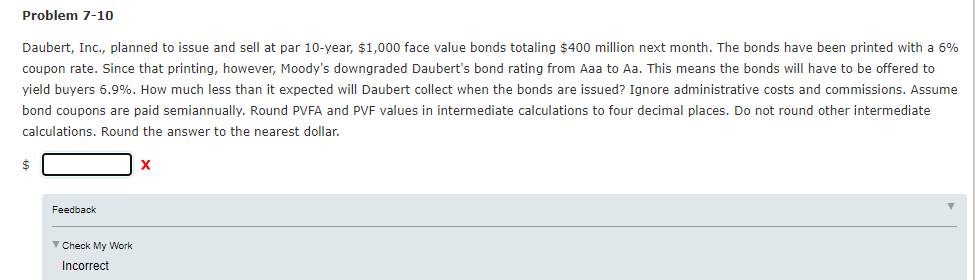

Question: Problem 7-10 Daubert, Inc., planned to issue and sell at par 10-year, $1,000 face value bonds totaling $400 million next month. The bonds have been

Problem 7-10 Daubert, Inc., planned to issue and sell at par 10-year, $1,000 face value bonds totaling $400 million next month. The bonds have been printed with a 5% coupon rate. Since that printing, however, Moody's downgraded Daubert's bond rating from Aaa to Aa. This means the bonds will have to be offered to yield buyers 6.9%. How much less than it expected will Daubert collect when the bonds are issued? Ignore administrative costs and commissions. Assume bond coupons are paid semiannually. Round PVFA and PVF values in intermediate calculations to four decimal places. Do not round other intermediate calculations. Round the answer to the nearest dollar. S X Feedback Check My Work Incorrect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts