Question: Problem 7-10 Bond Quotes (LG7-3) Consider the following three bond quotes: a Treasury bond quoted at 106.438, a corporate bond quoted at 96.55, and a

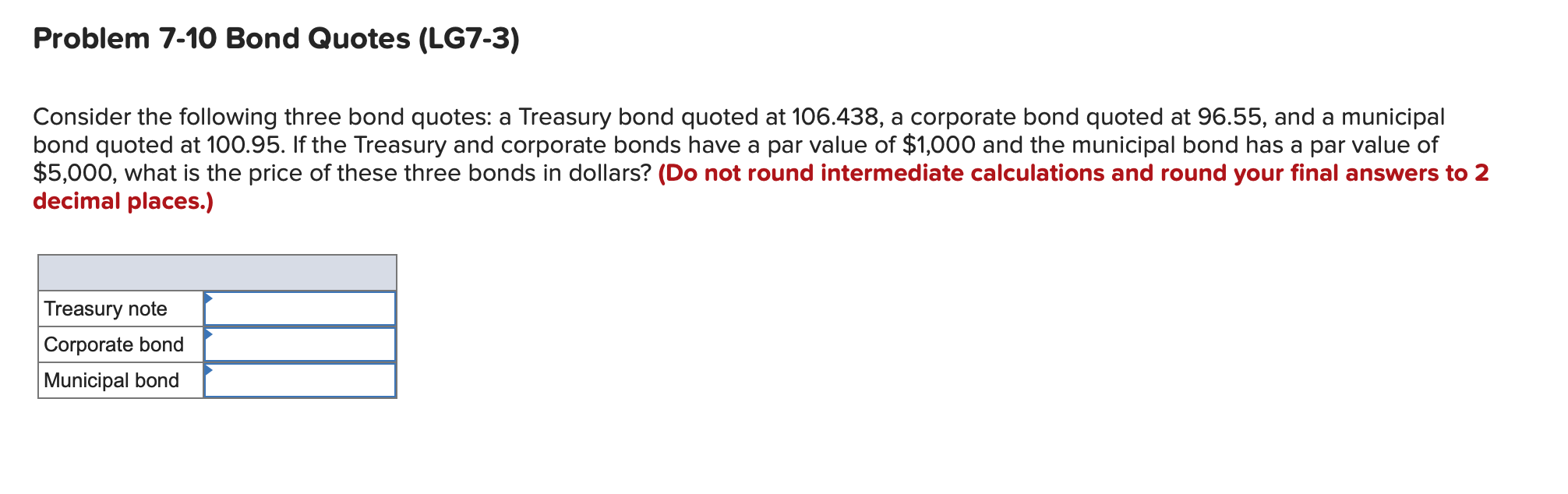

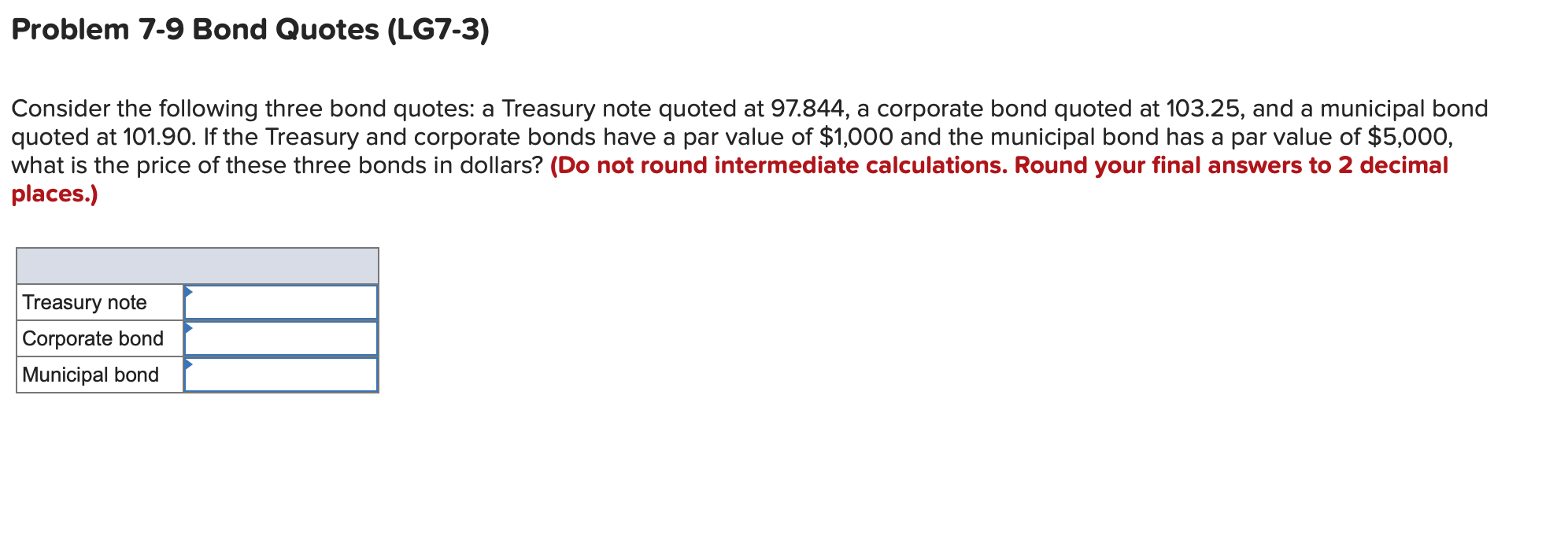

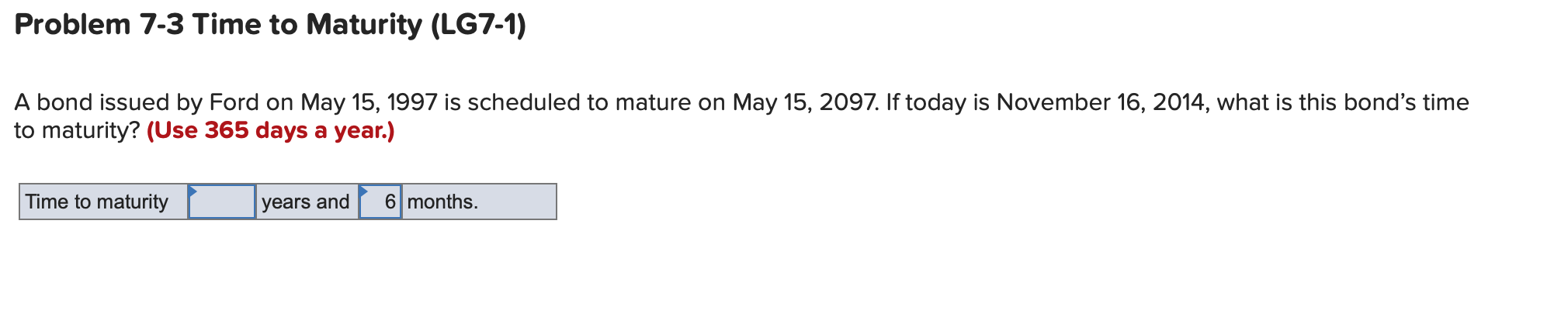

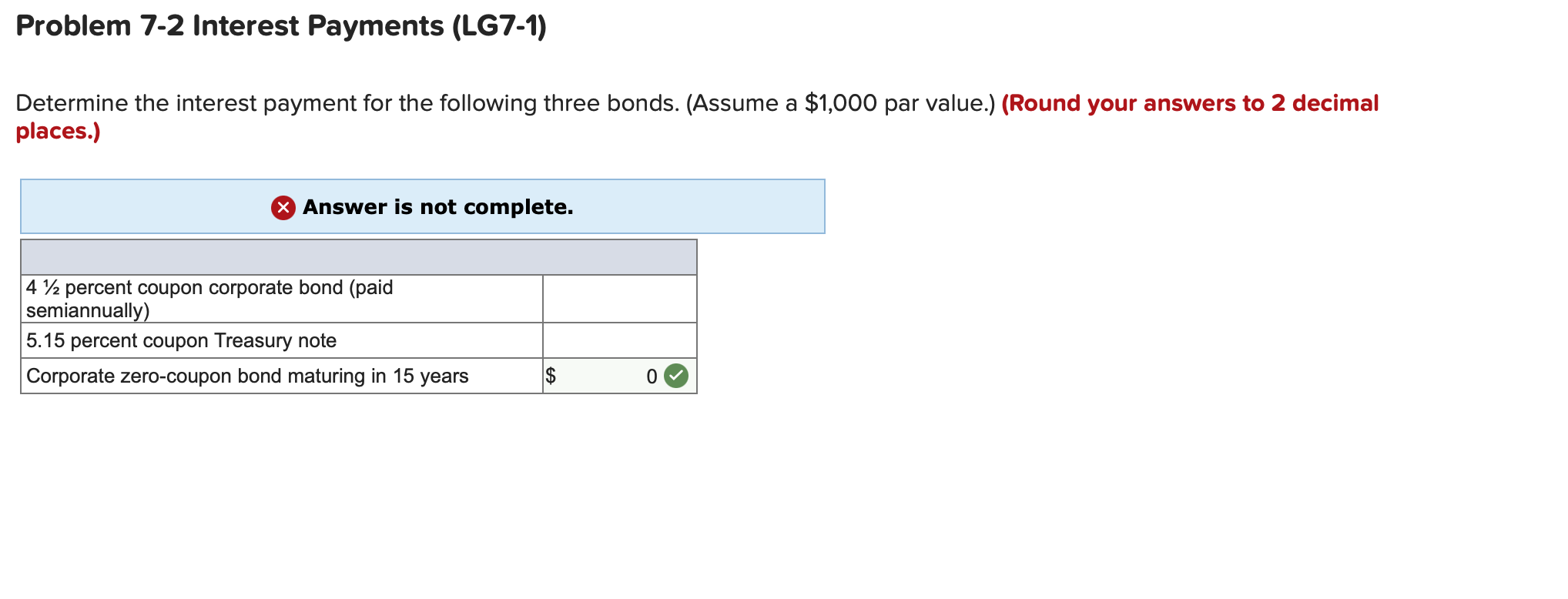

Problem 7-10 Bond Quotes (LG7-3) Consider the following three bond quotes: a Treasury bond quoted at 106.438, a corporate bond quoted at 96.55, and a municipal bond quoted at 100.95. If the Treasury and corporate bonds have a par value of $1,000 and the municipal bond has a par value of $5,000, what is the price of these three bonds in dollars? (Do not round intermediate calculations and round your final answers to 2 decimal places.) Treasury note Corporate bond Municipal bond Problem 7-9 Bond Quotes (LG7-3) Consider the following three bond quotes: a Treasury note quoted at 97.844, a corporate bond quoted at 103.25, and a municipal bond quoted at 101.90. If the Treasury and corporate bonds have a par value of $1,000 and the municipal bond has a par value of $5,000, what is the price of these three bonds in dollars? (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Treasury note Corporate bond Municipal bond Problem 7-3 Time to Maturity (LG7-1) A bond issued by Ford on May 15, 1997 is scheduled to mature on May 15, 2097. If today is November 16, 2014, what is this bond's time to maturity? (Use 365 days a year.) Time to maturity years and 6 months. Problem 7-2 Interest Payments (LG7-1) Determine the interest payment for the following three bonds. (Assume a $1,000 par value.) (Round your answers to 2 decimal places.) X Answer is not complete. 4 72 percent coupon corporate bond (paid semiannually). 5.15 percent coupon Treasury note Corporate zero-coupon bond maturing in 15 years $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts