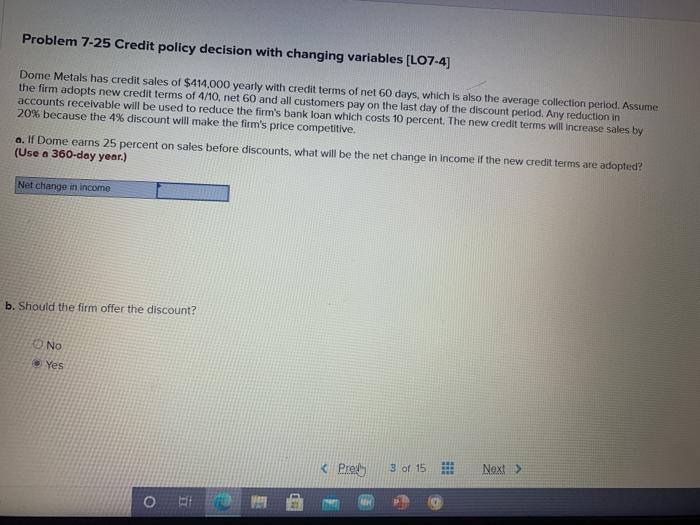

Question: Problem 7-25 Credit policy decision with changing variables (L07-4) Dome Metals has credit sales of $414,000 yearly with credit terms of net 60 days, which

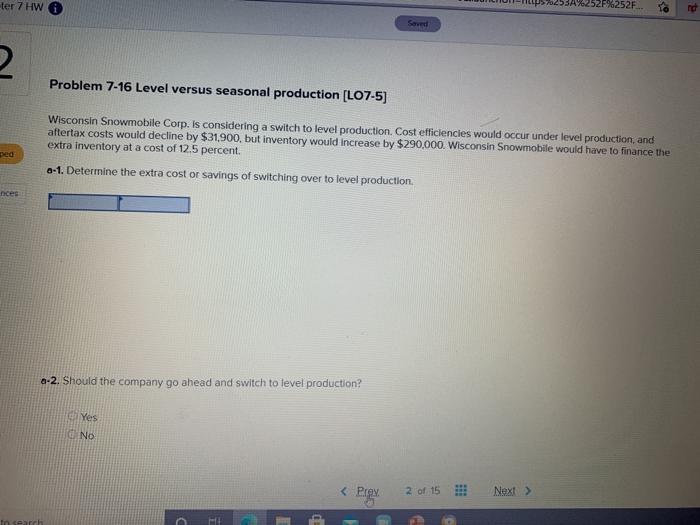

Problem 7-25 Credit policy decision with changing variables (L07-4) Dome Metals has credit sales of $414,000 yearly with credit terms of net 60 days, which is also the average collection period. Assume the firm adopts new credit terms of 4/10, net 60 and all customers pay on the last day of the discount period. Any reduction in accounts receivable will be used to reduce the firm's bank loan which costs 10 percent. The new credit terms will increase sales by 20% because the 4% discount will make the firm's price competitive. a. If Dome earns 25 percent on sales before discounts, what will be the net change in income if the new credit terms are adopted? (Use a 360-day year.) Net change in income b. Should the firm offer the discount? No Yes ORE ter 7 HW 2F%252F. te 2 Problem 7-16 Level versus seasonal production (L07-5) Wisconsin Snowmobile Corp. is considering a switch to level production Cost efficiencies would occur under level production, and aftertax costs would decline by $31.900, but inventory would increase by $290,000. Wisconsin Snowmobile would have to finance the extra inventory at a cost of 12.5 percent. 0-1. Determine the extra cost or savings of switching over to level production nces a-2. Should the company go ahead and switch to level production? Yes No 2 of 15 !!! Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts