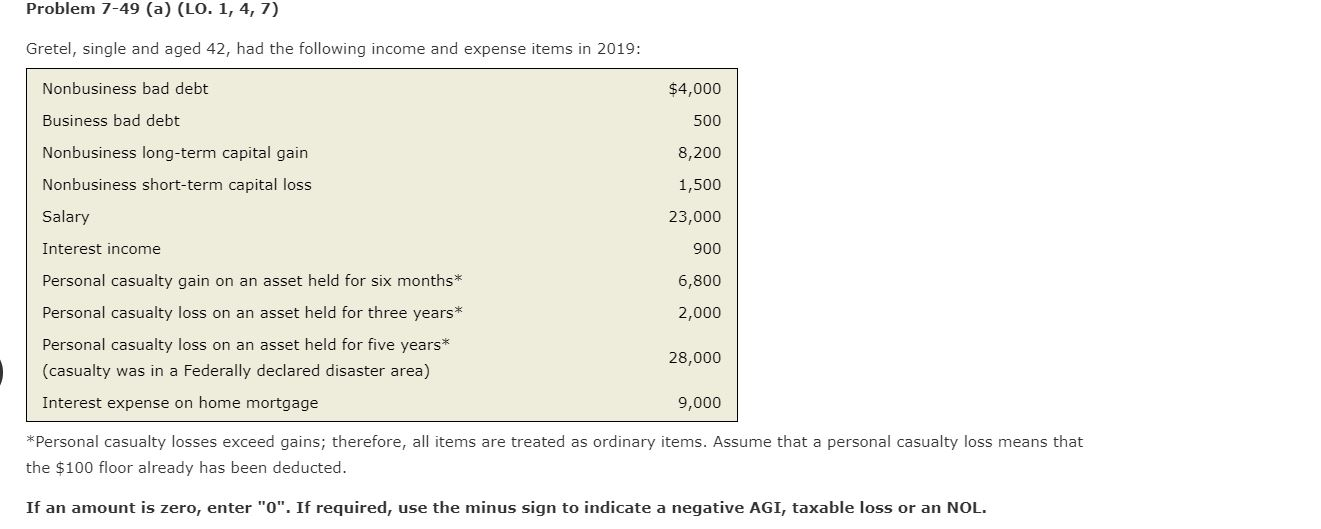

Question: Problem 7-49 (a) (LO. 1, 4, 7) Gretel, single and aged 42, had the following income and expense items in 2019: Nonbusiness bad debt $4,000

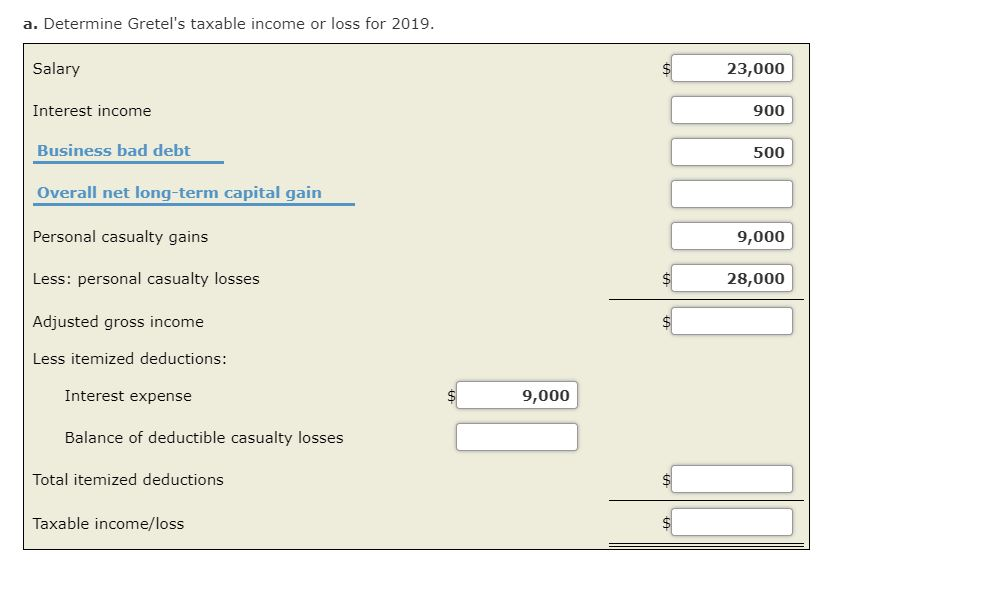

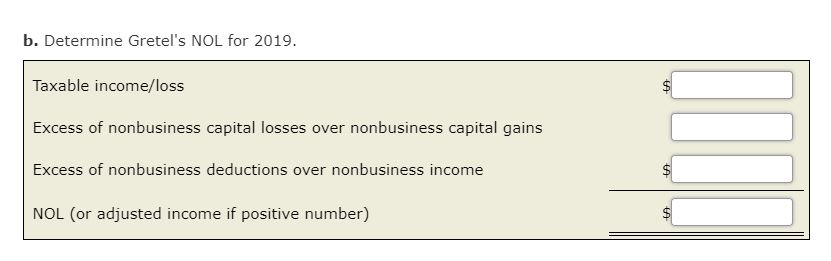

Problem 7-49 (a) (LO. 1, 4, 7) Gretel, single and aged 42, had the following income and expense items in 2019: Nonbusiness bad debt $4,000 Business bad debt 500 Nonbusiness long-term capital gain 8,200 Nonbusiness short-term capital loss 1,500 Salary 23,000 Interest income 900 Personal casualty gain on an asset held for six months* 6,800 Personal casualty loss on an asset held for three years* 2,000 Personal casualty loss on an asset held for five years 28,000 (casualty was in a Federally declared disaster area) Interest expense on home mortgage 9,000 *Personal casualty losses exceed gains; therefore, all items are treated as ordinary items. Assume that a personal casualty loss means that the $100 floor already has been deducted If an amount is zero, enter "0". If required, use the minus sign to indicate a negative AGI, taxable loss or an NOL a. Determine Gretel's taxable income or loss for 2019. Salary 23,000 Interest income 900 Business bad debt 500 Overall net long-term capital gain Personal casualty gains 9,000 Less: personal casualty losses 28,000 Adjusted gross income Less itemized deductions: Interest expense 9,000 Balance of deductible casualty losses Total itemized deductions Taxable income/loss b. Determine Gretel's NOL for 2019. Taxable income/loss Excess of nonbusiness capital losses over nonbusiness capital gains Excess of nonbusiness deductions over nonbusiness income NOL (or adjusted income if positive number) Problem 7-49 (a) (LO. 1, 4, 7) Gretel, single and aged 42, had the following income and expense items in 2019: Nonbusiness bad debt $4,000 Business bad debt 500 Nonbusiness long-term capital gain 8,200 Nonbusiness short-term capital loss 1,500 Salary 23,000 Interest income 900 Personal casualty gain on an asset held for six months* 6,800 Personal casualty loss on an asset held for three years* 2,000 Personal casualty loss on an asset held for five years 28,000 (casualty was in a Federally declared disaster area) Interest expense on home mortgage 9,000 *Personal casualty losses exceed gains; therefore, all items are treated as ordinary items. Assume that a personal casualty loss means that the $100 floor already has been deducted If an amount is zero, enter "0". If required, use the minus sign to indicate a negative AGI, taxable loss or an NOL a. Determine Gretel's taxable income or loss for 2019. Salary 23,000 Interest income 900 Business bad debt 500 Overall net long-term capital gain Personal casualty gains 9,000 Less: personal casualty losses 28,000 Adjusted gross income Less itemized deductions: Interest expense 9,000 Balance of deductible casualty losses Total itemized deductions Taxable income/loss b. Determine Gretel's NOL for 2019. Taxable income/loss Excess of nonbusiness capital losses over nonbusiness capital gains Excess of nonbusiness deductions over nonbusiness income NOL (or adjusted income if positive number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts