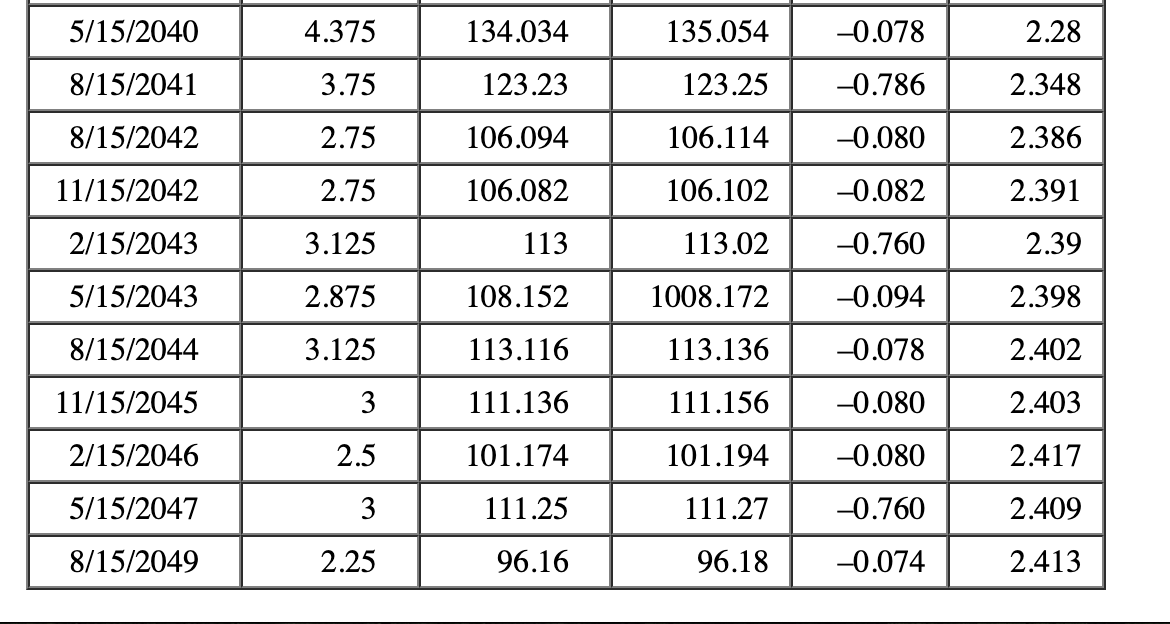

Question: Problem 7-16 Using Treasury Quotes (LO2] Locate the Treasury issue in Figure 7.5 maturing in August 2044. Assume a par value of $10,000. a. What

![Problem 7-16 Using Treasury Quotes (LO2] Locate the Treasury issue in](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6703703165579_57667037030e0b06.jpg)

Problem 7-16 Using Treasury Quotes (LO2] Locate the Treasury issue in Figure 7.5 maturing in August 2044. Assume a par value of $10,000. a. What is its coupon rate? (Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) b. What is its bid price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What was the previous day's asked price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Coupon rate b. Bid price c. Previous day's price FIGURE 7.5 Sample Wall Street Journal U.S. Treasury Note and Bond Prices Treasury Notes and Bonds Asked Yield Maturity Coupon Bid Asked Chg -0.022 5/15/2020 8.75 103.18 103.184 1.649 12/31/2020 2.5 100.294 100.3 -0.006 1.661 9/30/2021 1.125 98.304 98.31 0.102 1.684 4/30/2022 1.75 100.05 100.054 0.008 1.679 12/31/2022 2.125 101.096 101.102 0.002 1.69 1/31/2023 1.75 100.042 100.046 0.006 1.702 3/31/2023 2.5 102.194 102 0.002 1.698 7/31/2023 1.25 98.114 98.12 0.004 1.703 4/30/2024 2 101.036 101.042 -0.006 1.735 5/31/2024 2 101.066 101.072 0.004 1.719 1/31/2025 2.5 103.202 103.206 -0.004 1.765 10/31/2025 3 106.212 106.216 -0.002 1.814 11/15/2026 6.5 130.2 130.21 -0.030 1.821 8/15/2027 6.375 132.17 132.18 -0.022 1.85 2/15/2029 2.625 105.296 105.306 -0.008 1.919 2/15/2031 5.375 134.14 134.16 -0.036 1.947 2/15/2036 4.5 132.23 132.25 -0.770 2.108 2/15/2037 5 141.22 141.24 -0.094 2.131 5/15/2038 4.5 135.026 136.046 -0.074 2.182 2/15/2039 3.5 119.214 119.234 -0.076 2.233 5/15/2040 4.375 134.034 135.054 -0.078 2.28 8/15/2041 3.75 123.23 123.25 -0.786 2.348 8/15/2042 2.75 106.094 106.114 -0.080 2.386 11/15/2042 2.75 106.082 106.102 -0.082 2.391 2/15/2043 3.125 113 113.02 -0.760 2.39 5/15/2043 2.875 108.152 1008.172 -0.094 2.398 8/15/2044 3.125 113.116 113.136 -0.078 2.402 11/15/2045 3 111.136 111.156 -0.080 2.403 2/15/2046 2.5 101.174 101.194 -0.080 2.417 5/15/2047 3 111.25 111.27 -0.760 2.409 8/15/2049 2.25 96.16 96.18 -0.074 2.413

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts