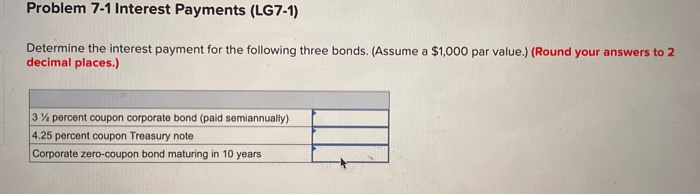

Question: Problem 7-1 Interest Payments (LG7-1) Determine the interest payment for the following three bonds. (Assume a $1,000 par value.) (Round your answers to 2 decimal

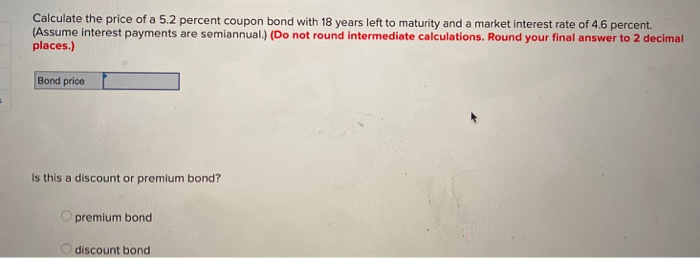

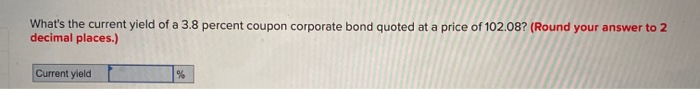

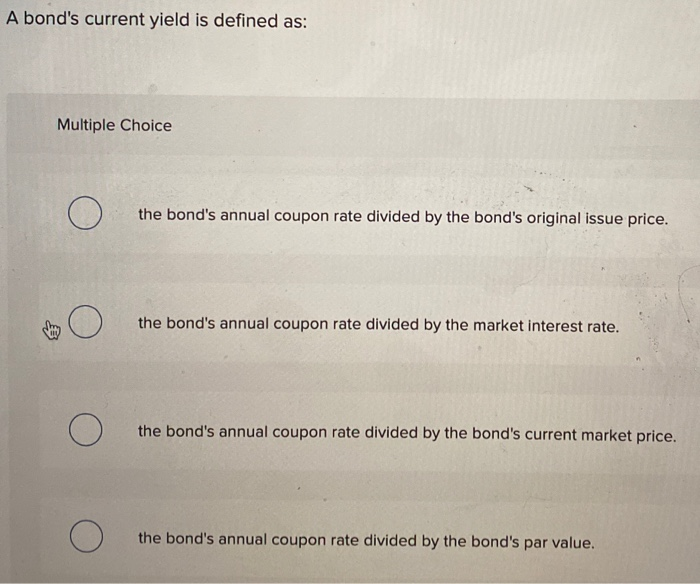

Problem 7-1 Interest Payments (LG7-1) Determine the interest payment for the following three bonds. (Assume a $1,000 par value.) (Round your answers to 2 decimal places.) 3% percent coupon corporate bond (paid semiannually) 4.25 percent coupon Treasury note Corporate zero-coupon bond maturing in 10 years Calculate the price of a 5.2 percent coupon bond with 18 years left to maturity and a market interest rate of 4.6 percent. (Assume interest payments are semiannual.) (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Bond price Is this a discount or premium bond? premium bond discount bond What's the current yield of a 3.8 percent coupon corporate bond quoted at a price of 102.08? (Round your answer to 2 decimal places.) Current yield % A bond's current yield is defined as: Multiple Choice the bond's annual coupon rate divided by the bond's original issue price. the bond's annual coupon rate divided by the market interest rate. the bond's annual coupon rate divided by the bond's current market price. the bond's annual coupon rate divided by the bond's par value. Which of the following terms means that during periods when interest rates change substantially, bondholders experience distinct gains and losses in their bond investments? Multiple Choice Reinvestment rate risk 0 Interest rate risk 0 Liquidity rate risk 0 Credit quality risk 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts