Question: problem 7-3A Problem 7-3A On May 31, 2017, Reber Company had a cash balance per books of $7,181.50. The bank statement from New York State

problem 7-3A

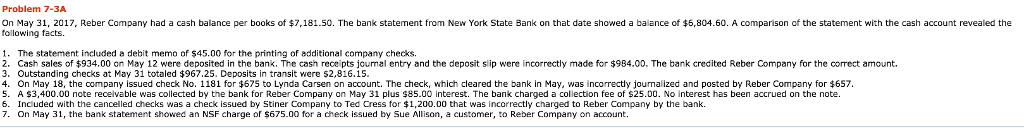

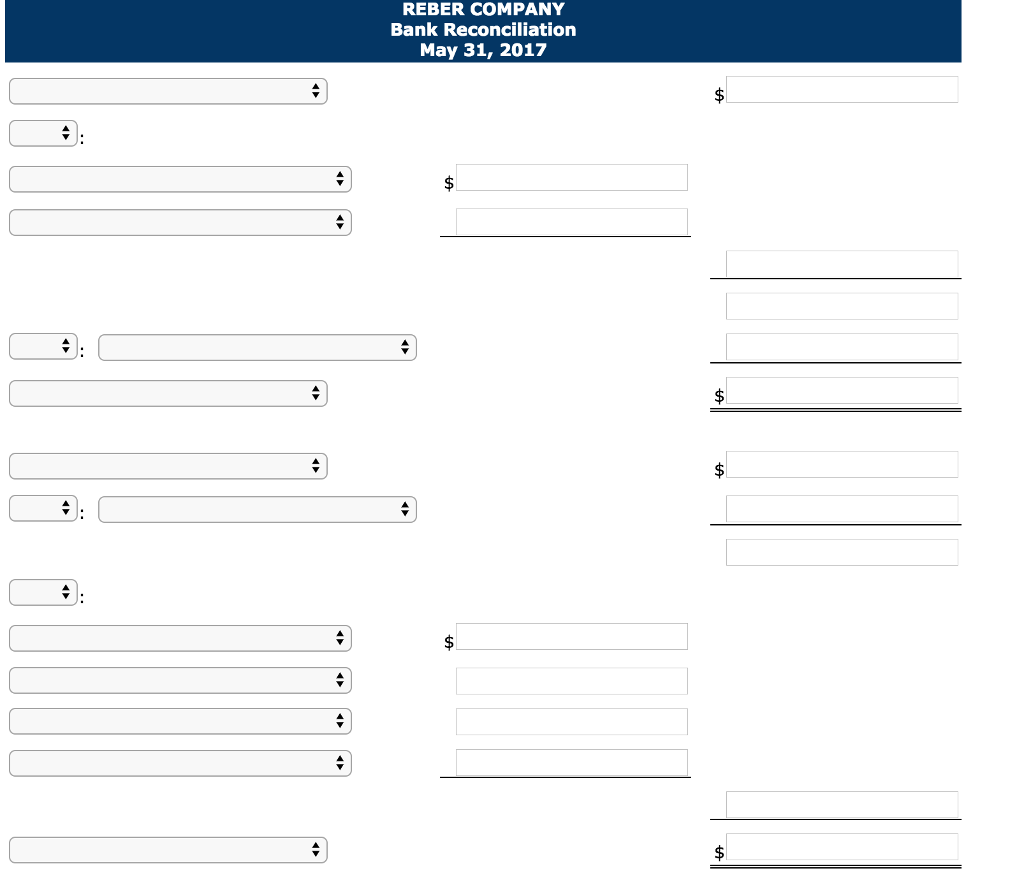

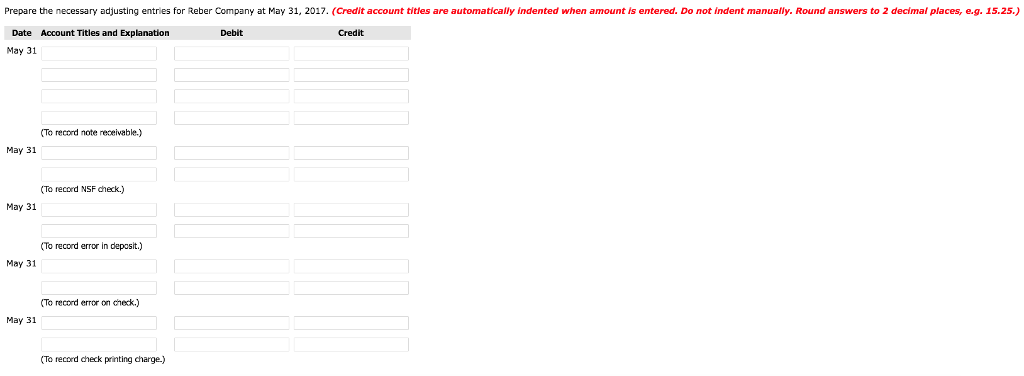

Problem 7-3A On May 31, 2017, Reber Company had a cash balance per books of $7,181.50. The bank statement from New York State Bank on that date showed a balance of $6,804.60. A comparison of the statement with the cash account revealed the following facts. . The statement included a dehit memo of $45.00 for the printing of additional company checks. 2. Cash sales of $934.00 on May 12 were deposited in the bank. The cash receipts joumal entry and the deposit sip were incorrectly made for $984.00. The bank credited Reber Company for the correct amount. 3. Outstanding checks at May 31 totaled $967.25. Deposits in transit were $2,816.15. 4. On May 18, the company issued check No. 1181 for $675 to Lynda Carsen on account. The check, which cleared the bank in May, was incorrectly journalized and posted by Reber Company for $657 5. A $3,400.00 note recelvable was collected by the bank for Reber Company on May 31 plus $85.00 interest. The bank charged a collection fee of $25.00. No interest has been accrued on the note. 6. Included with the canceled checks was a check issued by Stiner Company to Ted Cress for 1,200.00 that was incorrectly charged to Reber Company by the bank. 7. On May 31, the bank statement showed an NSF charge of $675.00 for a check issued by Sue Allison, a customer, to Reber Company on account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts