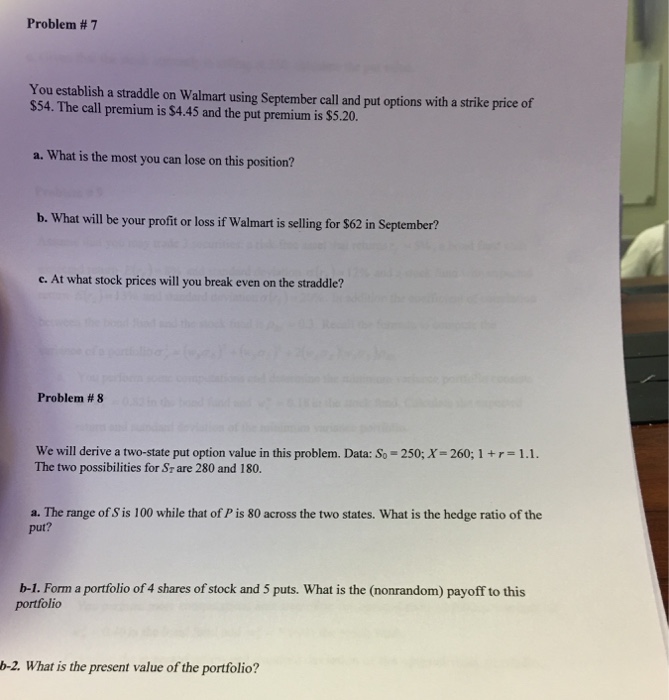

Problem # 7 You establish a straddle on Walmart using September call and put options with a strike price of $54. The call premium is $4.45 and the put premium is $5.20. a. What is the most you can lose on this position? b. What will be your profit or loss if Walmart is selling for $62 in September? c. At what stock prices will you break even on the straddle? Problem # 8 We will derive a two-state put option value in this problem. Data: So-250; X-260; 1 +?1.1. The two possibilities for S- are 280 and 180. a. The range of s is 100 while that of P is 80 across the two states. What is the hedge ratio of the put? b-1. Form a portfolio of 4 shares of stock and 5 puts. What is the (nonrandom) payoff to this portfolio b-2. What is the present value of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts