Question: Problem 7.31 (Solution Video) In order to fund her retirement, Jennifer needs her portfolio to have an expected return of 10.7 percent per year over

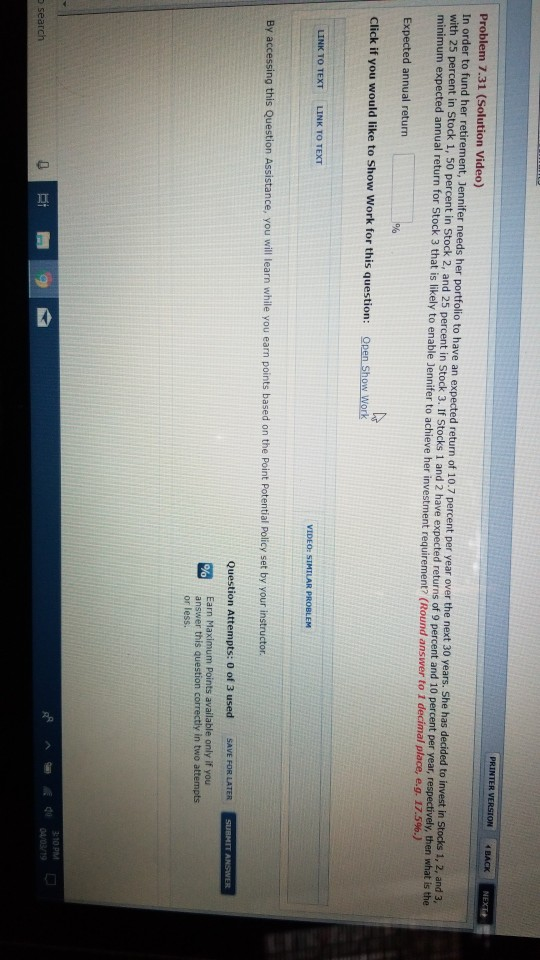

Problem 7.31 (Solution Video) In order to fund her retirement, Jennifer needs her portfolio to have an expected return of 10.7 percent per year over the next 30 years. She has decided to invest in Stocks 1, 2, and 3, with 25 percent in Stock 1, 50 percent in Stock 2, and 25 percent in Stock 3. If Stocks 1 and 2 have expected returns of 9 percent and 10 percent per year, respectively, then what is the minimum expected annual return for Stock 3 that is likely to enable Jennifer to achieve her investment requirement? (Round answer to i decimal place, e.g. 17.5 Expected annual return Click if you would like to Show Work for this question: Open S By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor Question Attempts: 0 of 3 used SAVE FOR LATERSUBAET ANSWER Earn Points available only if you answer this question correctly in two attempts or less 3-10 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts