Question: Problem 7-5 Formula in blue areas ( 5 points) Paste Preferred stock valuation. TXS Manufacturing has an outstanding preferred stock issue with a par value

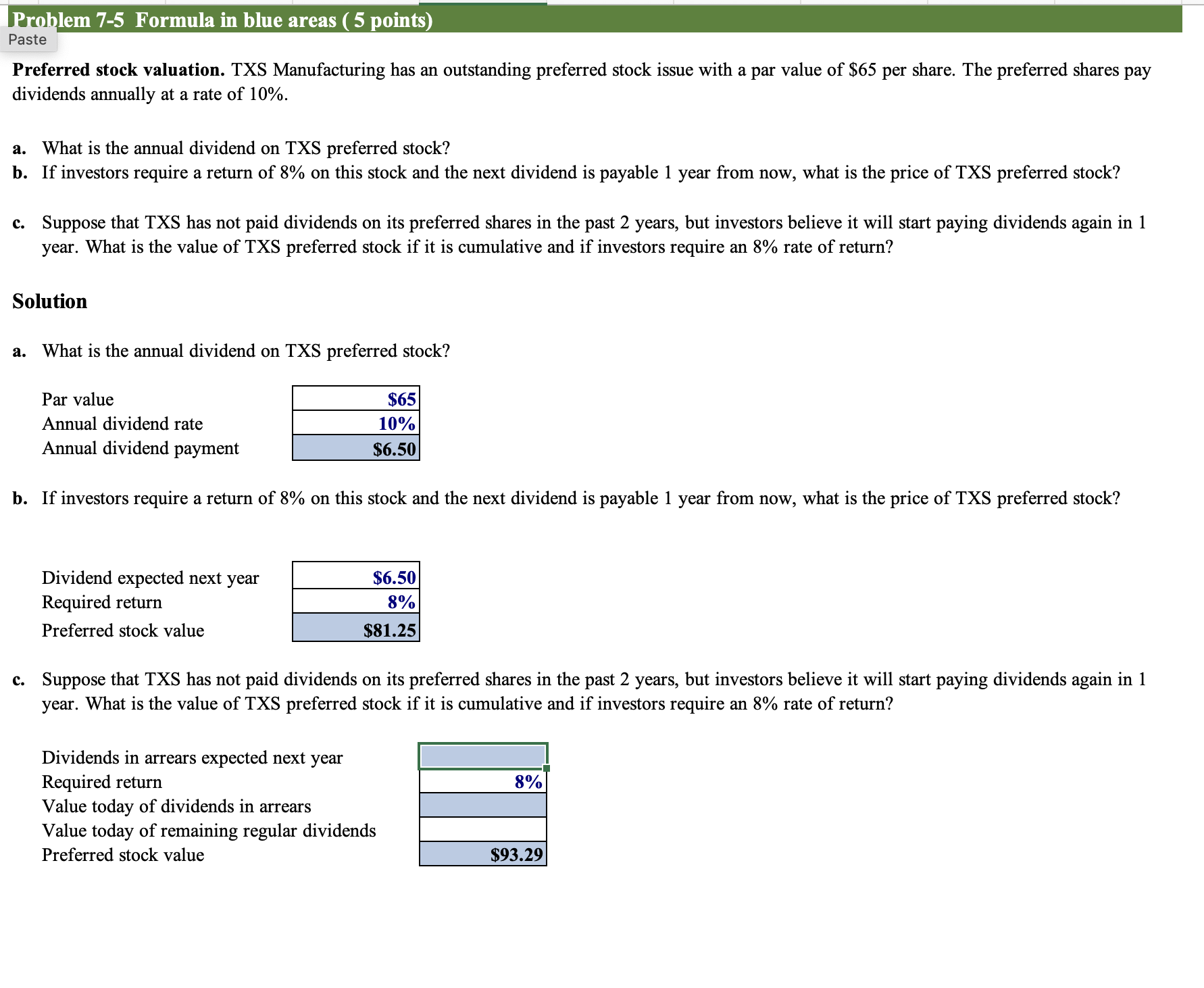

Problem 7-5 Formula in blue areas ( 5 points) Paste Preferred stock valuation. TXS Manufacturing has an outstanding preferred stock issue with a par value of $65 per share. The preferred shares pay dividends annually at a rate of 10%. a. What is the annual dividend on TXS preferred stock? b. If investors require a return of 8% on this stock and the next dividend is payable 1 year from now, what is the price of TXS preferred stock? c. Suppose that TXS has not paid dividends on its preferred shares in the past 2 years, but investors believe it will start paying dividends again in 1 year. What is the value of TXS preferred stock if it is cumulative and if investors require an 8% rate of return? Solution a. What is the annual dividend on TXS preferred stock? b. If investors require a return of 8% on this stock and the next dividend is payable 1 year from now, what is the price of TXS preferred stock? c. Suppose that TXS has not paid dividends on its preferred shares in the past 2 years, but investors believe it will start paying dividends again in 1 year. What is the value of TXS preferred stock if it is cumulative and if investors require an 8% rate of return? Problem 7-5 Formula in blue areas ( 5 points) Paste Preferred stock valuation. TXS Manufacturing has an outstanding preferred stock issue with a par value of $65 per share. The preferred shares pay dividends annually at a rate of 10%. a. What is the annual dividend on TXS preferred stock? b. If investors require a return of 8% on this stock and the next dividend is payable 1 year from now, what is the price of TXS preferred stock? c. Suppose that TXS has not paid dividends on its preferred shares in the past 2 years, but investors believe it will start paying dividends again in 1 year. What is the value of TXS preferred stock if it is cumulative and if investors require an 8% rate of return? Solution a. What is the annual dividend on TXS preferred stock? b. If investors require a return of 8% on this stock and the next dividend is payable 1 year from now, what is the price of TXS preferred stock? c. Suppose that TXS has not paid dividends on its preferred shares in the past 2 years, but investors believe it will start paying dividends again in 1 year. What is the value of TXS preferred stock if it is cumulative and if investors require an 8% rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts