Question: Problem 7-35 Bond Prices and Interest Rate Changes (LG7-5) A 705 percent coupon bond with 20 years left to maturity is priced to offer a

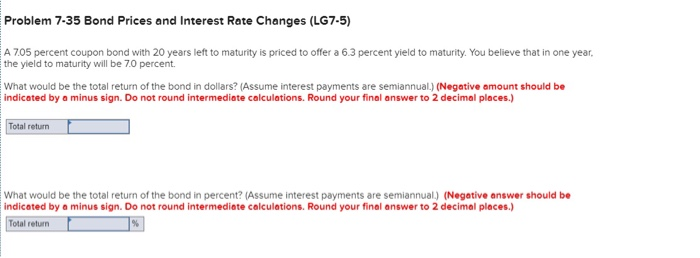

Problem 7-35 Bond Prices and Interest Rate Changes (LG7-5) A 705 percent coupon bond with 20 years left to maturity is priced to offer a 6.3 percent yield to maturity. You believe that in one year the yield to maturity will be 7.0 percent. What would be the total return of the bond in dollars? (Assume interest payments are semiannual.) (Negative amount should be indicated by a minus sign. Do not round intermediote colculations. Round your final answer to 2 decimal places.) Total return What would be the total return of the bond in percent? (Assume interest payments are semiannual) (Negative answer should be indicated by a minus sign. Do not round intermediate colculetions. Round your final answer to 2 decimal places.) Total return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts