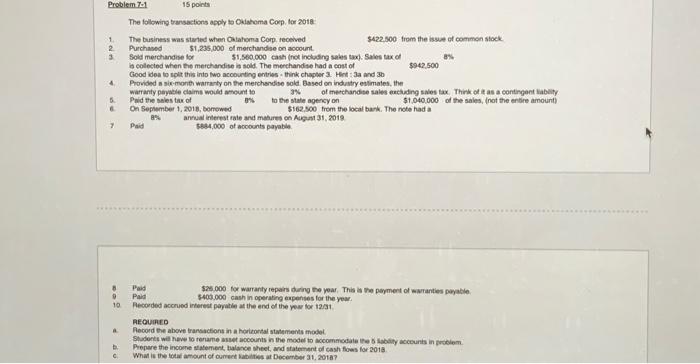

Question: Problem 7-1 1. 2. 3. 4. 5. 6. 7 8 9 10. a. 15 points The following transactions apply to Oklahoma Corp. for 2018: The

The following transactions apply so Odahema Corp. for aote: 1. The business was stulid when Olahoma Corp, recelved $422.500 from the issue of common stock. 2. Purchased $1,235,000 of morchandise on acoount. 3 Sold merchanole lor $1,560,000 cash (not including sales tux), Saltes tax ef as b colected when the merchandise is sold. The menchandise had a cost of $942,500 Good liba to tole thit into lwo accounting entries - think chapter 3 . Hint : 3 a and 30 4. Provided a six-monei warranty on the merchondise sold Based on induitry entimates, the 5. Prid the soles tix of to be state apency on $1,040,000 of the sales, (not the entire amount) 6. On Sephember 1, 2018, benowed $162.500 from the local bark. The note had a 7 Paid antual interest rate and matres on Augan 31,2019 stat,000 of acoounts payabie. B Paid $25,000 for warranity repairs diding the vear, This is the poyment of mananties peyable. Paid \$400.000 canh in operating expenses for the yew. 10 Aesorded acconed interest payalie at the end of the wew lor 12/31. AEOurro a. Recond the above transactions in a horitontal statements mosel. b. Pepare the income statement, talance sheet, med staterment of cash flows for 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts