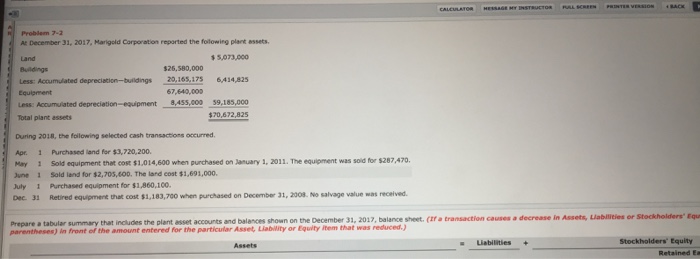

Question: Problem 7-2 At December 31, 2017, parigeldarpration reported the folowing part ssets. s 5,073,000 Buildinge $26,580,000 Less: Accumulated depreciation-buildings 20,165,175 6,414,825 67,640,000 Equipment Less: Accumulated

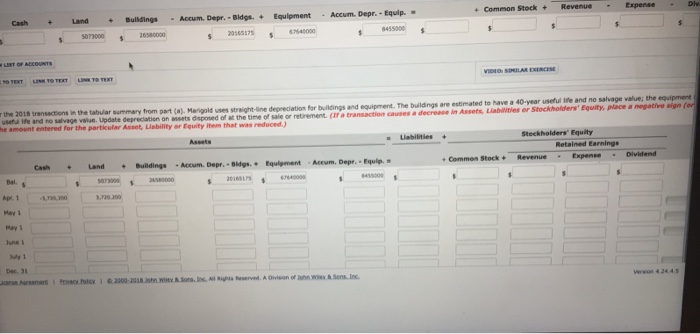

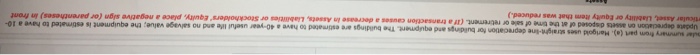

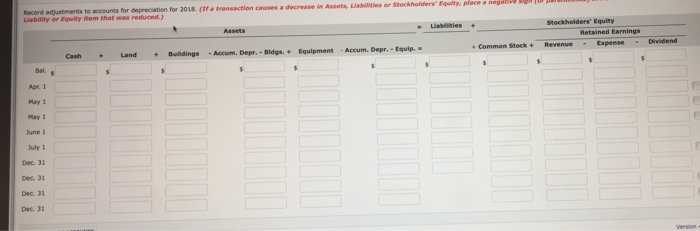

Problem 7-2 At December 31, 2017, parigeldarpration reported the folowing part ssets. s 5,073,000 Buildinge $26,580,000 Less: Accumulated depreciation-buildings 20,165,175 6,414,825 67,640,000 Equipment Less: Accumulated depreciation-equipment Total plant assets 59,185,000 70,672,825 8,455,000 During 2018, the folowing selected cash transactions occurred. Apr. 1 Purchased land for $3,720,200. May 1 Sold equipment thet cost $1,014,600 when purchased on January 1, 2011. The equipment was soid for $287,470. une 1 Sold land for $2,705,600. The land cost $1,691,000 July1 Purchased equipment for $1,860,100. Dec. 31 Retired equipment that cost $1,183,700 when purchased on December 31, 2008. No salvage value was recelved. Prepare a tabular summary that includes the plant asset accounts and balances shown on the December 31, 2017, balance sheet.(tf a transaction causes a decrease in parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets, Labilities or Stockholders Equ Stockholders Equity Retained tE Problem 7-2 At December 31, 2017, parigeldarpration reported the folowing part ssets. s 5,073,000 Buildinge $26,580,000 Less: Accumulated depreciation-buildings 20,165,175 6,414,825 67,640,000 Equipment Less: Accumulated depreciation-equipment Total plant assets 59,185,000 70,672,825 8,455,000 During 2018, the folowing selected cash transactions occurred. Apr. 1 Purchased land for $3,720,200. May 1 Sold equipment thet cost $1,014,600 when purchased on January 1, 2011. The equipment was soid for $287,470. une 1 Sold land for $2,705,600. The land cost $1,691,000 July1 Purchased equipment for $1,860,100. Dec. 31 Retired equipment that cost $1,183,700 when purchased on December 31, 2008. No salvage value was recelved. Prepare a tabular summary that includes the plant asset accounts and balances shown on the December 31, 2017, balance sheet.(tf a transaction causes a decrease in parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets, Labilities or Stockholders Equ Stockholders Equity Retained tE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts