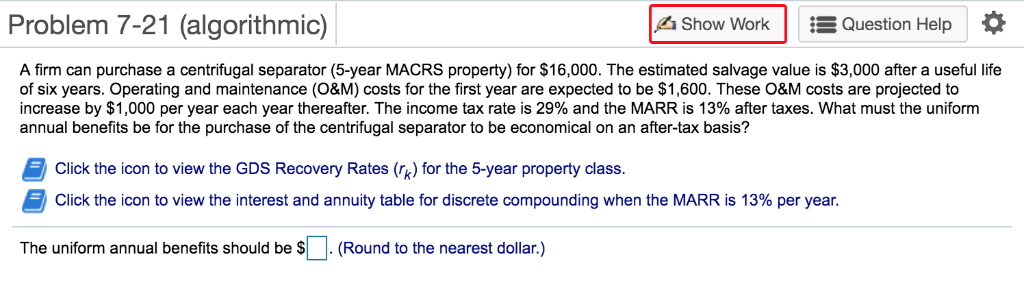

Question: Problem 7-21 (algorithmic) Show WorkQuestion Help A firm can purchase a centrifugal separator (5-year MACRS property) for $16,000. The estimated salvage value is $3,000 after

Problem 7-21 (algorithmic) Show WorkQuestion Help A firm can purchase a centrifugal separator (5-year MACRS property) for $16,000. The estimated salvage value is $3,000 after a useful life of six years. Operating and maintenance (O&M) costs for the first year are expected to be $1,600. These O&M costs are projected to increase by $1,000 per year each year thereafter. The income tax rate is 29% and the MARR is 13% after taxes. What must the uniform annual benefits be for the purchase of the centrifugal separator to be economical on an after-tax basis? Click the icon to view the GDS Recovery Rates (rk) for the 5-year property class Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year. The uniform annual benefits should be S.(Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts