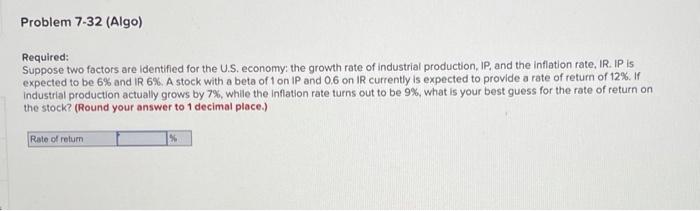

Question: Problem 7-32 (Algo) Required: Suppose two factors are identified for the U.S. economy: the growth rate of industrial production, IP, and the inflation rate, IR.

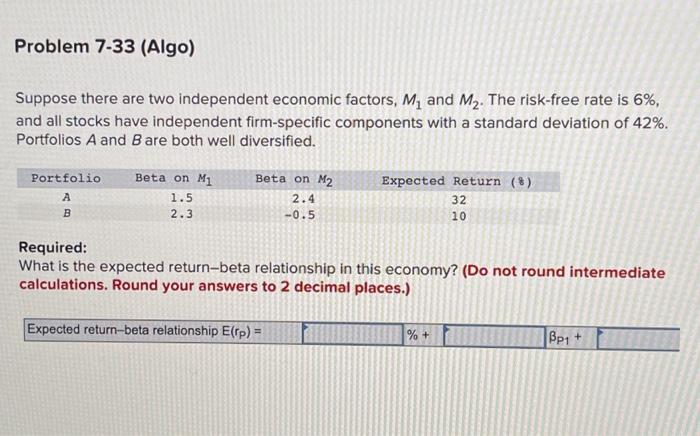

Problem 7-32 (Algo) Required: Suppose two factors are identified for the U.S. economy: the growth rate of industrial production, IP, and the inflation rate, IR. IP is expected to be 6% and IR 6%. A stock with a beta of 1 on IP and 0.6 on IR currently is expected to provide a rate of return of 12%. I Industrial production actually grows by 7%, while the inflation rate turns out to be 9%, what is your best guess for the rate of return on the stock? (Round your answer to 1 decimal place.) Rate of return % Problem 7-33 (Algo) Suppose there are two independent economic factors, M, and M2. The risk-free rate is 6%, and all stocks have independent firm-specific components with a standard deviation of 42%. Portfolios A and B are both well diversified. Portfolio A B Beta on My 1.5 2.3 Beta on M2 2.4 -0.5 Expected Return (8) 32 10 Required: What is the expected return-beta relationship in this economy? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected return-beta relationship E(rp) = %+ Bp1 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts