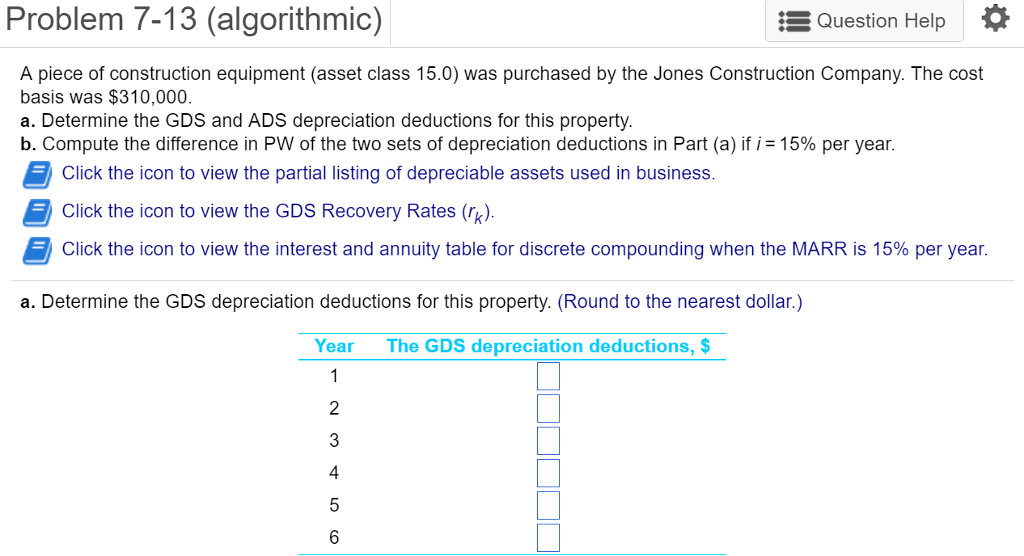

Question: Problem 7-13 E Question Help Problem 7-13 (algorithmic) A piece of construction equipment (asset class 15.0) was purchased by the Jones Construction Company. The cost

Problem 7-13

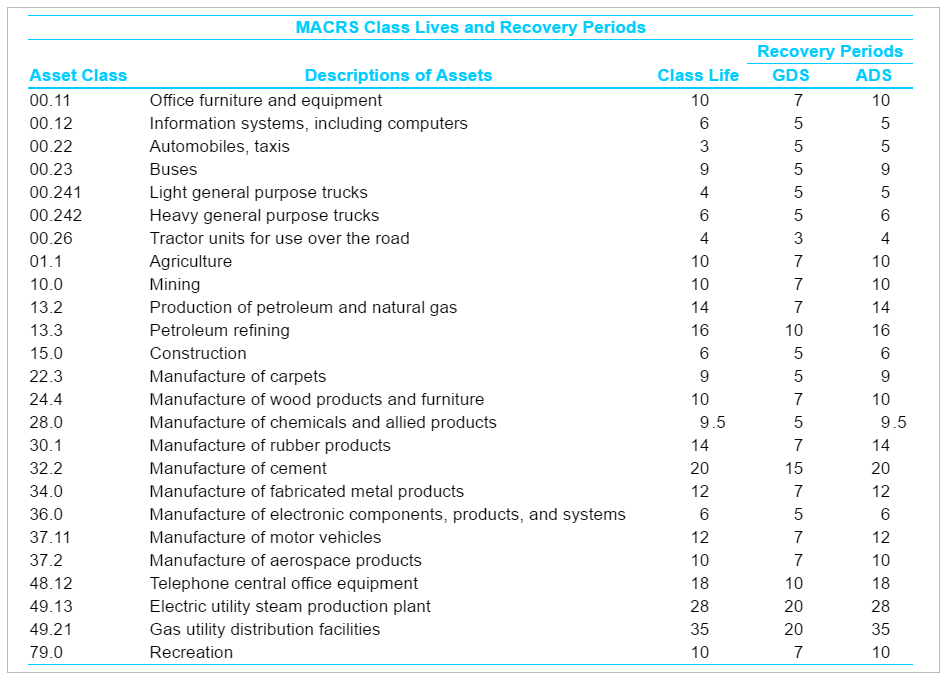

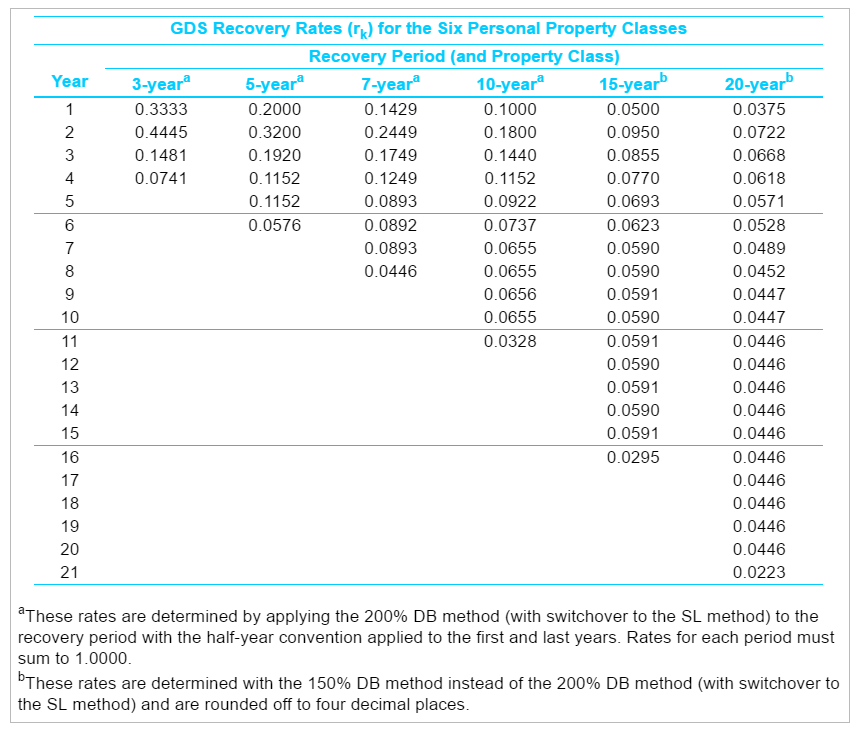

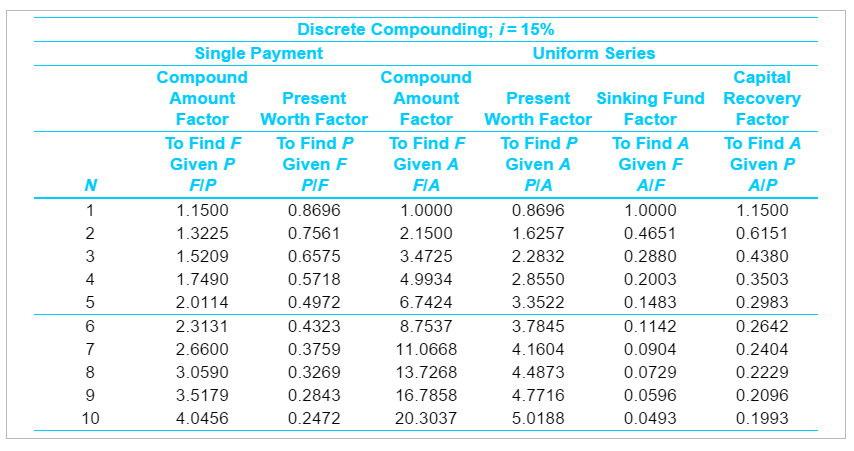

E Question Help Problem 7-13 (algorithmic) A piece of construction equipment (asset class 15.0) was purchased by the Jones Construction Company. The cost basis was $310,000 a. Determine the GDS and ADS depreciation deductions for this property b. Compute the difference in PW of the two sets of depreciation deductions in Part (a) if i -15% per year. E Click the icon to view the partial listing of depreciable assets used in business E Click the icon to view the GDs Recovery Rates (rk) E Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year. a. Determine the GDS depreciation deductions for this property. (Round to the nearest dollar) Year The GDS depreciation deductions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts