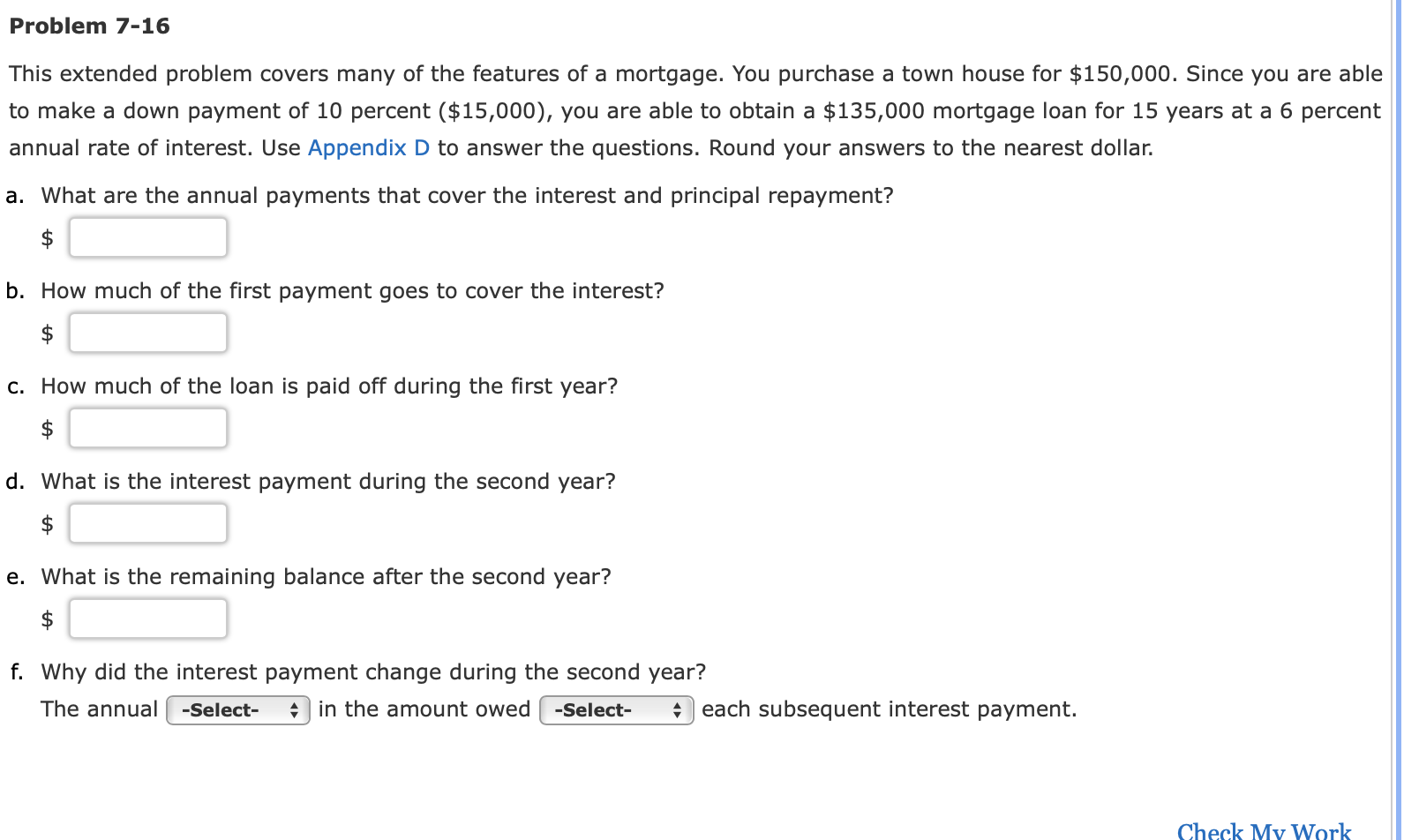

Question: Problem 7-16 This extended problem covers many of the features of a mortgage. You purchase a town house for $150,000. Since you are able to

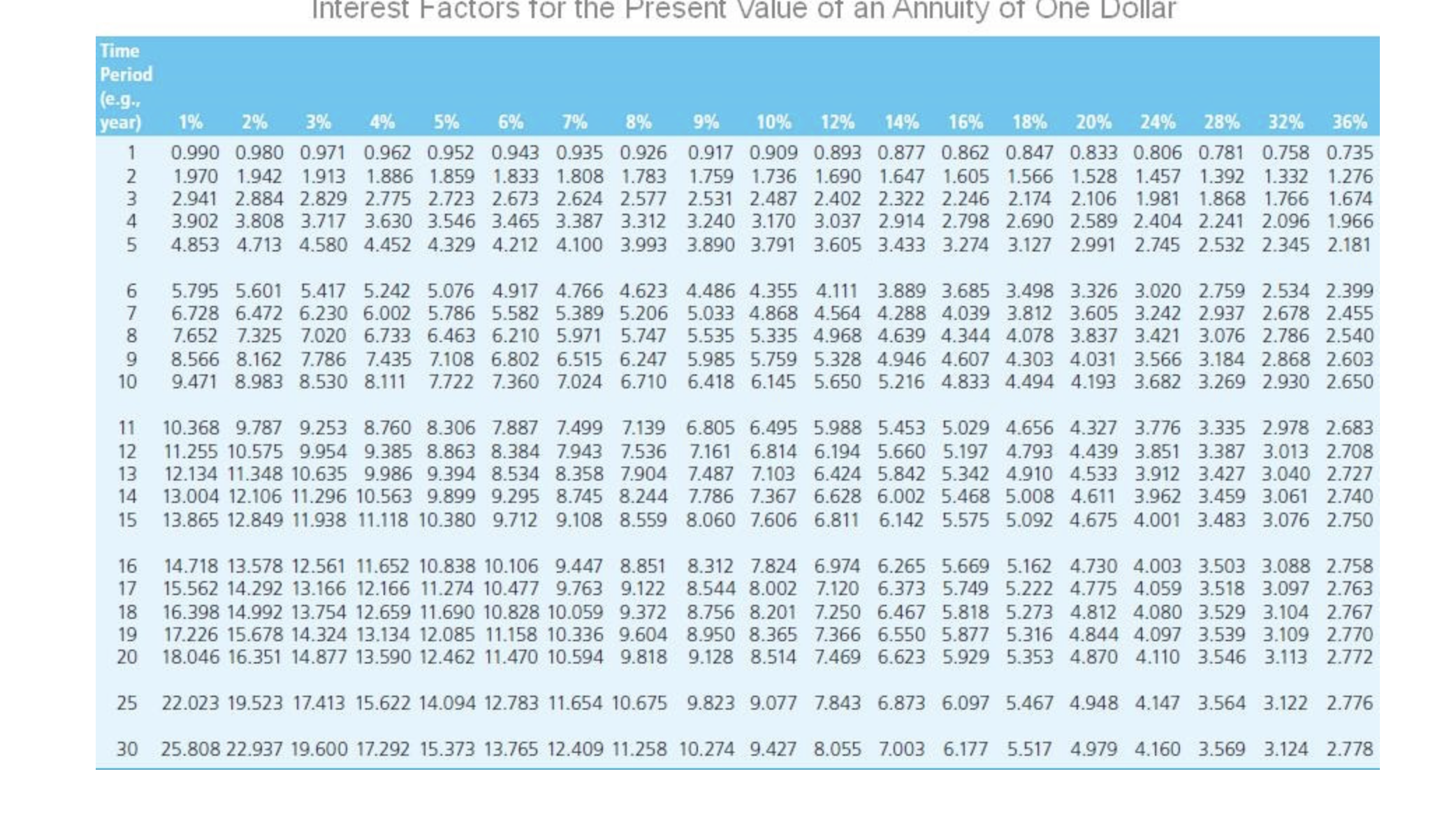

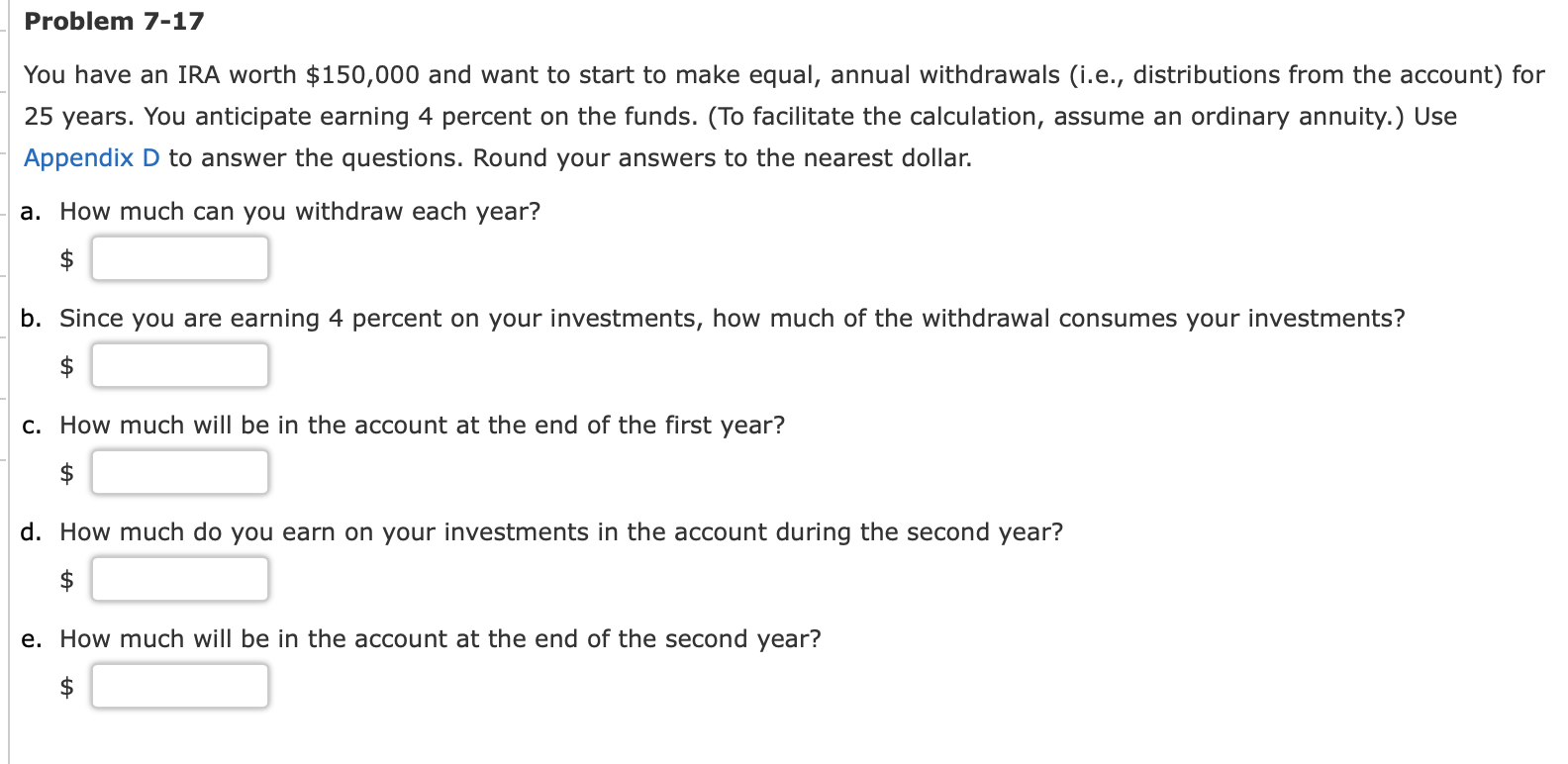

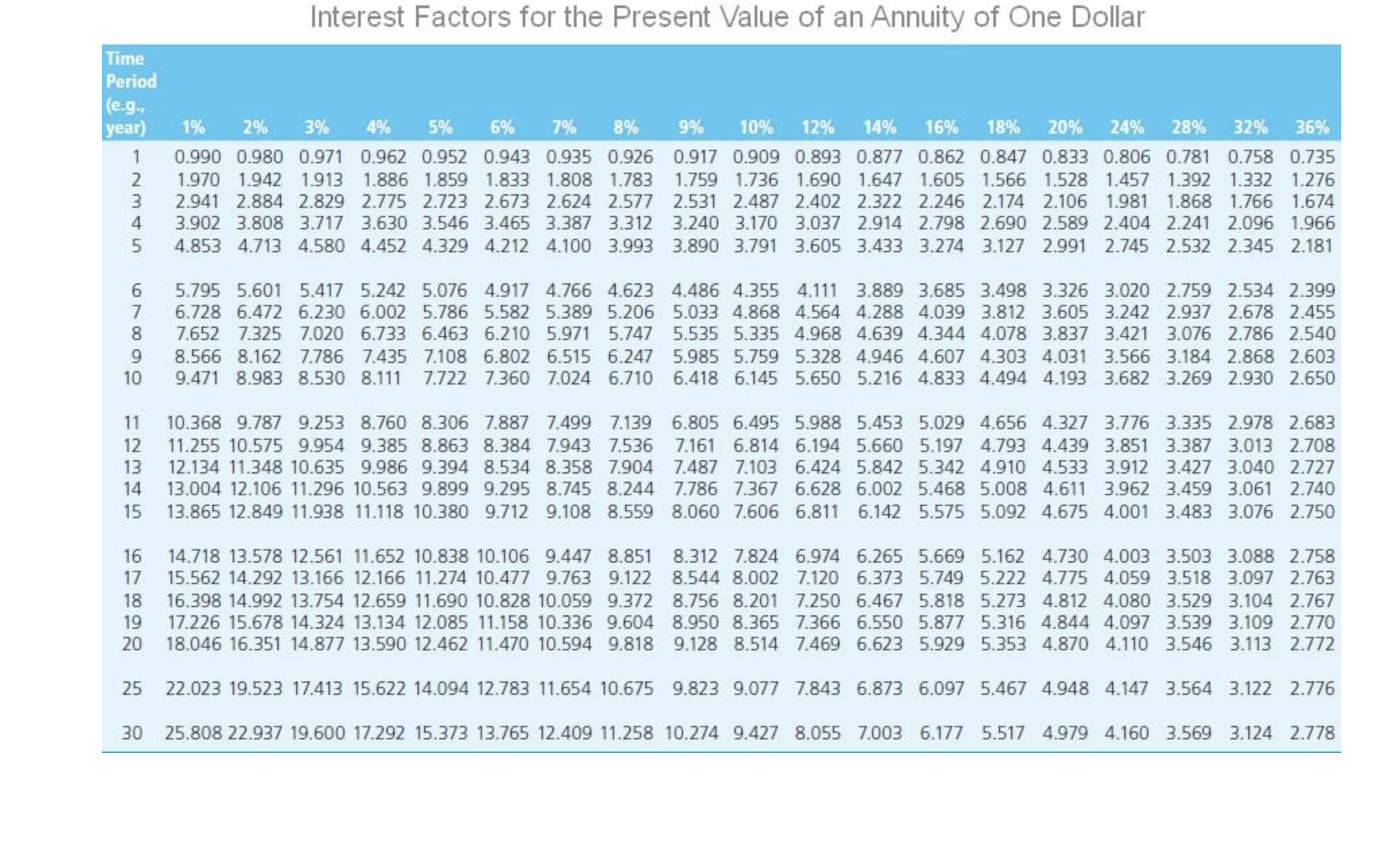

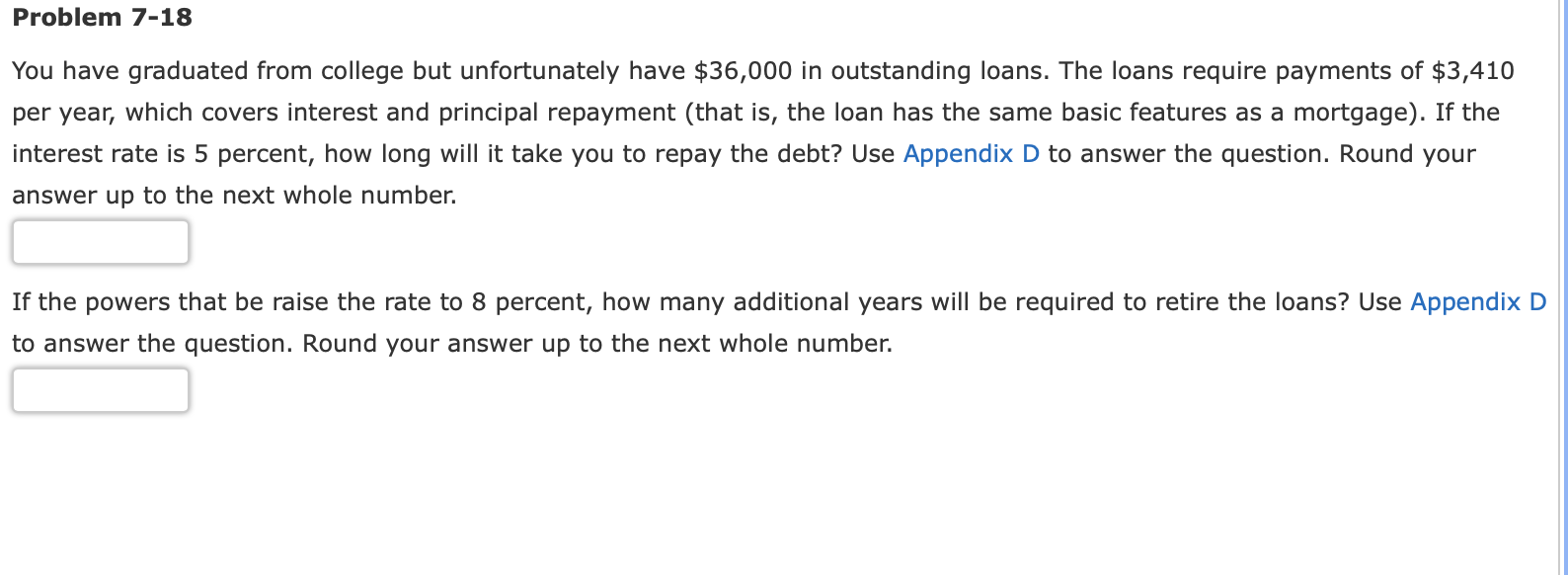

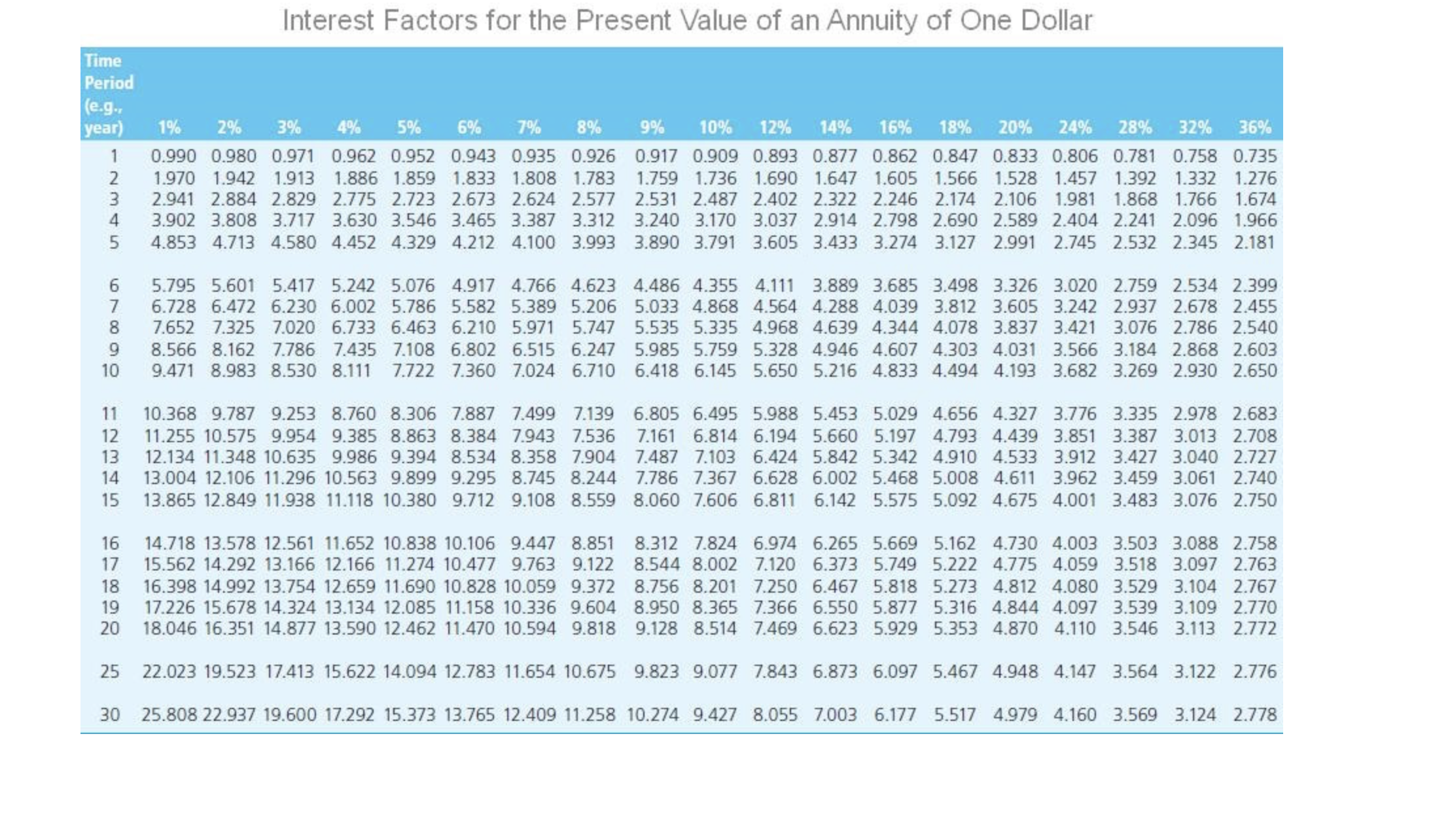

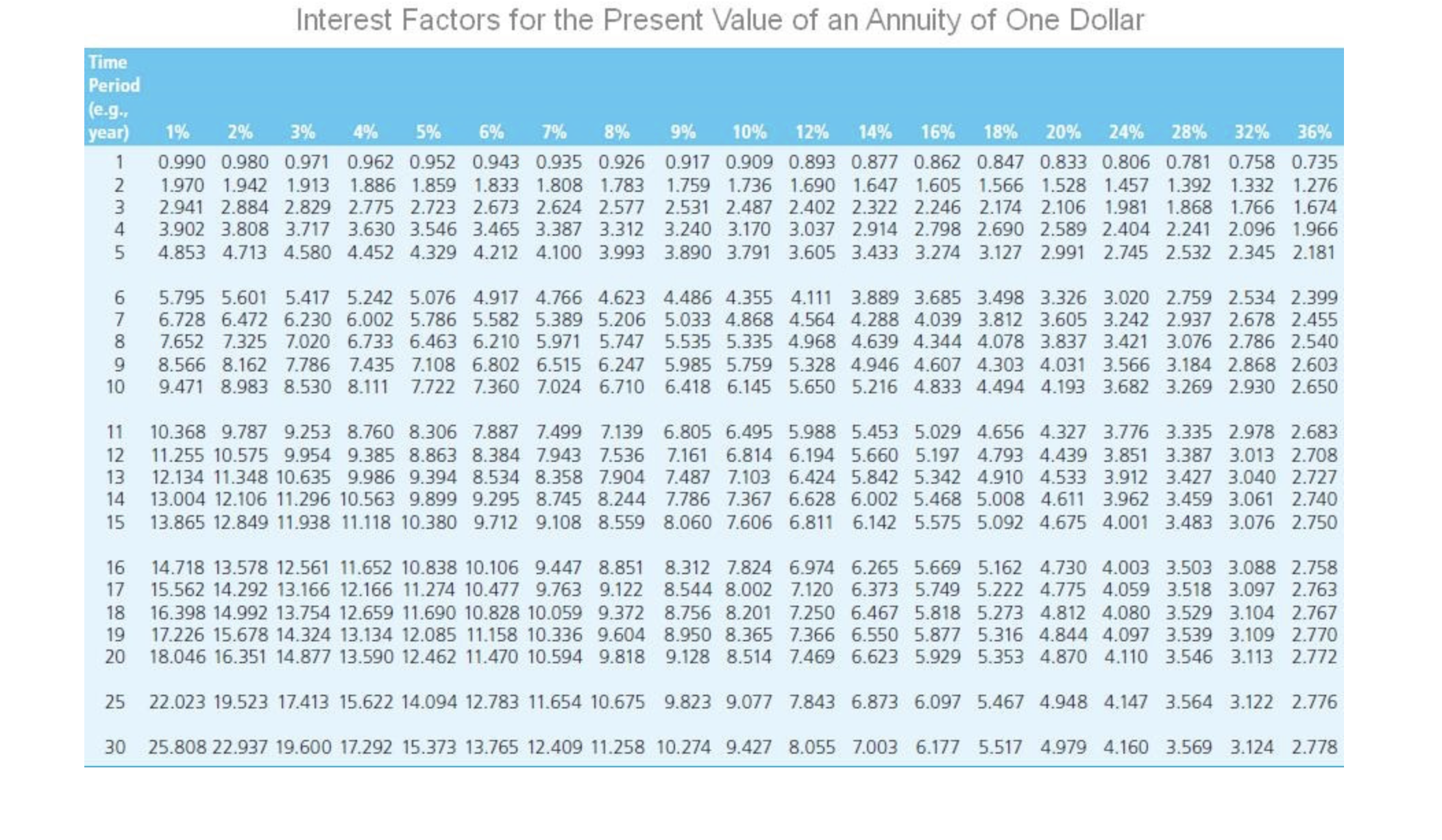

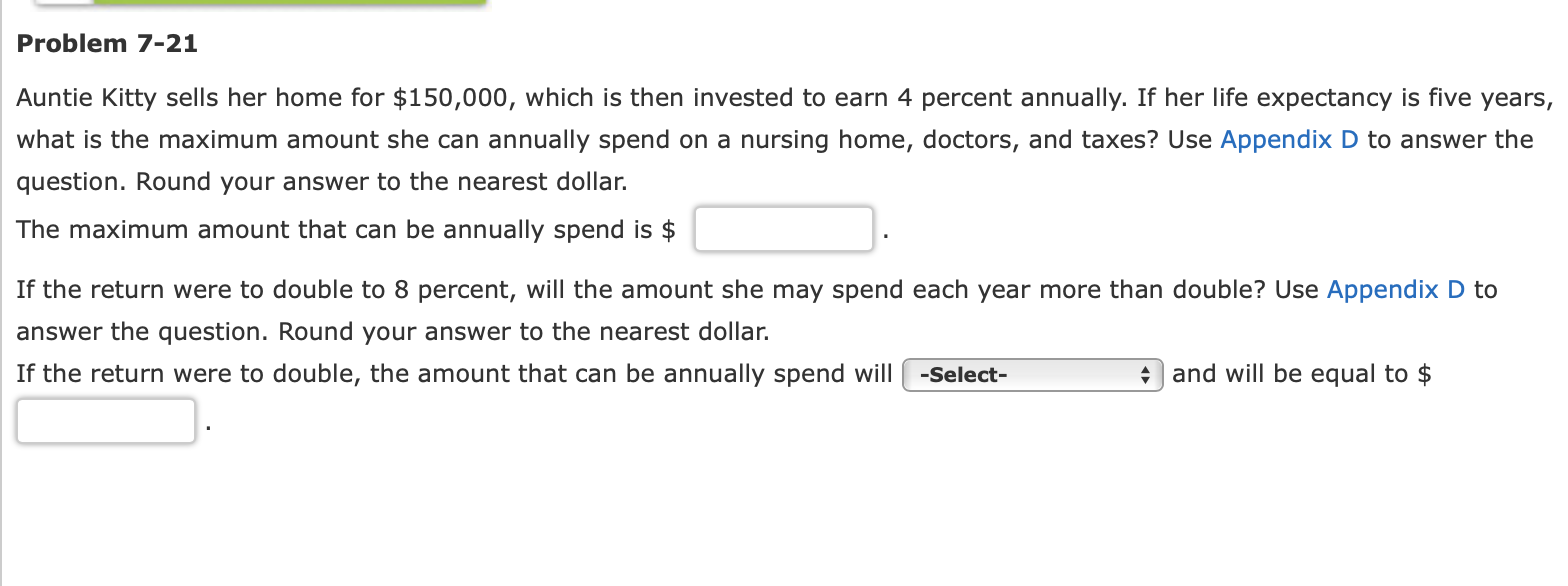

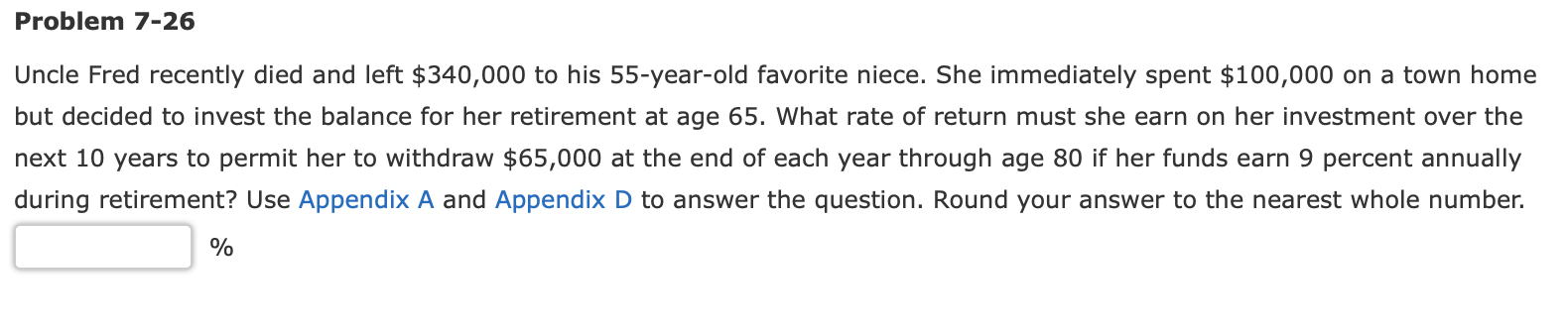

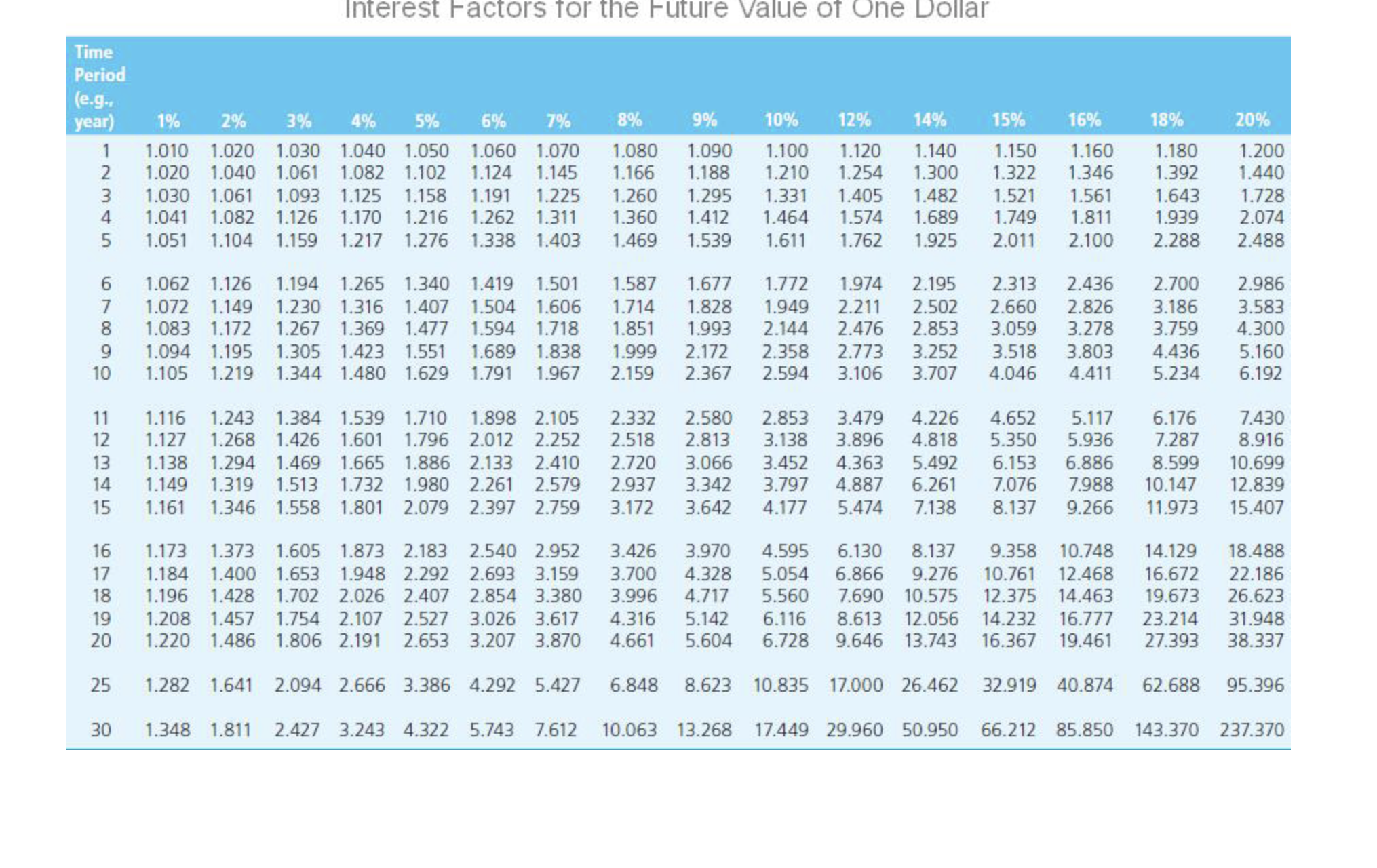

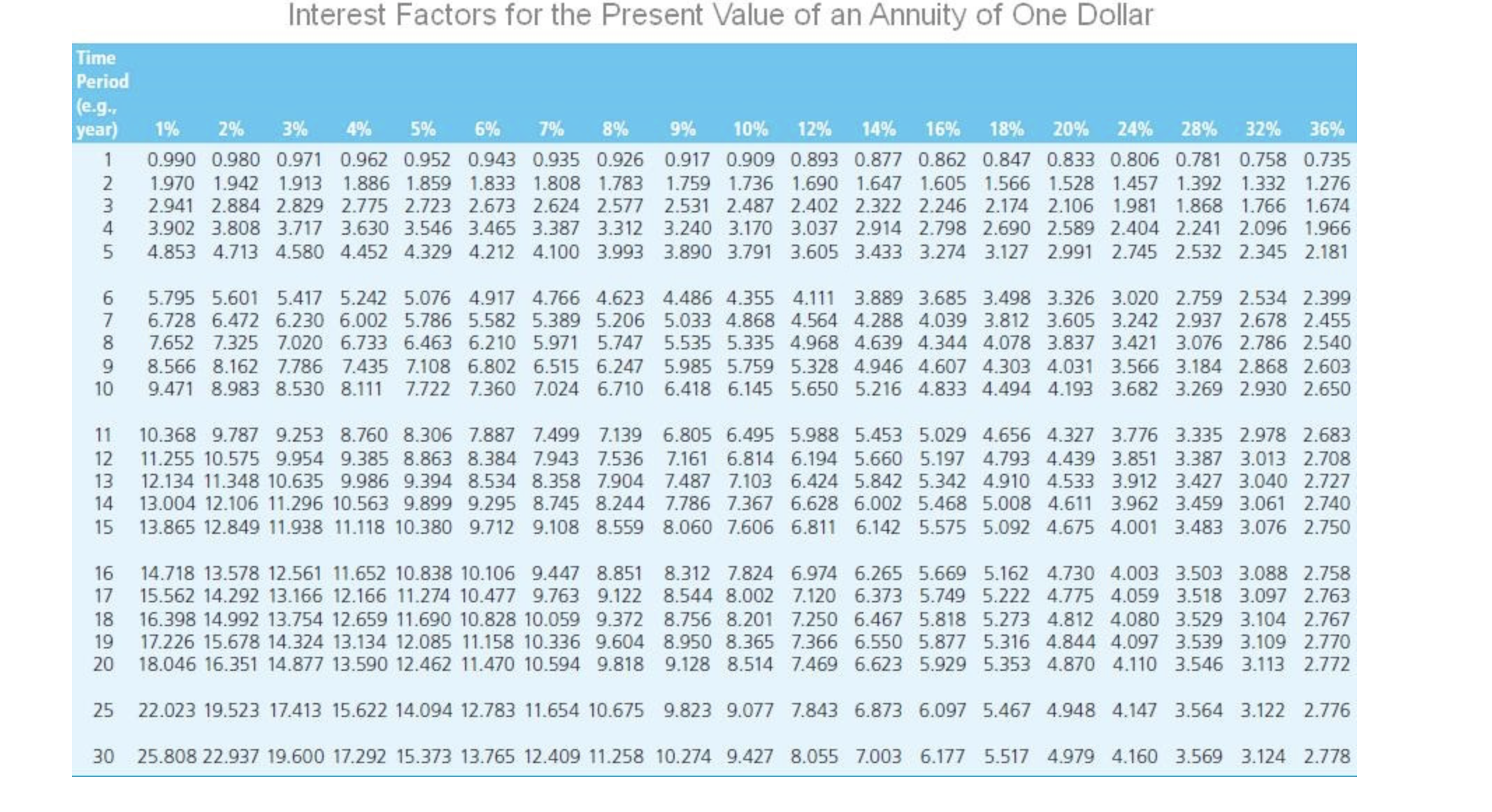

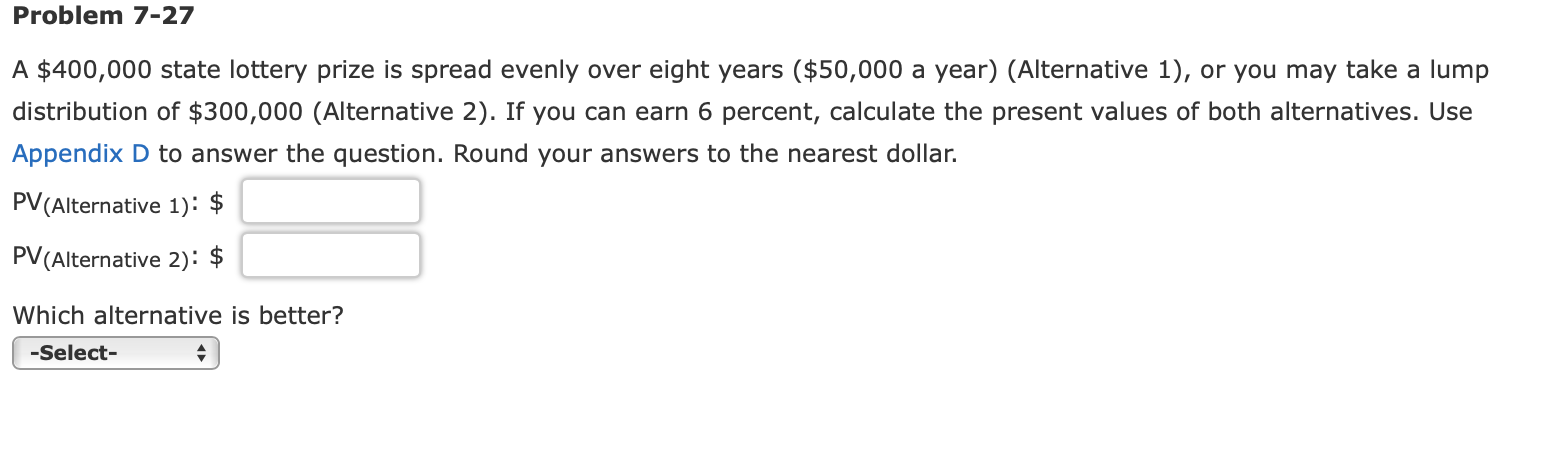

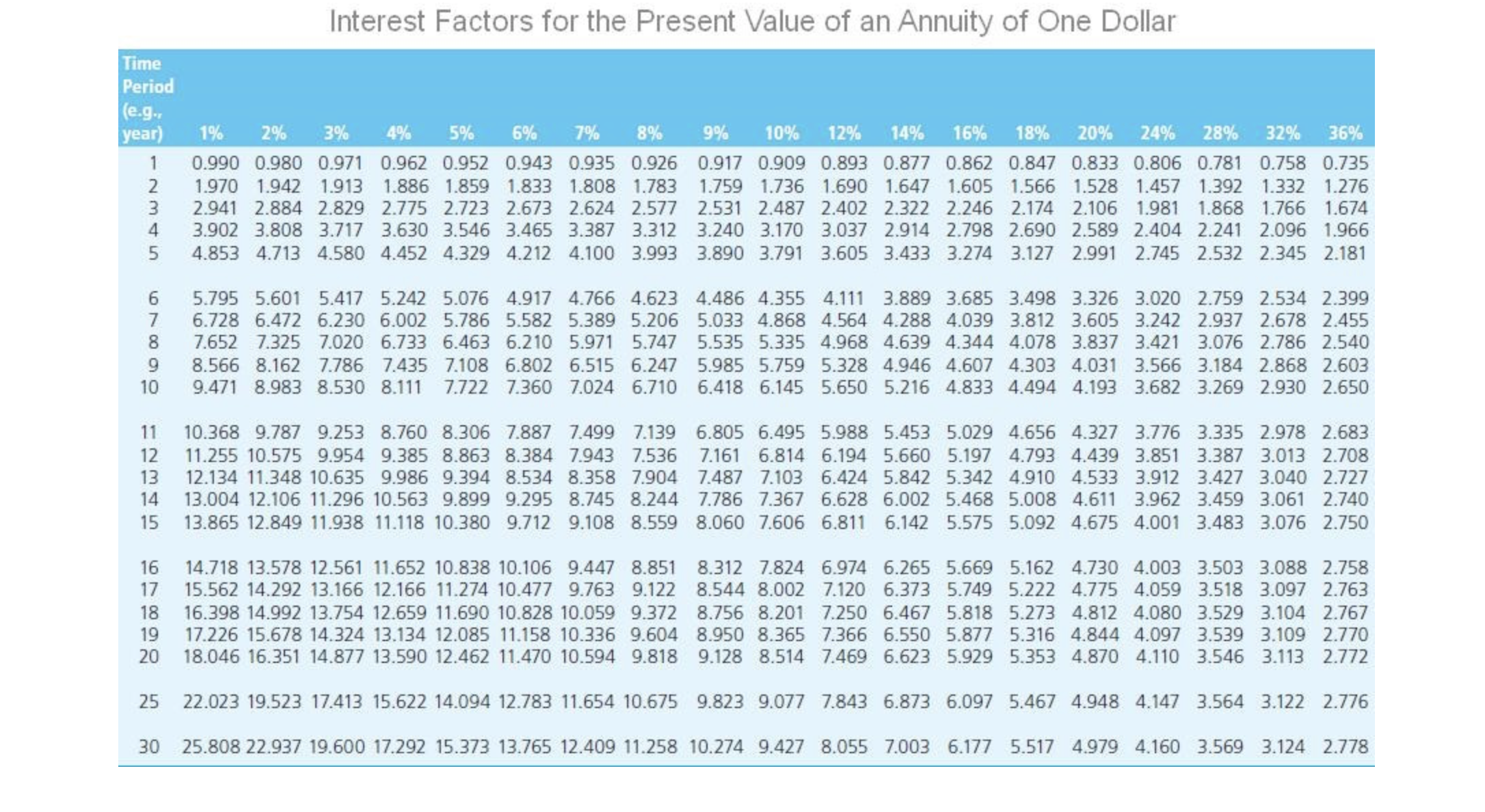

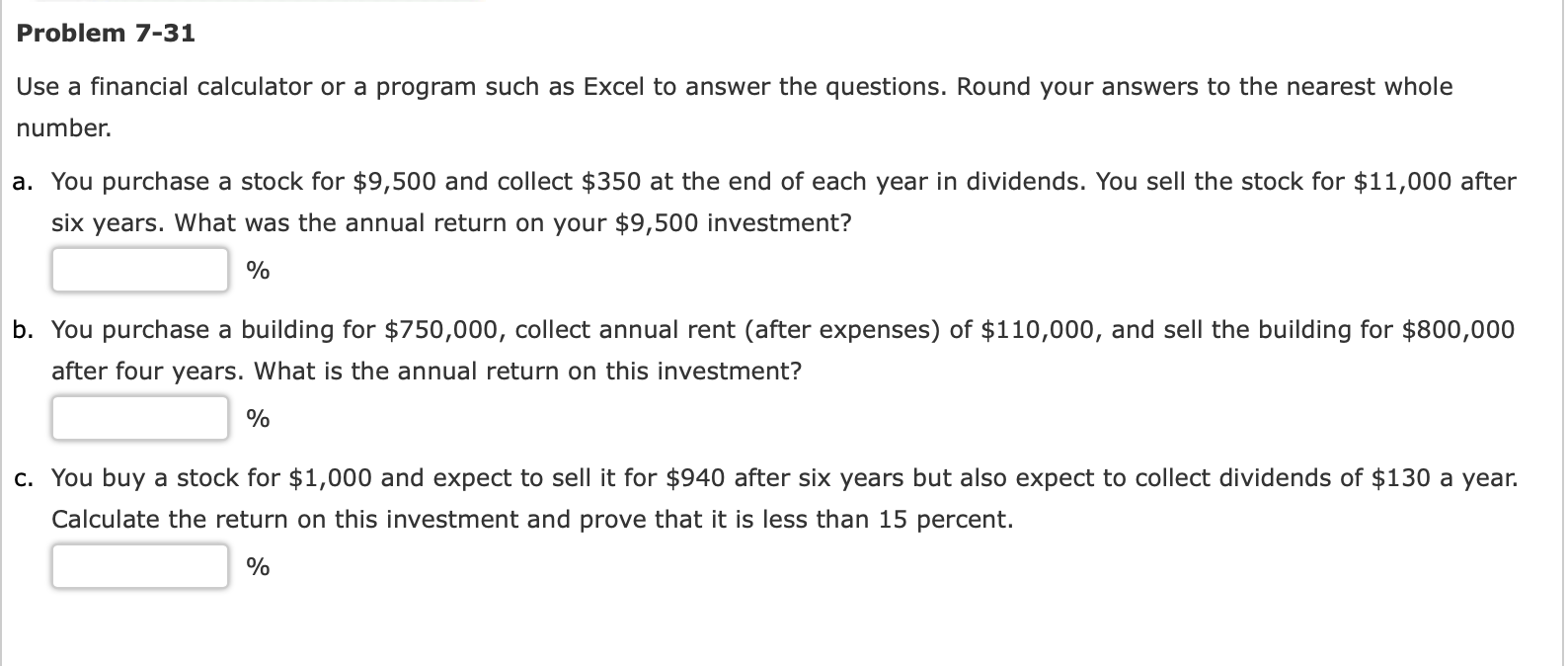

Problem 7-16 This extended problem covers many of the features of a mortgage. You purchase a town house for $150,000. Since you are able to make a down payment of 10 percent ($15,000), you are able to obtain a $135,000 mortgage loan for 15 years at a 6 percent annual rate of interest. Use Appendix D to answer the questions. Round your answers to the nearest dollar. a. What are the annual payments that cover the interest and principal repayment? $ b. How much of the rst payment goes to cover the interest? $ c. How much of the loan is paid off during the rst year? $ d. What is the interest payment during the second year? $ e. What is the remaining balance after the second year? $ f. Why did the interest payment change during the second year? The annual in the amount owed each subsequent interest payment. Ch er'k Mv Wnrk Interest Factors for the Present Value of an Annuity of One Dollar Time Period e.g.. year) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 AWN 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1.674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 13 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.763 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778Problem 7-17 You have an IRA worth $150,000 and want to start to make equal, annual withdrawals (i.e., distributions from the account) for 25 years. You anticipate earning 4 percent on the funds. (To facilitate the calculation, assume an ordinary annuity.) Use Appendix D to answer the questions. Round your answers to the nearest dollar. a. How much can you withdraw each year? $ b. Since you are earning 4 percent on your investments, how much of the withdrawal consumes your investments? $ c. How much will be in the account at the end of the rst year? $ d. How much do you earn on your investments in the account during the second year? $ e. How much will be in the account at the end of the second year? $ Interest Factors for the Present Value of an Annuity of One Dollar 0.990 0.980 0.971 0.962 0.952 0.943 1.970 1.942 1.913 1.886 1.859 1.833 2.941 2.884 2.829 2.775 3.902 3.808 3.717 3.630 4.853 4.713 4.580 4.452 5.795 5.601 5.417 5.242 6.728 6.472 6.230 6.002 7.652 7.325 7.020 6.733 8.566 8.162 7.786 7.435 9.471 8.983 8.530 8.111 10.368 9.787 9.253 8.760 11.255 10.575 9.954 9.385 12.134 11.348 10.635 9.986 13.004 12.106 11.296 10.563 2.723 2.673 3.546 3.465 4.329 4.212 5.076 4.917 5.786 5.582 6.463 6.210 7.108 6.802 7.722 7.360 8.306 7.887 8.863 8.384 9.394 8.534 9.899 9.295 13.865 12.84911.938 11.118 10.380 9.712 14.718 13.578 12.561 11.652 10.838 10.106 15.562 14.292 13.166 12.166 11.274 10.477 1639814992 13.754 12.659 11.690 10.828 10.059 17.226 15.678 14.324 13.134 12.085 11.158 10.336 1804616351 14.877 13.590 12.462 11.470 10.594 9.818 7% 0.935 1.808 2.624 3.387 4.1 00 4.766 5.389 5.971 6.51 5 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7. 536 7. 904 8.244 8. 559 8.851 9.122 9.372 9.604 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 25.808 22.937 19.600 17192 15.373 13.765 12.409 11.258 9% 10% 0. 917 0.909 1.759 1.736 2. 531 2. 487 3. 240 3.170 3.890 3.791 4.486 4.355 5.033 4.868 5.535 5.335 5.985 5.759 6.418 6.145 6.805 6.495 7.161 6.814 7.487 7.103 7.786 7.367 8.060 7.606 8.312 7.824 8.544 8.002 8.756 8.201 8.950 8.365 9.128 8.514 9.823 9.077 10.274 9.427 12% 14% 0.893 0.877 1.690 1.647 2 .402 2. 322 3.037 2.914 3.605 3.433 4.111 3.889 4.564 4.288 4.968 4.639 5.328 4.946 5.650 5.216 5.988 5.453 6.194 5.660 6.424 5.842 6.628 6.002 6.811 6.142 6.974 6.265 7.120 6.373 7.250 6.467 7.366 6.550 7.469 6.623 7.843 6.873 8.055 7.003 1 6% 0.862 1.605 2. 246 2 .798 3.274 3.685 4.039 4.344 4. 607 4. 833 5.029 5.197 5. 342 5. 468 5.575 5.669 5 .749 5.818 5.877 5.929 6.097 6.177 1 8% 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 20% 0.833 1 .528 2 106 2.589 2.991 3.326 3.605 3.837 4.031 4.193 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.844 4.870 4.948 4.979 24% 0.806 1.457 1.981 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 4.003 4. 059 4. 080 4.097 4.110 4.147 4.160 28% 32% 0.781 0.758 1.392 1.332 1.868 1.766 2.241 2.096 2.532 2.345 2.759 2.534 2.937 2.678 3.076 2.786 3.184 2.868 3.269 2.930 3.335 2.978 3.387 3.013 3.427 3.040 3.459 3.061 3.483 3.076 3.503 3.088 3.518 3.097 3.529 3.104 3.539 3.109 3.546 3.113 3.564 3.122 3.569 3.124 36% 0.735 1.276 1.674 1.966 2.181 2.399 2.455 2.540 2.603 2.650 2.683 2.708 2.727 2.740 2.750 2.758 2.763 2.767 2.770 2.772 2.776 2.778 Problem 7-18 You have graduated from college but unfortunately have $36,000 in outstanding loans. The loans require payments of $3,410 per year, which covers interest and principal repayment (that is, the loan has the same basic features as a mortgage). If the interest rate is 5 percent, how long will it take you to repay the debt? Use Appendix D to answer the question. Round your answer up to the next whole number. If the powers that be raise the rate to 8 percent, how many additional years will be required to retire the loans? Use Appendix D to answer the question. Round your answer up to the next whole number. Time Period (2 .9., yea r) Interest Factors for the Present Value of an Annuity of One Dollar 1% 2% 3% 0.990 0.980 0.971 1.970 1.942 1.913 2.941 2.884 2.829 3.902 3.808 3.717 4.853 4.713 4.580 5.795 5.601 5.417 6.728 6.472 6.230 7.652 7.325 7.020 8.566 8.162 7.786 9.471 8.983 8.530 10.368 9.787 9.253 11.255 10.575 9.954 12.134 11.348 10.635 4% 0.962 5% 0.952 1.886 1.859 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.1 1 1 8.760 9.385 9.986 13.004 12.106 11.296 10.563 13.865 12.849 11.938 11.118 10.380 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.534 9.295 9.712 14.718 13.578 12.561 11.652 10.838 10.106 15.562 14.292 13.166 12.166 11.274 10.477 16.398 14.992 13.754 12.659 11.690 10.828 10.059 17.226 15.678 14.324 13.134 12.085 11.158 10.336 18.046 16.351 14.877 13.590 12.462 11.470 10.594 7% 0.935 1.808 2.624 3.387 4.100 4.766 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.985 6.418 6.805 7.161 7.487 7.786 8.060 8.312 8.544 8.756 8.950 9.128 9.823 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 10% 0.909 1.736 2. 487 3.170 3.791 4. 355 4. 868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.002 8. 201 8.365 8.514 9.077 9.427 12% 0. 893 1.690 2 .402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.988 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 14% 16% 0.877 0.862 1.647 1.605 2.322 2.246 2.914 2.798 3.433 3.274 3.889 3.685 4.288 4.039 4.639 4.344 4.946 4.607 5.216 4.833 5 .453 5.029 5. 660 5.197 5. 842 5.342 6. 002 5. 468 6.142 5.575 6.265 5.669 6.373 5.749 6.467 5.818 6.550 5.877 6.623 5.929 6.873 6.097 7.003 6.177 1 8% 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 20% 0.833 1 .528 2.106 2. 589 2.991 3.326 3.605 3.837 4.031 4.193 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4. 812 4. 844 4. 870 4.948 4.979 24% 0.806 1.457 1.981 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 4.003 4. 059 4.080 4.097 4.110 4.147 4.160 28% 0.781 1. 392 1.868 2. 241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 3.564 3.569 32% 0.758 1.332 1.766 2.096 2. 345 2.534 2.678 2.786 2.868 2.930 2. 978 3.013 3.040 3.061 3.076 3.088 3.097 3.104 3.109 3.113 3.122 3.124 36% 0.735 1.276 1.674 1.966 2.181 2.399 2.455 2.540 2.603 2.650 2.683 2.708 2.727 2.740 2.750 2.758 2.763 2 .767 2.770 2.772 2.776 2.778 25 Interest Factors for the Present Value of an Annuity of One Dollar 4% 0.990 0.962 1 .970 2.941 3902 4.853 0.980 1 .942 2.884 3.808 4.713 0.971 1.913 2.829 3.717 4.580 2.775 3.630 4.452 5.795 6.728 7.652 8.566 9.471 5.601 6.472 7.325 8.162 8.983 5.417 6.230 7.020 7.786 8.530 5.242 6.002 6.733 7.435 8.111 10.368 9.787 9.253 11.255 10.575 9.954 9.385 12.134 11.348 10.635 9.986 13.004 12.106 11.296 10.563 8.760 5% 0.952 1.886 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 13.865 12.849 11.938 11.118 10.380 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.534 9.295 9.712 14.718 13.578 12.561 11.652 10.838 10.106 15.562 14.292 13.166 12.166 11.274 10.477 1639814992 13.754 12.659 11.690 10.828 10.059 17.226 15.678 14.324 13.134 12.085 11.158 10.336 18.046 16.351 14.877 13.590 12.462 11.470 10.594 7% 0935 1.808 2.624 3.387 4.100 4.766 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 8% 0.926 1 .783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9372 9.604 9.818 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 9% 0.917 1.759 2.531 3.240 3.890 10% 0.909 1.736 2.487 3.170 3.791 4. 486 5.033 5.535 5.985 6.418 4.355 4.868 5.335 5.759 6.145 6.805 7.161 7.487 7.786 8.060 6.495 6.814 7.103 7.367 7.606 8.312 8.544 8.756 8.201 8.950 8.365 9.128 8.514 7.824 8.002 9.823 9.077 10.274 9.427 12% 0.893 1 .690 2.402 3.037 3.605 4.111 4.564 4. 968 5. 328 5.650 5.988 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 14% 0.877 1.647 2.322 2.914 3.433 16% 0.862 1.605 2.246 2.798 3.274 3.889 3.685 4.288 4.039 4.639 4.344 4.946 4.607 5.216 4.833 5453 5.660 5.842 6.002 6.142 5.029 5.197 5.342 5. 468 5. 575 6.265 6.373 6.467 6.550 6.623 5.669 5 .749 5.818 5.877 5.929 6.873 6.097 7.003 6.177 1 8% 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 5 .092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 20% 0.833 1.528 2106 2. 589 2.991 3.326 3.605 3.837 4.031 4.193 4.327 4.439 4.533 4.61 1 4.675 4.730 4.775 4.812 4.844 4.870 4.948 4.979 24% 0.806 1. 457 1.981 2.404 2. 745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3962 4.001 4.003 4. 059 4.080 4.097 4.110 4.147 4.160 28% 0.781 1.392 1.868 2.241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 3.564 3.569 32% 0.758 1.332 1.766 2 .096 2.345 2.534 2.678 2.786 2.868 2.930 2.978 3. 013 3 .040 3. 061 3.076 3.088 3.097 3.104 3.109 3.113 3.122 3.124 36% 0.735 1.276 1.674 1.966 2.181 2.399 2.455 2.540 2 .603 2 .650 2.683 2.708 2.727 2.740 2.750 2.758 2.763 2.767 2.770 2.772 2.776 2.778 Problem 7-21 Auntie Kitty sells her home for $150,000, which is then invested to earn 4 percent annually. If her life expectancy is five years, what is the maximum amount she can annually spend on a nursing home, doctors, and taxes? Use Appendix D to answer the question. Round your answer to the nearest dollar. The maximum amount that can be annually spend is $ If the return were to double to 8 percent, will the amount she may spend each year more than double? Use Appendix D to answer the question. Round your answer to the nearest dollar. If the return were to double, the amount that can be annually spend will and will be equal to $ Time Period (e.g., year) 1 2 3 4 5 6 7 8 9 0 Interest Factors for the Present Value of an Annuity of One Dollar 1% 2% 3% 0.990 0.980 0.971 1.970 1.942 1.913 2.941 2.884 2.829 3.902 3.808 3.717 4.853 4.713 4.580 5.795 5.601 5.417 6.728 6.472 6.230 7.652 7.325 7.020 8.566 8.162 7.786 9.471 8.983 8.530 10.368 9.787 9.253 11.255 10.575 9.954 12.134 11.348 10.635 4% 0.962 5% 0.952 1.886 1.859 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.1 1 1 8.760 9.385 9.986 13.004 12.106 11.296 10.563 13.865 12.849 11.938 11.118 10.380 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.534 9.295 9.712 14.718 13.578 12.561 11.652 10.838 10.106 15.562 14.292 13.166 12.166 11.274 10.477 16.398 14.992 13.754 12.659 11.690 10.828 10.059 17.226 15.678 14.324 13.134 12.085 11.158 10.336 18.046 16.351 14.877 13.590 12.462 11.470 10.594 7% 0.935 1 .808 2.624 3.387 4.100 4.766 5.389 5.971 6.51 5 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 9% 0.917 1.759 2.531 3.240 3.890 4. 486 5.033 5.535 5.985 6.418 6.805 7.161 7.487 7. 786 8. 060 8.312 8.544 8. 756 8 .950 9.128 9.823 10.274 10% 0.909 1 .736 2. 487 3.170 3.791 4. 355 4.868 5 335 5.759 6.145 6.495 6.814 7.103 7. 367 7. 606 7. 824 8. 002 8. 201 8. 365 8.514 9.077 9.427 12% 14% 0.893 0.877 1.690 1.647 2.402 2.322 3.037 2.914 3.605 3.433 4.111 3.889 4.564 4.288 4.968 4.639 5.328 4.946 5.650 5.216 5.988 5.453 6.194 5.660 6.424 5.842 6.628 6.002 6.811 6.142 6.974 6.265 7.120 6.373 7.250 6.467 7.366 6.550 7.469 6.623 7.843 6.873 8.055 7.003 16% 0.862 1. 605 2. 246 2. 798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5. 468 5.575 5.669 5.749 5.818 5.877 5.929 6.097 6.177 18% 0. 847 1. 566 2.174 2. 690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4910 5 .008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.193 4.327 4.439 4.533 4.61 1 4.675 4.730 4.775 4.812 24% 0.806 1 .457 1.981 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 4.003 4.059 4.080 4.844 4.097 4.870 4.110 28% 0.781 1.392 1.868 2.241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 4.948 4.147 3.564 4.979 4.160 3.569 32% 0.758 1. 332 1.766 2.096 2.345 2.534 2.678 2.786 2.868 2 .930 2.978 3. 013 3 .040 3. 061 3.076 3.088 3. 097 3.104 3.109 3.113 3.122 3.124 36% 0.735 1.276 1.674 1.966 2.181 2.399 2.455 2.540 2.603 2.650 2.683 2.708 2.727 2.740 2.750 2.758 2. 763 2.767 2.770 2.772 2.776 2.778 Interest Factors for the Present Value of an Annuity of One Dollar 0.990 0.980 0.971 1.970 1.942 1.913 2.941 2.884 2.829 3902 3.808 3.717 4.853 4.713 4.580 5.795 5.601 5.417 6.728 6.472 6.230 7.652 7.325 7.020 8.566 8.162 7.786 9.471 8.983 8.530 10.368 9.787 9.253 11.255 10.575 9.954 12.134 11.348 10.635 4% 0.962 1 .886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.1 1 1 8.760 9.385 9.986 13.004 12.106 11.296 10.563 13.865 12.849 11.938 11.118 10.380 5% 0.952 1 .859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.534 9.295 9.712 14.718 13.578 12.561 11.652 10.838 10.106 15.562 14.292 13.166 12.166 11.274 10.477 1639814992 13.754 12.659 11.690 10.828 10.059 17.226 15.678 14.324 13.134 12.085 11.158 10.336 18.046 16.351 14.877 13.590 12.462 11.470 10.594 7% 0.935 1.808 2.624 3.387 4.100 4.766 5.389 5.971 6.51 5 7.024 7. 499 7. 943 8. 358 8.745 9.108 9.447 9.763 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9372 9.604 9.818 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 9% 0.917 1.759 2.531 3.240 3.890 4. 486 5.033 5.535 5.985 6.418 6.805 7.161 7.487 7. 786 8. 060 8.312 8.544 8. 756 8 .950 9.128 9.823 10.274 10% 0.909 1.736 2. 487 3.170 3.791 4. 355 4. 868 5.335 5.759 6.145 6.495 6.814 7.103 7. 367 7. 606 7. 824 8. 002 8. 201 8. 365 8.514 9.077 9.427 12% 0.893 1 .690 2.402 3.037 3.605 4.111 4. 564 4. 968 5.328 5.650 5.988 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5 .453 5 .660 5. 842 6. 002 6.142 6.265 6.373 6.467 6.550 6.623 6.873 7.003 16% 0.862 1. 605 2. 246 2. 798 3.274 3.685 4.039 4. 344 4. 607 4. 833 5.029 5.197 5.342 5.468 5.575 5.669 5 .749 5.818 5.877 5.929 6.097 6.177 1 8% 0. 847 1. 566 2.174 2. 690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5 .008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 20% 0.833 1.528 2.106 2. 589 2.991 3. 326 3. 605 3. 837 4.031 4.193 4.327 4.439 4.533 4.61 1 4.675 4. 730 4. 775 4. 812 4. 844 4.870 4.948 4.979 24% 0.806 1.457 1.981 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 4.003 4 .059 4. 080 4.097 4.110 4.147 4.160 28% 0.781 1. 392 1.868 2. 241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 3.564 3.569 32% 0.758 1. 332 1.766 2.096 2.345 2.534 2.678 2.786 2.868 2 930 2.978 3.013 3.040 3. 061 3. 076 3.088 3. 097 3.104 3.109 3.113 3.122 3.124 36% 0.735 1.276 1.674 1.966 2.181 2. 399 2.455 2.540 2.603 2.650 2.683 2.708 2.727 2.740 2.750 2. 758 2. 763 2.767 2.770 2.772 2.776 2.778 Problem 7-23 You win a judgment in an auto accident case for $115,000. You immediately receive $25,000 but must pay your lawyer's fee of $20,000. In addition, you will receive $3,000 a year for 25 years for a total of $75,000, after which the balance owed ($15,000) will be paid. If the interest rate is 7 percent, what is the current value of your settlement? Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. $ \fInterest Factors for the Present Value of an Annuity of One Dollar 0.990 0.980 0.971 1.970 1.942 1.913 2.941 2.884 2.829 3.902 3.808 3.717 4.853 4.713 4.580 5.795 5.601 5.417 6.728 6.472 6.230 7.652 7.325 7.020 8.566 8.162 7.786 9.471 8.983 8.530 10.368 9.787 9.253 11.255 10.575 9.954 12.134 11.348 10.635 4% 0.962 1 .886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.1 1 1 8.760 9.385 9.986 13.004 12.106 11.296 10.563 13.865 12.849 11.938 11.118 10.380 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.534 9.295 9.712 14.718 13.578 12.561 11.652 10.838 10.106 15.562 14.292 13.166 12.166 11.274 10.477 16.398 14.992 13.754 12.659 11.690 10.828 10.059 17.226 15.678 14.324 13.134 12.085 11.158 10.336 18.046 16.351 14.877 13.590 12.462 11.470 10.594 7% 0.935 1.808 2.624 3.387 4.100 4.766 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 25.808 22.937 19.600 17292 15.373 13.765 12.409 11.258 9% 0.917 1.759 2.531 3.240 3.890 4. 486 5 .033 5.535 5.985 6.418 6.805 7.161 7.487 7.786 8.060 8.312 8.544 8.756 8. 950 9.128 9.823 10.274 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.002 8.201 8.365 8.514 9.077 9.427 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.988 6.194 6.424 6.628 6.811 6.974 7.120 72 50 7.366 7.469 7.843 8.055 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6002 6.142 6.265 6.373 6.467 6.550 6.623 6.873 7.003 16% 0.862 1. 605 2.246 2. 798 3.274 3.685 4.039 4. 344 4. 607 4 833 5.029 5.197 5.342 5. 468 5.575 5 .669 5.749 5.818 5.877 5.929 6.097 6.177 18% 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 20% 0.833 1.528 2 106 2. 589 2.991 3.326 3.605 3.837 4.031 4.193 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.844 4.870 4.948 4.979 24% 0.806 1.457 1.981 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 4.003 4. 059 4. 080 4.097 4.110 4.147 4.160 28% 0.781 1. 392 1.868 2.241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 3.564 3.569 32% 0.758 1.332 1.766 2.096 2.345 2.534 2.678 2.786 2.868 2.930 2.978 3.013 3.040 3.061 3.076 3.088 3.097 3.104 3.109 3.113 3.122 3.124 36% 0.735 1.276 1.674 1.966 2.181 2.399 2.455 2.540 2.603 2.650 2.683 2.708 2.727 2.740 2.750 2.758 2.763 2.767 2.770 2.772 2.776 2.778 Problem 7-24 A firm must choose between two investment alternatives, each costing $90,000. The first alternative generates $35,000 a year for four years. The second pays one large lump sum of $163,100 at the end of the fourth year. If the rm can raise the required funds to make the investment at an annual cost of 12 percent, what are the present values of two investment alternatives? Use Appendix B and Appendix D to answer the question. Round your answers to the nearest dollar. PV(First alternative): $ PV(Seoond alternative): $ Which alternative should be preferred? The alternative should be preferred. \fInterest Factors for the Present Value of an Annuity of One Dollar 6% 7% 8% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 11.25510.575 9.954 9.385 8.863 8.384 7.943 7.536 12.13411.34810.635 9.986 9.394 8.534 8.358 7.904 13.00412.10611.29610.563 9.899 9.295 8.745 8.244 13.86512.84911.938 11.118 10.380 9.712 9.108 8.559 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 1639814992 13.754 12.659 11.690 10.828 10.059 9.372 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9 /- 0.917 1.759 2.531 3.240 3.890 4. 486 5. 033 5.535 5.985 6.418 6.805 7.161 7.487 7.786 8.060 8.312 8.544 8.756 8.950 9.128 9.823 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 10% 0. 909 1.736 2. 487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7. 824 8. 002 8. 201 8.365 8.514 9.077 9.427 12% 0.3 1.690 2.402 3.037 3.605 4.111 4.564 4. 968 5.328 5. 650 5.988 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 14% 0.877 1.647 2. 322 2. 914 3.433 3. 889 4. 288 4. 639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 6.873 7.003 16% 0.862 1.605 2. 246 2. 798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5. 468 5.575 5. 669 5. 749 5.818 5.877 5.929 6.097 6.177 1 8% 0. 847 1. 566 2.174 2. 690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 20% 0.833 1.528 2.106 2. 589 2.991 3. 326 3.605 3. 837 4.031 4.193 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.844 4.870 4.948 4.979 24% 0.806 1.457 1.981 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 4.003 4. 059 4.080 4.097 4.110 4.147 4.160 28% 0.781 1.392 1.868 2. 241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 3.564 3.569 32% 0.758 1.332 1.766 2.096 2. 345 2.534 2.678 2.786 2.868 2 930 2.978 3.013 3.040 3. 061 3.076 3.088 3. 097 3.104 3.109 3.113 3.122 3.124 36% 0.735 1.276 1.674 1.966 2.181 2.399 2.455 2.540 2.603 2.650 2.683 2.708 2.727 2.740 2.750 2. 758 2. 763 2.767 2.770 2.772 2.776 2.778 Problem 7-26 Uncle Fred recently died and left $340,000 to his 55-year-old favorite niece. She immediately spent $100,000 on a town home but decided to invest the balance for her retirement at age 65. What rate of return must she earn on her investment over the next 10 years to permit her to withdraw $65,000 at the end of each year through age 80 if her funds earn 9 percent annually during retirement? Use Appendix A and Appendix D to answer the question. Round your answer to the nearest whole number. /o Interest Factors for the Future Value of One Dollar Time Period (e.g.. year) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.120 1.140 1.150 1.160 1.180 1.200 1.020 1.040 1.061 1.082 1.102 1.124 1.145 1.166 1.188 1.210 1.254 1.300 1.322 1.346 1.392 1.440 UI AWN- 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.405 1.482 1.521 1.561 1.643 1.728 1.041 1.082 1.126 1.170 1.216 1.262 1.311 1.360 1.412 1.464 1.574 1.689 1.749 1.811 1.939 2.074 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.762 1.925 2.011 2.100 2.288 2.488 6 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.677 1.772 1.974 2.195 2.313 2.436 2.700 2.986 1.072 1.149 1.230 1.316 1.407 1.504 1.606 1.714 1.828 1.949 2.211 2.502 2.660 2.826 3.186 3.583 900 1.083 1.172 1.267 1.369 1.477 1.594 1.718 1.851 1.993 2.144 2.476 2.853 3.059 3.278 3.759 4.300 9 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358 2.773 3.252 3.518 3.803 4.436 5.160 10 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.367 2.594 3.106 3.707 4.046 4.411 5.234 6.192 11 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 2.580 2.853 3.479 4.226 4.652 5.117 6.176 7.430 12 1.127 1.268 1.426 1.601 1.796 2.012 2.252 2.518 2.813 3.138 3.896 4.818 5.350 5.936 7.287 8.916 13 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 4.363 5.492 6.153 6.886 8.599 10.699 14 1.149 1.319 1.513 1.732 1.980 2.261 2.579 2.937 3.342 3.797 4.887 6.261 7.076 7.988 10.147 12.839 15 1.161 1.346 1.558 1.801 2.079 2.397 2.759 3.172 3.642 4.177 5.474 7.138 8.137 9.266 11.973 15.407 16 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 6.130 8.137 9.358 10.748 14.129 18.488 17 1.184 1.400 1.653 1.948 2.292 2.693 3.159 3.700 4.328 5.054 6.866 9.276 10.761 12.468 16.672 22.186 18 1.196 1.428 1.702 2.026 2.407 2.854 3.380 3.996 4.717 5.560 7.690 10.575 12.375 14.463 19.673 26.623 19 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 5.142 6.116 8.613 12.056 14.232 16.777 23.214 31.948 20 1.220 1.486 1.806 2.191 2.653 3.207 3.870 4.661 5.604 6.728 9.646 13.743 16.367 19.461 27.393 38.337 25 1.282 1.641 2.094 2.666 3.386 4.292 5.427 6.848 8.623 10.835 17.000 26.462 32.919 40.874 62.688 95.396 30 1.348 1.811 2.427 3.243 4.322 5.743 7.612 10.063 13.268 17.449 29.960 50.950 66.212 85.850 143.370 237.370Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g.. year 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1.674 UI AWN 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 13 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.763 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778Problem 7-27 A $400,000 state lottery prize is spread evenly over eight years ($50,000 a year) (Alternative 1), or you may take a lump distribution of $300,000 (Alternative 2). If you can earn 6 percent, calculate the present values of both alternatives. Use Appendix D to answer the question. Round your answers to the nearest dollar. PV(Alternative 1) : $ PV (Alternative 2): $ Which alternative is better? -Select-Interest Factors for the Present Value of an Annuity of One Dollar 0.990 0.980 0.971 1.970 1.942 1.913 2.941 2.884 2.829 3.902 3.808 3.717 4.853 4.713 4.580 5.795 5.601 5.417 6.728 6.472 6.230 7.652 7.325 7.020 8.566 8.162 7.786 9.471 8.983 8.530 10.368 9.787 9.253 1125510575 9.954 12.134 11.348 10.635 4% 0.962 5% 0.952 1.886 1.859 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.1 1 1 8.760 9.385 9.986 13.004 12.106 11.296 10.563 13.865 12.849 11.938 11.118 10.380 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.534 9.295 9.712 14.718 13.578 12.561 11.652 10.838 10.106 15.562 14.292 13.166 12.166 11.274 10.477 1639814992 13.754 12.659 11.690 10.828 10.059 17.226 15.678 14.324 13.134 12.085 11.158 10.336 18.046 16.351 14.877 13.590 12.462 11.470 10.594 7% 0.935 1.808 2.624 3.387 4.1 00 4.766 5.389 5.971 6.51 5 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.81 8 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.985 6.418 6.805 7.161 7.487 7.786 8.060 8.312 8.544 8.756 8.950 9.128 9.823 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.002 8.201 8.365 8.514 9.077 9.427 12% 0.893 1.690 2.402 3.037 3.605 4.1 1 1 4.564 4.968 5.328 5.650 5.988 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 6.873 7.003 1 6% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5 468 5.575 5.669 5.749 5.313 5.877 5.929 6.097 6.177 1 8% 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5 008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 20% 24% 0.833 0.806 1.528 1.457 2.106 1.981 2.589 2.404 2.991 2.745 3.326 3.020 3.605 3.242 3.837 3.421 4.031 3.566 4.193 3.682 4.327 3.776 4.439 3.851 4.533 3.912 4.611 3.962 4.675 4.001 4.730 4.003 4.775 4.059 4.812 4.080 4.844 4.097 4.870 4.110 4.948 4.147 4.979 4.160 28% 0.781 1.392 1.868 2.241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 3.564 3.569 32% 0.758 1.332 1.766 2.096 2.345 2.534 2.678 2.786 2.868 2.930 2.978 3.013 3.040 3.061 3.076 3.088 3.097 3.104 3.109 3.113 3.122 3.124 36% 0.735 1.276 1.674 1.966 2.181 2.399 2.455 2.540 2.603 2.650 2.683 2.708 2.727 2.740 2.750 2.758 2.763 2.767 2.770 2.772 2.776 2.778 Problem 7-31 Use a financial calculator or a program such as Excel to answer the questions. Round your answers to the nearest whole number. a. You purchase a stock for $9,500 and collect $350 at the end of each year in dividends. You sell the stock for $11,000 after six years. What was the annual return on your $9,500 investment? c'/::I b. You purchase a building for $750,000, collect annual rent (after expenses) of $110,000, and sell the building for $800,000 after four years. What is the annual return on this investment? \"/0 c. You buy a stock for $1,000 and expect to sell it for $940 after six years but also expect to collect dividends of $130 a year. Calculate the return on this investment and prove that it is less than 15 percent. c'/::I