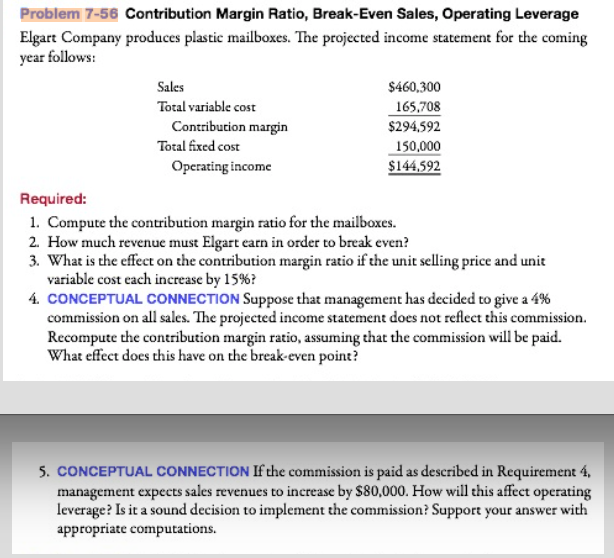

Question: Problem 7-56 Contribution Margin Ratio, Break-Even Sales, Operating Leverage Elgart Company produces plastic mailboxes. The projected income statement for the coming year follows: Sales Total

Problem 7-56 Contribution Margin Ratio, Break-Even Sales, Operating Leverage Elgart Company produces plastic mailboxes. The projected income statement for the coming year follows: Sales Total variable cost $460,300 165,708 $294,592 150,000 $144,592 Contribution margin Total fixed cost Operatingincome Required: for the mailboxes. 1. Compute the contribution margin ratio 2. How much revenue must Elgart earn in order to break even? 3. What is the effect on the contribution margin ratio if the unit selling price and unit variable cost each increase by 15%? 4. CONCEPTUAL CONNEC TION Suppose that management has decided to give a 4% commission on all sales. The projected income statement does not reflect this commission. Recompute the contribution margin ratio, assuming t What effect does this have on the break-even point? that the commission will be paid. 5. CONCEPTUAL CONNECTION If the commission is paid as described in Requirement 4 management expects sales revenues to increase by $80,000. How will this affect operating leverage? Is it a sound decision to implement the commission? Support your answer with appropriate computations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts