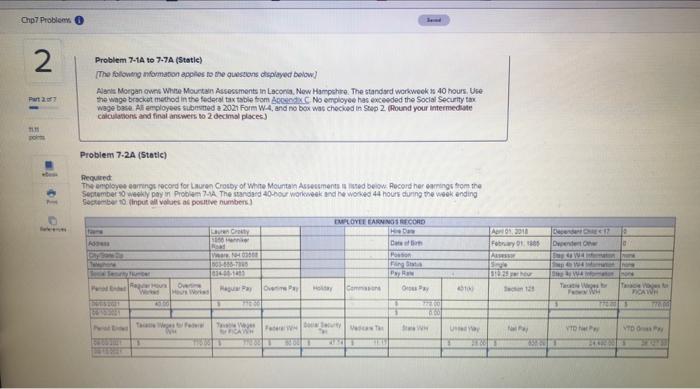

Question: Problem 7-1A to 7-7A (Static) The foloneng nifomation appites ro the dueselons ctspiayed bolow] Wage base At employees kubnsthed a 2027 Folm Wa, and no

![dueselons ctspiayed bolow] Wage base At employees kubnsthed a 2027 Folm Wa,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6a4330139e_34666e6a4328b4c0.jpg)

![7.7A (Static) The following information applies to the questions displayed below] Alanis](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6a435b73f8_34966e6a4354c5a3.jpg)

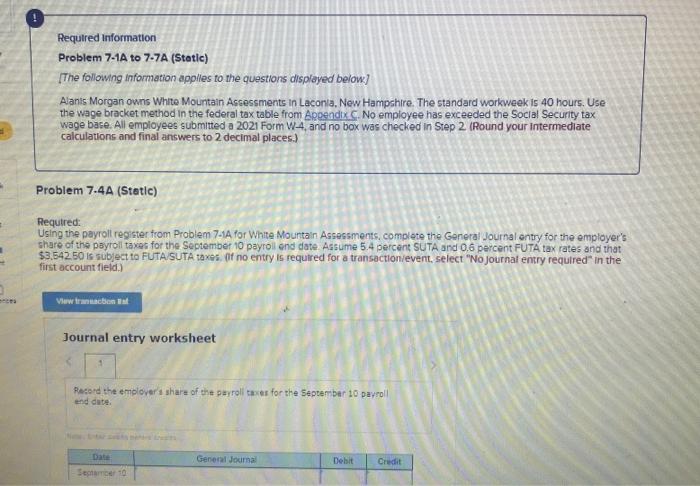

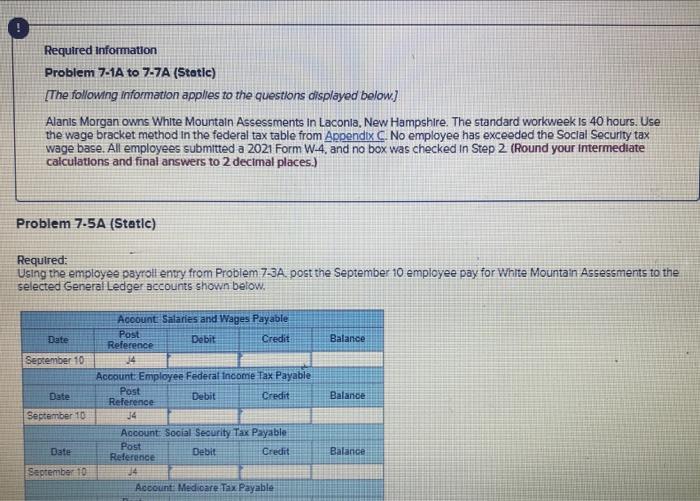

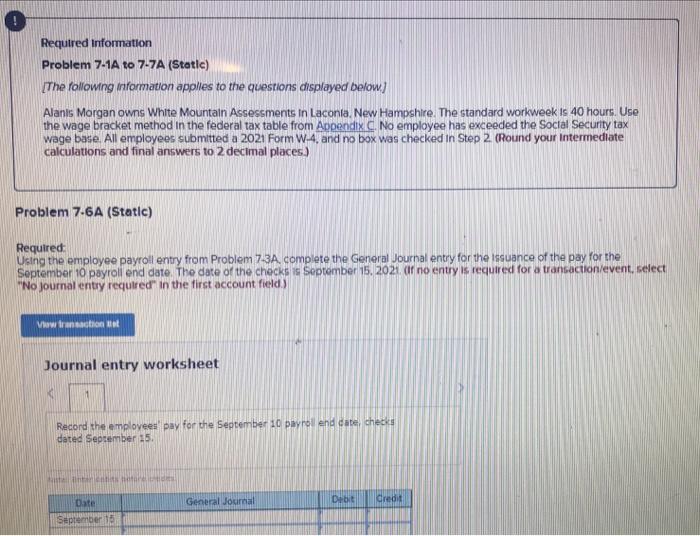

Problem 7-1A to 7-7A (Static) The foloneng nifomation appites ro the dueselons ctspiayed bolow] Wage base At employees kubnsthed a 2027 Folm Wa, and no bex was checked in Stes 2. Phound your intermectute calculshons and final answees to 2 decimsl places.) Problem 7.2A (5tetic) Pecuared Fepteribe to (inpue ali veues at potheve numbers) Required information Problem 7.1A to 7.7A (Static) The following information applies to the questions displayed below] Alanis Morgan owns White Mountain Assesemonts in Laconia, New Hampchire. The standard workweek is 40 hourg. Use the woge bracket method in the federal tax zable from Apoendix C. No employee has exceeded the Soclal Security tax wage base. Ali employees submitted a 2021 Form W-4, and no box was checked in Step 2 (Pound your intermediate calculations and final answers to 2 decimal places) Problem 7.3A (Static) Requtred Using the paytoli register from Problom 7.1A for Whas Mountain Aszessments, complete the General Journal entry for the employees" pay for the September 10 pay date. Paychecks witl be ifeyed on Septemoer 15 . Employees are pald weekly. (If no entry is required for a transectionievent, select 'No journal entyy required" in the first account fieid.) Journal entry worksheet Required information Problem 7-1A to 7.7A (Stotic) [The following information applles to the questions displayed below] Alanis Morgan owns White Mountain Ascessments in Laconla, New Hampshire. The standard workweek is 40 hours. Use the wage bracket method in the federal tax table from Appendix. . No employee has exceeded the Soclal Security tax wage base. All employees submitted a 2021 Form W-4, and no box was checked in Step 2 (Round your intermediate calculations and final answers to 2 decimal places.) Problem 7.4A (Static) Requtred: Using the payroll register from Problem 7-1A for White Mountain Assessments. complete the General Journal entry for the employer's share of the payroll taxes for the September 10 payroll end date Assume 5.4 percent SUTA and 0.6 percent FUTA tax rates and that $3.542.50 is subject to FUTA.SUTA taxes. (if no entry is requtred for a transactionievent, select "No journal entry required" in the first account field.) Journal entry worksheet Rese ta the emplorer 1 shar of the parroli taries for the Septefiber 10 payroll end date. Required infomation Problem 7-1A to 7-7A (5tatic) [The following information applies to the questions displayed below] Alanis Morgan owns White Mountain Assessments in Laconia, New Hampshire. The standard workweek is 40 hours. Use the wage bracket method in the federal tax table from Appendix C. No employee has exceeded the Soclal Security tax wage base. All employees submitted a 2021 Form W-4, and no box was checked in Step 2 (Round your intermediate calculations and final answers to 2 decimal places.) roblem 7.5A (Static) equlred: sing the employee payroll entry from Problem 7.3A. post the September 10 employee pay for White Mountain Assessments to the elected General Ledger accounts shown below. Required Information Problem 7.1A to 7.7A (Statlc) [The following information applies to the questions displayed befow] Alanis Morgan owns White Mountain Assessments in Laconia. New Hampshire. The standard workweek is 40 hours. Use the wage bracket method in the federal tax table from Appendix C. No employee has exceeded the Soctal Security tax Wage base All employees submitted a 2021 Form W-4, and no box was checked in Step 2. (Round your Intermediate calculations and final answers to 2 decimal places) roblem 7.6A (Static) equired: sing the employee payroll entry from Problem 7.3A. complete the General Journal entry for the Iscuance of the pay for the eptember 10 payroli end date. The date of the checks is September 15. 2021 . (if no entry is required for a transaction/event, select No journal entry required" in the first account field. Journal entry worksheet Record the employee: pay for the September 10 payrol end datel thetks dated September 15. Problem 7-8A (Statlc) KMH Industries is a monthly schedule depositor of payroll taxes. For the month of August 2021, the payroll taxes (employee and employer share combined) were as follows: Soclal Securrty tax $3,252.28 Medicare tax: $760.61 Employee Federal income tax: $2,520.00 Required: Create the General Joumal entry for the remittance of the taxes. (If no entry is required for a transaction/event, select "No journal entry required" In the first account field. Round your answers to 2 decimal places.) Journal entry worksheet Record the remittance of August payroll taxes. Note: Enter debits hetare crodibt: Problem 7-1A to 7-7A (Static) The foloneng nifomation appites ro the dueselons ctspiayed bolow] Wage base At employees kubnsthed a 2027 Folm Wa, and no bex was checked in Stes 2. Phound your intermectute calculshons and final answees to 2 decimsl places.) Problem 7.2A (5tetic) Pecuared Fepteribe to (inpue ali veues at potheve numbers) Required information Problem 7.1A to 7.7A (Static) The following information applies to the questions displayed below] Alanis Morgan owns White Mountain Assesemonts in Laconia, New Hampchire. The standard workweek is 40 hourg. Use the woge bracket method in the federal tax zable from Apoendix C. No employee has exceeded the Soclal Security tax wage base. Ali employees submitted a 2021 Form W-4, and no box was checked in Step 2 (Pound your intermediate calculations and final answers to 2 decimal places) Problem 7.3A (Static) Requtred Using the paytoli register from Problom 7.1A for Whas Mountain Aszessments, complete the General Journal entry for the employees" pay for the September 10 pay date. Paychecks witl be ifeyed on Septemoer 15 . Employees are pald weekly. (If no entry is required for a transectionievent, select 'No journal entyy required" in the first account fieid.) Journal entry worksheet Required information Problem 7-1A to 7.7A (Stotic) [The following information applles to the questions displayed below] Alanis Morgan owns White Mountain Ascessments in Laconla, New Hampshire. The standard workweek is 40 hours. Use the wage bracket method in the federal tax table from Appendix. . No employee has exceeded the Soclal Security tax wage base. All employees submitted a 2021 Form W-4, and no box was checked in Step 2 (Round your intermediate calculations and final answers to 2 decimal places.) Problem 7.4A (Static) Requtred: Using the payroll register from Problem 7-1A for White Mountain Assessments. complete the General Journal entry for the employer's share of the payroll taxes for the September 10 payroll end date Assume 5.4 percent SUTA and 0.6 percent FUTA tax rates and that $3.542.50 is subject to FUTA.SUTA taxes. (if no entry is requtred for a transactionievent, select "No journal entry required" in the first account field.) Journal entry worksheet Rese ta the emplorer 1 shar of the parroli taries for the Septefiber 10 payroll end date. Required infomation Problem 7-1A to 7-7A (5tatic) [The following information applies to the questions displayed below] Alanis Morgan owns White Mountain Assessments in Laconia, New Hampshire. The standard workweek is 40 hours. Use the wage bracket method in the federal tax table from Appendix C. No employee has exceeded the Soclal Security tax wage base. All employees submitted a 2021 Form W-4, and no box was checked in Step 2 (Round your intermediate calculations and final answers to 2 decimal places.) roblem 7.5A (Static) equlred: sing the employee payroll entry from Problem 7.3A. post the September 10 employee pay for White Mountain Assessments to the elected General Ledger accounts shown below. Required Information Problem 7.1A to 7.7A (Statlc) [The following information applies to the questions displayed befow] Alanis Morgan owns White Mountain Assessments in Laconia. New Hampshire. The standard workweek is 40 hours. Use the wage bracket method in the federal tax table from Appendix C. No employee has exceeded the Soctal Security tax Wage base All employees submitted a 2021 Form W-4, and no box was checked in Step 2. (Round your Intermediate calculations and final answers to 2 decimal places) roblem 7.6A (Static) equired: sing the employee payroll entry from Problem 7.3A. complete the General Journal entry for the Iscuance of the pay for the eptember 10 payroli end date. The date of the checks is September 15. 2021 . (if no entry is required for a transaction/event, select No journal entry required" in the first account field. Journal entry worksheet Record the employee: pay for the September 10 payrol end datel thetks dated September 15. Problem 7-8A (Statlc) KMH Industries is a monthly schedule depositor of payroll taxes. For the month of August 2021, the payroll taxes (employee and employer share combined) were as follows: Soclal Securrty tax $3,252.28 Medicare tax: $760.61 Employee Federal income tax: $2,520.00 Required: Create the General Joumal entry for the remittance of the taxes. (If no entry is required for a transaction/event, select "No journal entry required" In the first account field. Round your answers to 2 decimal places.) Journal entry worksheet Record the remittance of August payroll taxes. Note: Enter debits hetare crodibt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts