Question: Problem 7-3A (Part Level Submission) On July 31, 2017, Cullumber Company had a cash balance per books of $6,250.00. The statement from Dakota State Bank

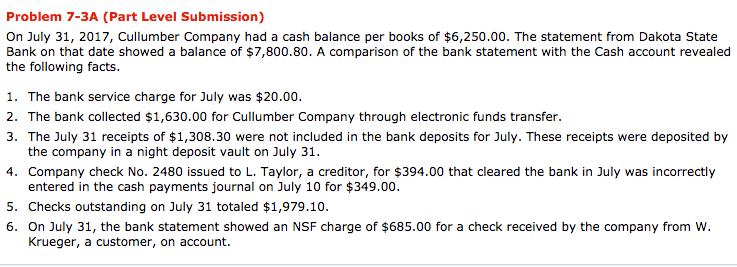

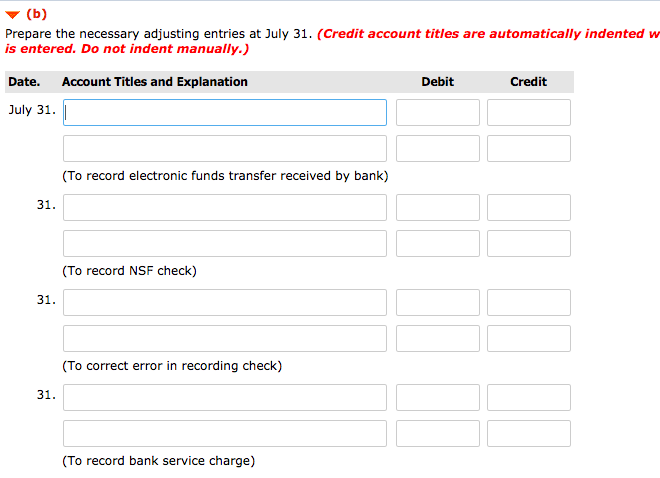

Problem 7-3A (Part Level Submission) On July 31, 2017, Cullumber Company had a cash balance per books of $6,250.00. The statement from Dakota State Bank on that date showed a balance of $7,800.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was $20.00. 2. The bank collected $1,630.00 for Cullumber Company through electronic funds transfer. 3. The July 31 receipts of $1,308.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. Company check No. 2480 issued to L. Taylor, a creditor, for $394.00 that cleared the bank in July was incorrectly entered in the cash payments journal on July 10 for $349.00 5 Checks outstanding on July 31 totaled $1,979.10. 6. On July 31, the bank statement showed an NSF charge of $685.00 for a check received by the company from W. Krueger, a customer, on account. Prepare the necessary adjusting entries at July 31. (Credit account titles are automatically indented w is entered. Do not indent manually.) Date. Account Titles and Explanation July 31. Debit Credit (To record electronic funds transfer received by bank) 31. (To record NSF check) 31. 31. (To record bank service charge)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts