Question: Problem 7-17 (a) (LO. 3) On April 5, 2020, Ryan received land and a building from Thom as a gift. Thom's adjusted basis and the

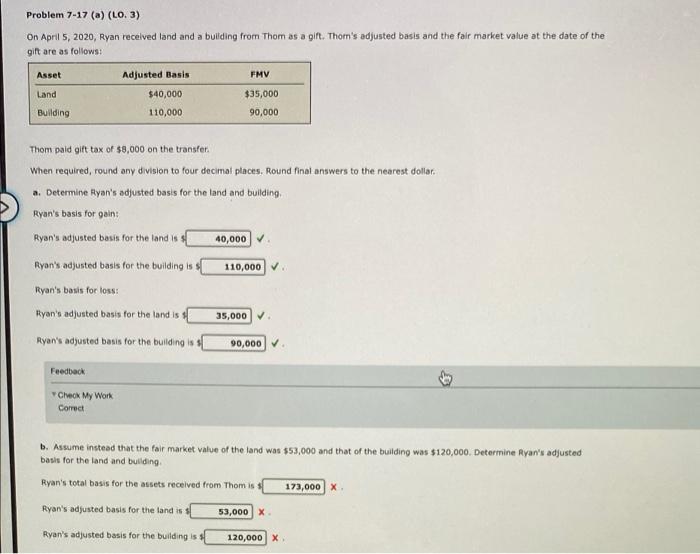

Problem 7-17 (a) (LO. 3) On April 5, 2020, Ryan received land and a building from Thom as a gift. Thom's adjusted basis and the fair market value at the date of the gift are as follows: Asset Adjusted Basis FMV Land $40,000 $35,000 Building 110,000 90,000 Thom paid gift tax of $8,000 on the transfer. When required, round any division to four decimal places. Round final answers to the nearest dollar. a. Determine Ryan's adjusted basis for the land and building. Ryan's basis for gain: Ryan's adjusted basis for the land is i 40,000 Ryan's adjusted basis for the building is 110,000 Ryan's basis for loss: Ryan's adjusted basis for the land is s 35,000 .. Ryan's adjusted basis for the building is 90,000 . Feedback Check My Work Correct b. Assume instead that the fair market value of the land was $53,000 and that of the building was $120,000. Determine Ryan's adjusted basis for the land and building. Ryan's total basis for the assets received from Thom is t 173,000 X Ryan's adjusted basis for the land is s 53,000 X. Ryan's adjusted basis for the building is s 120,000 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts