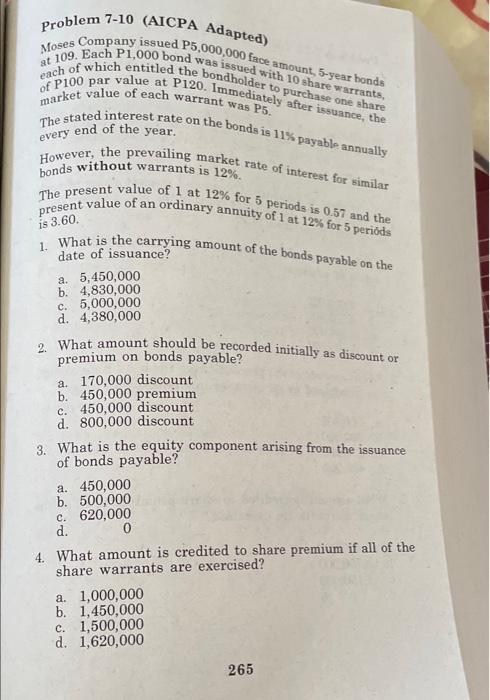

Question: PROBLEM 7-10 Problem 7-10 (AICPA Adapted) Moses Company issued P5,000,000 face amount, 5-year bonds at 109. Each P1,000 bond was issued with 10 share warrants,

Problem 7-10 (AICPA Adapted) Moses Company issued P5,000,000 face amount, 5-year bonds at 109. Each P1,000 bond was issued with 10 share warrants, each of which entitled the bondholder to purchase one share of P100 par value at P120. Immediately after issuance, the market value of each warrant was P5. The stated interest rate on the bonds is 11% payable annually However, the prevailing market rate of interest for similar The present value of 1 at 12% for 5 periods is 0.57 and the present value of an ordinary annuity of 1 at 12% for 5 periods 1. What is the carrying amount of the bonds payable on the every end of the year. bonds without warrants is 12% is 3.60. date of issuance? a. 5,450,000 b. 4,830,000 c. 5,000,000 d. 4,380,000 2. What amount should be recorded initially as discount or premium on bonds payable? a. 170,000 discount b. 450,000 premium c. 450,000 discount d. 800,000 discount 3. What is the equity component arising from the issuance of bonds payable? a. 450,000 b. 500,000 c. 620,000 d. 0 4. What amount is credited to share premium if all of the share warrants are exercised? a. 1,000,000 b. 1,450,000 c. 1,500,000 d. 1,620,000 265

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts