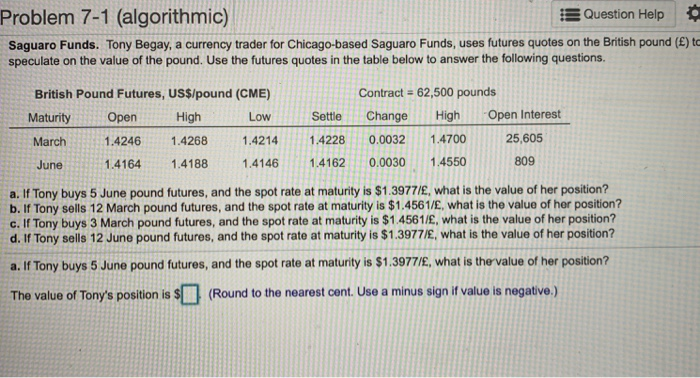

Question: Problem 7-1 (algorithmic) Question Help Saguaro Funds. Tony Begay, a currency trader for Chicago-based Saguaro Funds, uses futures quotes on the British pound () to

Problem 7-1 (algorithmic) Question Help Saguaro Funds. Tony Begay, a currency trader for Chicago-based Saguaro Funds, uses futures quotes on the British pound () to speculate on the value of the pound. Use the futures quotes in the table below to answer the following questions. British Pound Futures, US$/pound (CME) Maturity Open High Low March 1.4246 1.4268 1.4214 June 1.4164 1.4188 1.4146 Settle 1.4228 1.4162 Contract = 62,500 pounds Change High Open Interest 0.0032 1.4700 25,605 0.0030 809 0030 1.4550 a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3977/, what is the value of her position? b. If Tony sells 12 March pound futures, and the spot rate at maturity is $1.4561/, what is the value of her position? c. If Tony buys 3 March pound futures, and the spot rate at maturity is $1.4561/, what is the value of her position? d. If Tony sells 12 June pound futures, and the spot rate at maturity is $1.3977/, what is the value of her position? a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3977/, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent. Use a minus sign if value is negative.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts