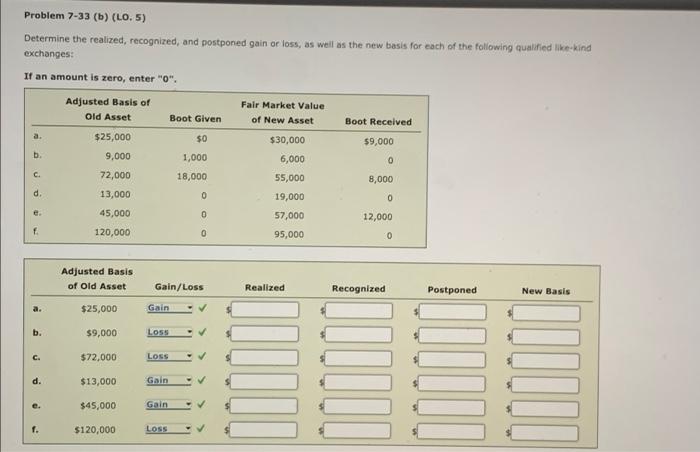

Question: Problem 7-33 (b) (LO. 5) Determine the realized, recognized, and postponed gain or loss, as well as the new basis for each of the following

Problem 7-33 (b) (LO. 5) Determine the realized, recognized, and postponed gain or loss, as well as the new basis for each of the following qualified like-kind exchanges: If an amount is zero, enter "o". Adjusted Basis of Old Asset Fair Market Value of New Asset Boot Given Boot Received $25,000 $0 $9,000 0 b 9,000 1,000 18,000 C. 8,000 $30,000 6,000 55,000 19,000 57,000 95,000 72,000 13,000 45,000 d. 0 0 0 12,000 120,000 0 O Adjusted Basis of Old Asset Gain/Loss Realized Recognized Postponed New Basis $25,000 Gain b. $9,000 Loss C. $72,000 LOSS COLONA d. $13,000 Gain nel e. $45,000 Gain 1. 1. $120,000 LOSS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts