Question: Problem 7-25 Apollo Data Systems is considering a promotional campaign that will increase annual credit sales by $610,000. The company will require investments in accounts

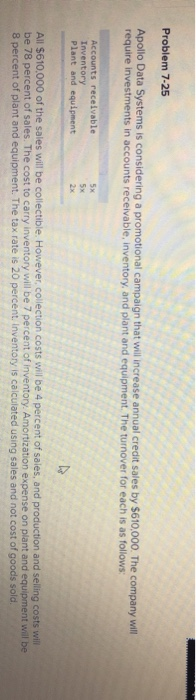

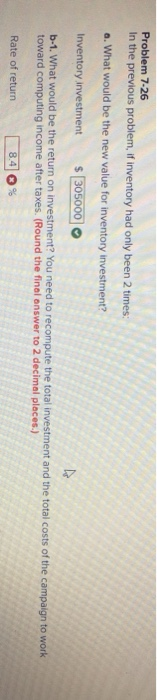

Problem 7-25 Apollo Data Systems is considering a promotional campaign that will increase annual credit sales by $610,000. The company will require investments in accounts receivable, inventory, and plant and equipment. The turnover for each is as follows: Accounts receivable Inventory Plant and equipment All $610,000 of the sales will be collectible. However, collection costs will be 4 percent of sales, and production and selling costs will be 78 percent of sales. The cost to carry inventory will be 7 percent of inventory. Amortization expense on plant and equipment will be 8 percent of plant and equipment. The tax rate is 20 percent. Inventory is calculated using sales and not cost of goods sold. Problem 7-26 In the previous problem, if inventory had only been 2 times: a. What would be the new value for inventory investment? Inventory investment $305000 b-1. What would be the return on investment? You need to recompute the total investment and the total costs of the campaign to work toward computing income after taxes. (Round the final answer to 2 decimal places.) Rate of return 8.4 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts