Question: Problem 7.2 Amber McClain Amber McClain, the currency speculator we met earlier in the chapter, sells eight June futures contracts for 500,000 pesos at the

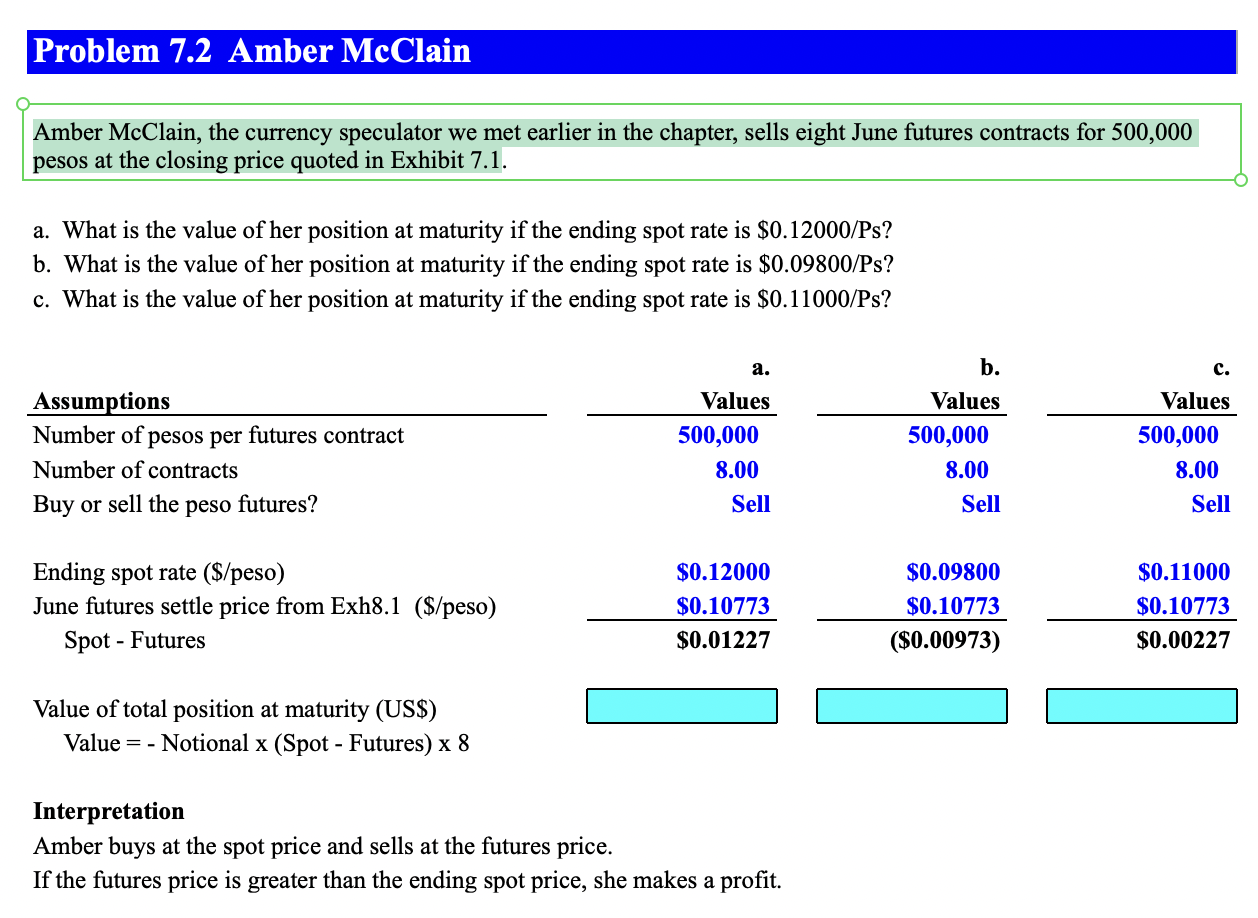

Problem 7.2 Amber McClain Amber McClain, the currency speculator we met earlier in the chapter, sells eight June futures contracts for 500,000 pesos at the closing price quoted in Exhibit 7.1. a. What is the value of her position at maturity if the ending spot rate is $0.12000/Ps? b. What is the value of her position at maturity if the ending spot rate is $0.09800/Ps? c. What is the value of her position at maturity if the ending spot rate is $0.11000/Ps? a. Assumptions Number of pesos per futures contract Number of contracts Buy or sell the peso futures? Values 500,000 8.00 Sell b. Values 500,000 8.00 Sell c. Values 500,000 8.00 Sell Ending spot rate ($/peso) June futures settle price from Exh8.1 ($/peso) Spot - Futures $0.12000 $0.10773 $0.01227 $0.09800 $0.10773 ($0.00973) $0.11000 $0.10773 $0.00227 Value of total position at maturity (US$) Value = - Notional x (Spot - Futures) x 8 Interpretation Amber buys at the spot price and sells at the futures price. If the futures price is greater than the ending spot price, she makes a profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts