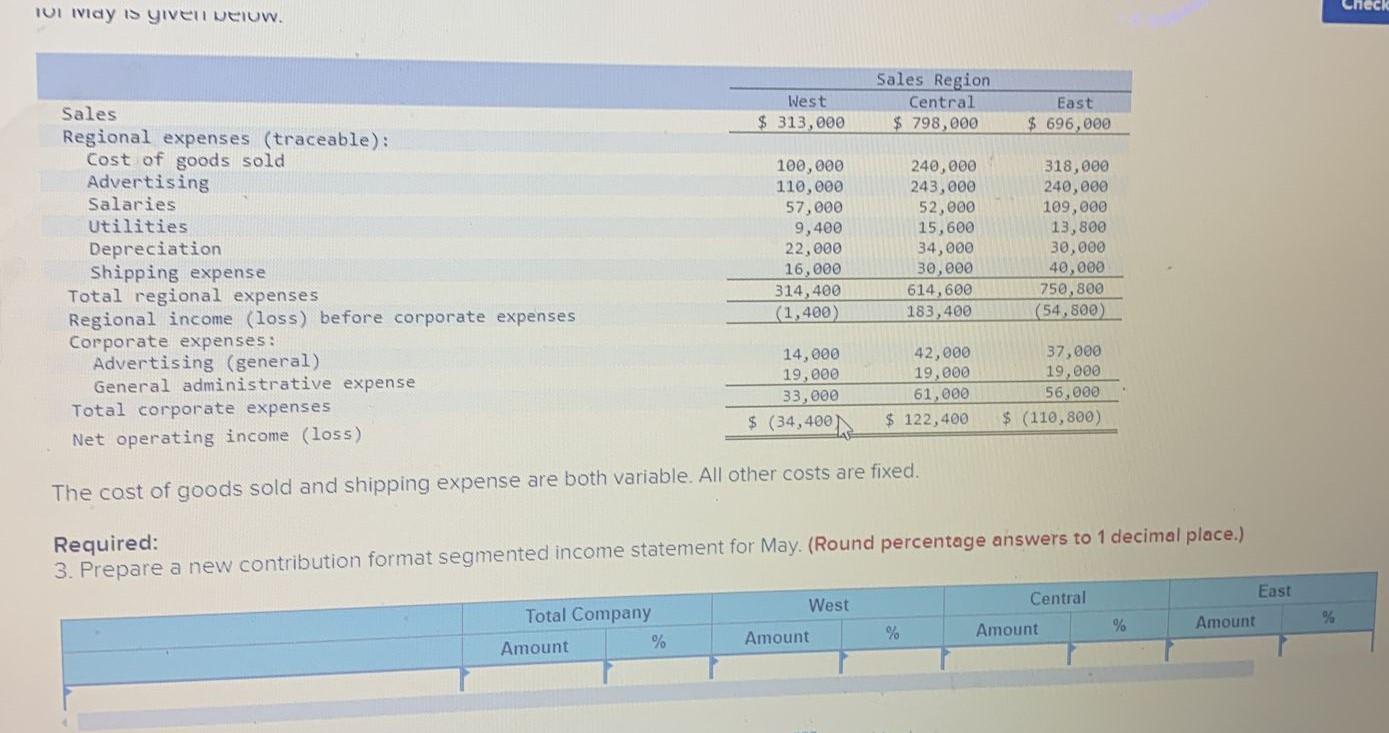

Question: Problem 7-26 (Algo) Restructuring a Segmented Income Statement [LO7-4] Millard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and

![Problem 7-26 (Algo) Restructuring a Segmented Income Statement [LO7-4] Millard Corporation](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66dba89c64907_57966dba89bce997.jpg)

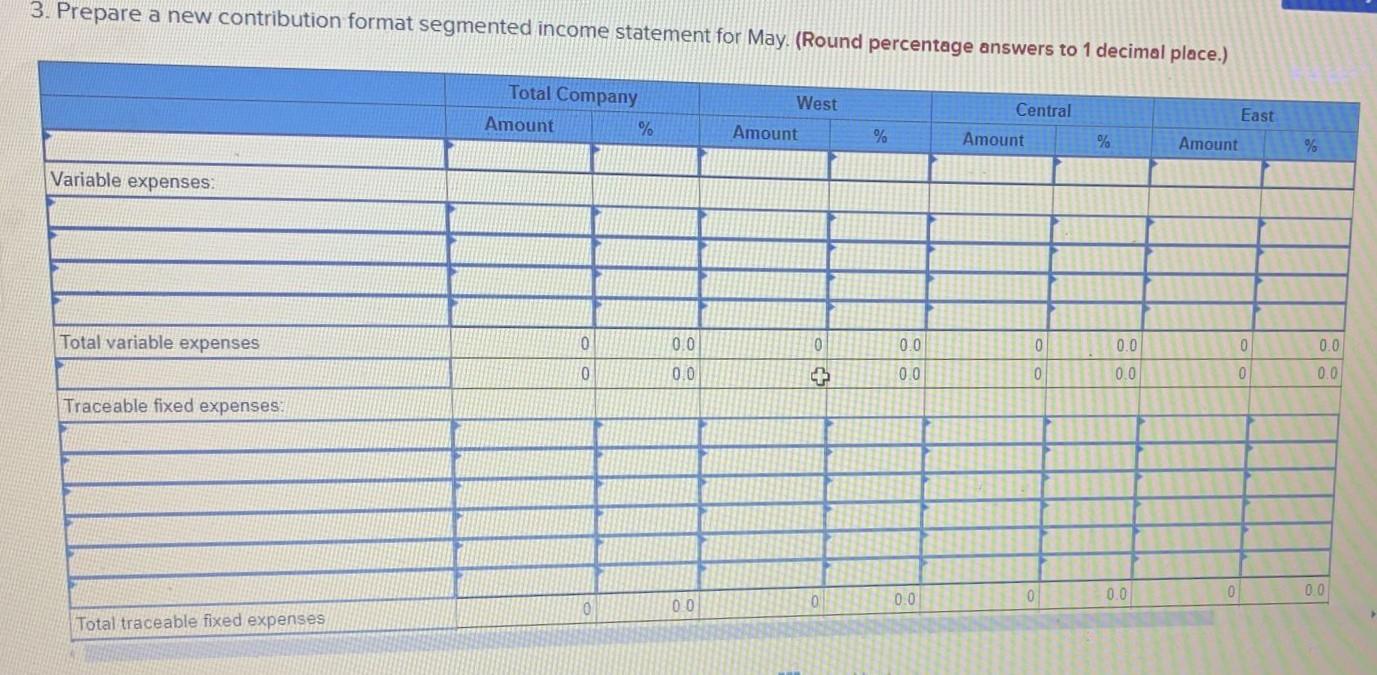

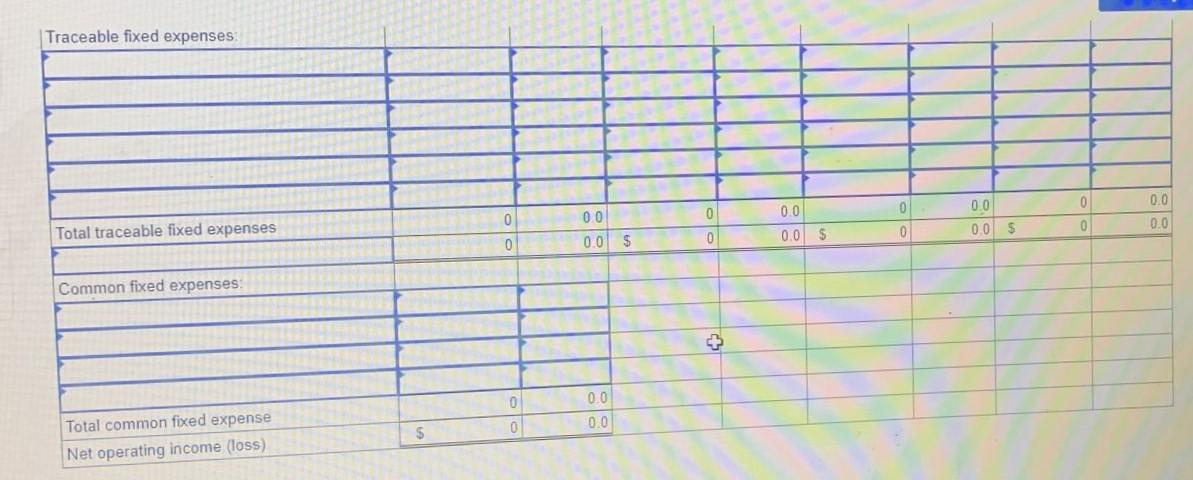

Problem 7-26 (Algo) Restructuring a Segmented Income Statement [LO7-4] Millard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff. The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company's first effort at preparing a segmented income statement for May is given below. West $ 313,000 Sales Region Central $ 798,000 East $ 696,000 Sales Regional expenses (traceable): Cost of goods sold Advertising Salaries Utilities Depreciation Shipping expense Total regional expenses Regional income (loss before corporate expenses Corporate expenses: Advertising (general) General administrative expense Total corporate expenses Net operating income (loss) 100,000 110,ooch 57,000 9,400 22,000 16,000 314,400 (1,400) 240,000 243,000 52,000 15,600 34,000 30,000 614,600 183,400 318,000 240,000 109,000 13,800 30,000 40,000 750,800 (54,800) 14,000 19,000 33,000 $ (34,400 42,000 19,000 61,000 $ 122,400 37,000 19,000 56,000 $ (110, 800) Check 101 vidy is given below. West $ 313,000 Sales Region Central $ 798,000 East $ 696,000 Sales Regional expenses (traceable): Cost of goods sold Advertising Salaries Utilities Depreciation Shipping expense Total regional expenses Regional income (loss) before corporate expenses Corporate expenses: Advertising (general) General administrative expense Total corporate expenses Net operating income (loss) 100,000 110,000 57,000 9,400 22,000 16,000 314,400 (1,400) 240,000 243,000 52,000 15,600 34,000 30,000 614,600 183,400 318,000 240,000 109,000 13,800 30,000 40,000 750,800 (54,800) 14,000 19,000 33,000 42,000 19,000 61,000 $ 122,400 37,000 19,000 56,000 $ (110, 800) $ $ (34,400N The cost of goods sold and shipping expense are both variable. All other costs are fixed. Required: 3. Prepare a new contribution format segmented income statement for May. (Round percentage answers to 1 decimal place.) East West Amount Central Amount % Amount % Total Company Amount % % 3. Prepare a new contribution format segmented income statement for May. (Round percentage answers to 1 decimal place.) Total Company Amount % West East Amount Central Amount % % Amount % Variable expenses Total variable expenses 0 0 0.0 0 0 0.0 0.0 0.0 0.0 0.0 0.0 0 + 0.0 0 0 Traceable fixed expenses: 0.0 0 00 00 0.0 0 Total traceable fixed expenses Traceable fixed expenses 0 0.0 0 0 0.0 0.0 $ 0 0 0.0 00 $ 0.0 0.0 $ 0.0 Total traceable fixed expenses 0 0 0 Common fixed expenses 0 0.0 0.0 $ 0 Total common fixed expense Net operating income (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts