Question: Problem 7-16 Comparing Traditional and Activity-Based Product Margins [LO7-1, LO7-3, L07-4, LO7-5] Hi-Tek Manufacturing, Inc., makes two types of industrial component parts-the B300 and the

![LO7-5] Hi-Tek Manufacturing, Inc., makes two types of industrial component parts-the B300](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbea762685b_58966fbea75a6d06.jpg)

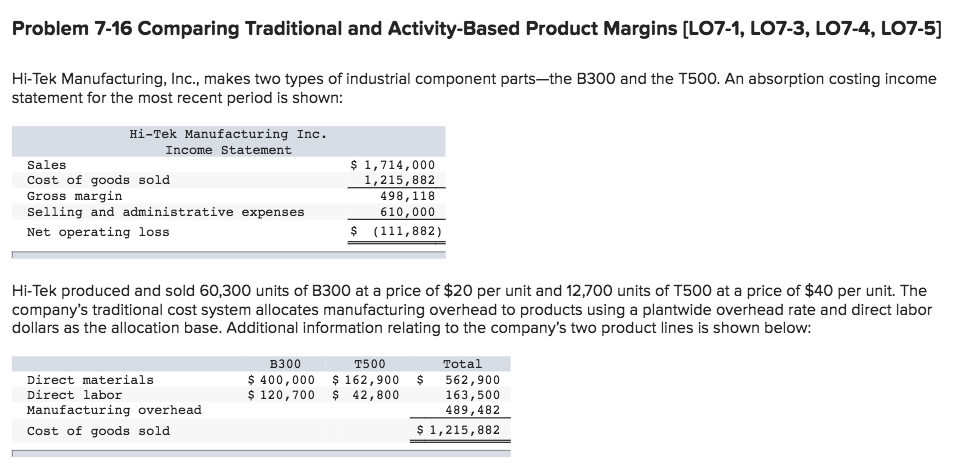

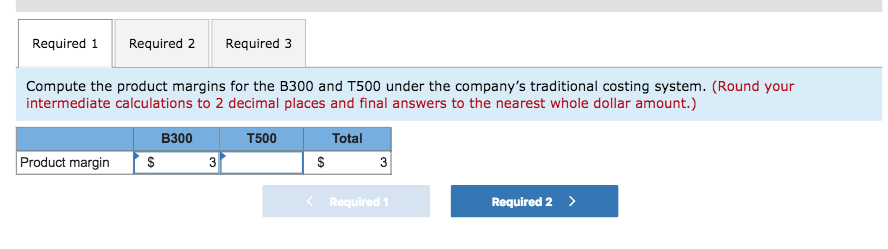

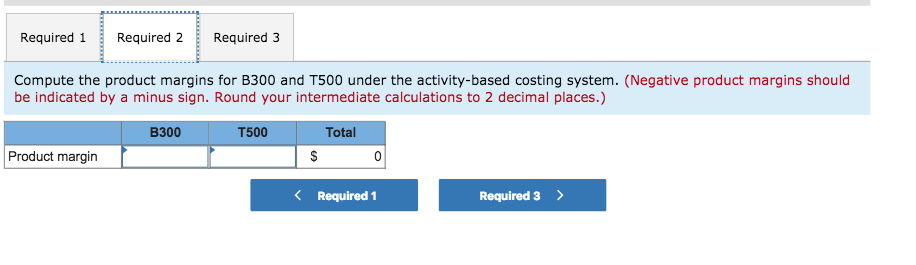

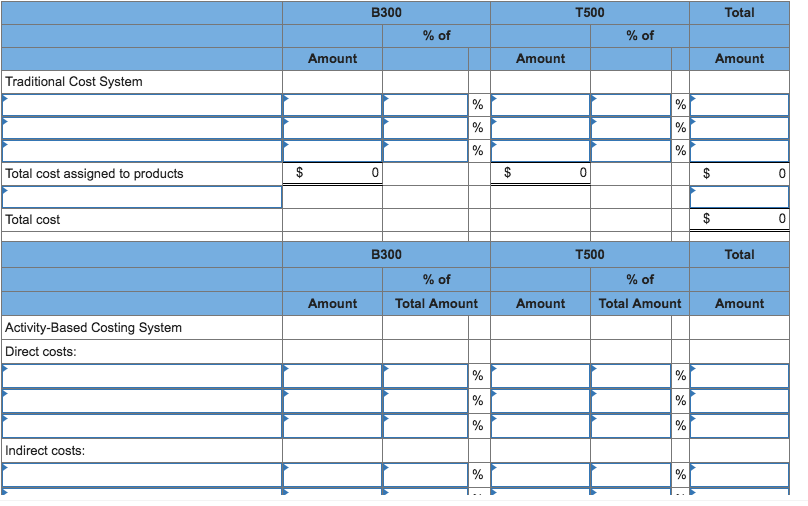

Problem 7-16 Comparing Traditional and Activity-Based Product Margins [LO7-1, LO7-3, L07-4, LO7-5] Hi-Tek Manufacturing, Inc., makes two types of industrial component parts-the B300 and the T500. An absorption costing incomee statement for the most recent period is shown Hi-Tek Manufacturing Inc. Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss $ 1,714,000 1,215, 882 498,118 610,000 $ (111,882) Hi-Tek produced and sold 60,300 units of B300 at a price of $20 per unit and 12,700 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: B300 400,000 120,700 42,800 T500 Total Direct materials Direct labor Manufacturing overhead Cost of goods sold 162,900 $562,900 163,500 489,482 $ 1,215,882

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts