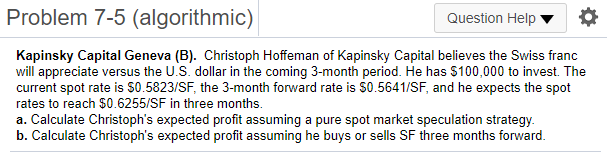

Question: Problem 7-5 (algorithmic) Question Help Kapinsky Capital Geneva (B). Christoph Hoffeman of Kapinsky Capital believes the Swiss franc will appreciate versus the U.S. dollar in

Problem 7-5 (algorithmic) Question Help Kapinsky Capital Geneva (B). Christoph Hoffeman of Kapinsky Capital believes the Swiss franc will appreciate versus the U.S. dollar in the coming 3-month period. He has $100,000 to invest. The current spot rate is $0.5823/SF, the 3-month forward rate is $0.5641/SF, and he expects the spot rates to reach $0.6255/SF in three months. a. Calculate Christoph's expected profit assuming a pure spot market speculation strategy. b. Calculate Christoph's expected profit assuming he buys or sells SF three months forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts