Question: Problem 7.2 In a fixed-for-fixed currency swap, 4% on a US dollar principal of $160 million is received and 5% on a British pound principal

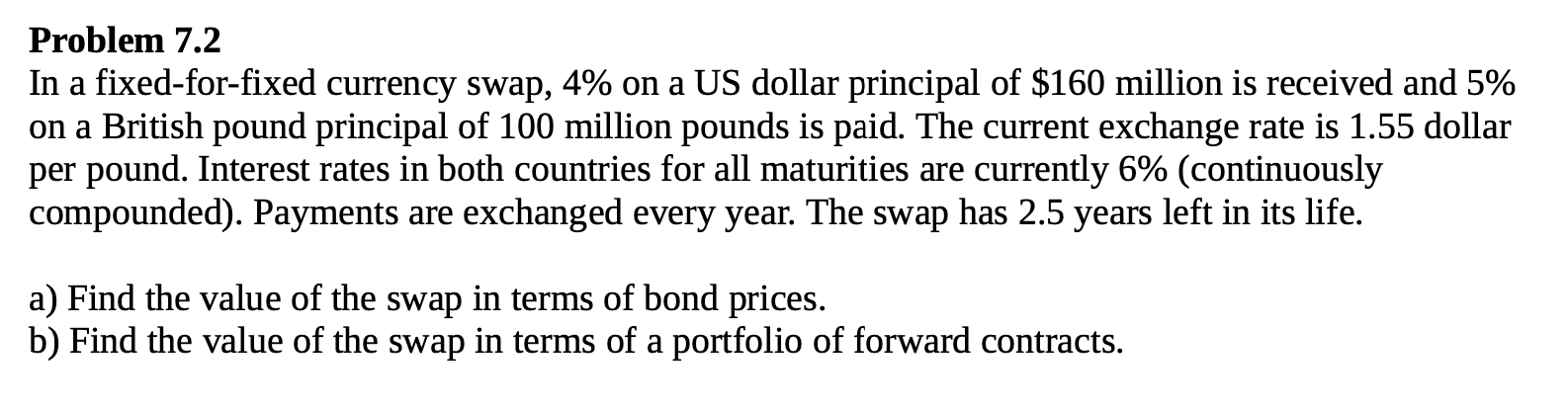

Problem 7.2 In a fixed-for-fixed currency swap, 4% on a US dollar principal of $160 million is received and 5% on a British pound principal of 100 million pounds is paid. The current exchange rate is 1.55 dollar per pound. Interest rates in both countries for all maturities are currently 6% (continuously compounded). Payments are exchanged every year. The swap has 2.5 years left in its life. a) Find the value of the swap in terms of bond prices. b) Find the value of the swap in terms of a portfolio of forward contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts