Question: Problem 7-5A (Algo) Analyzing and journalizing notes receivable transactions LO C2, C3, P4 The following transactions are from Ohlm Company. (Use 360 days a year.)

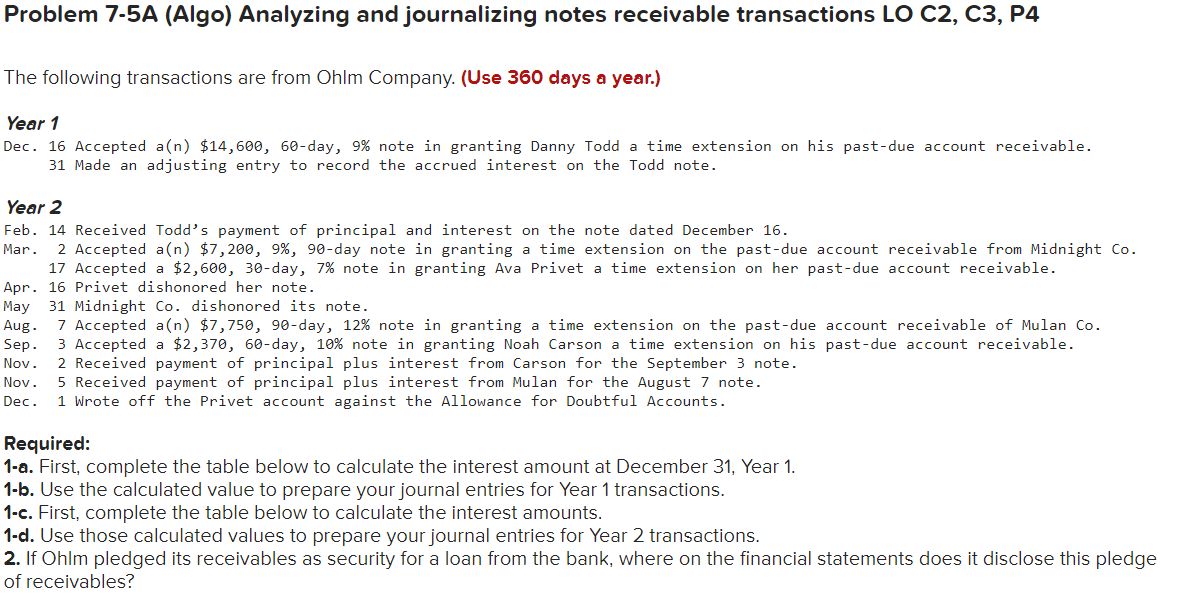

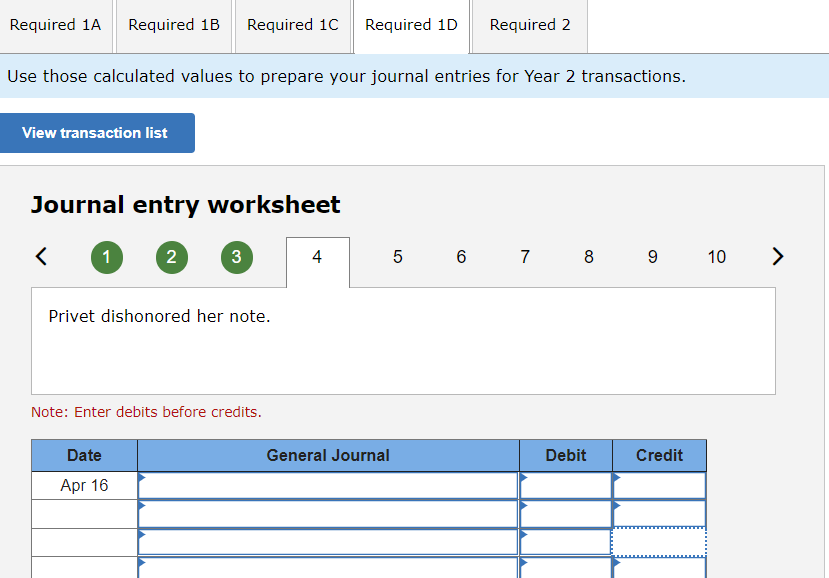

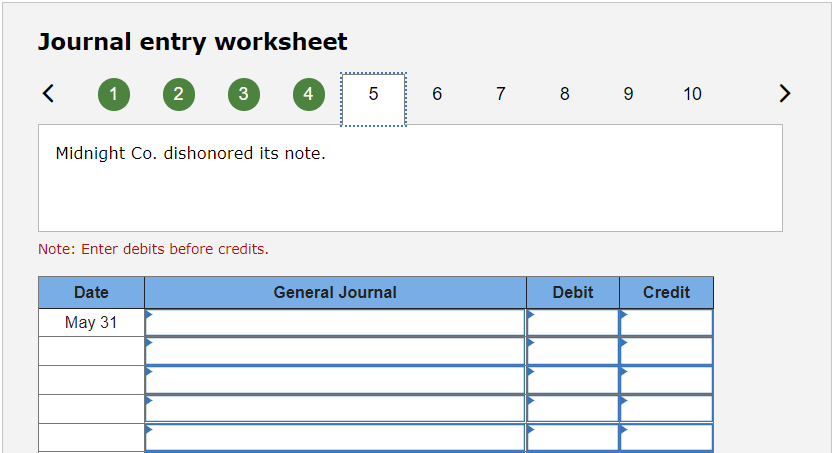

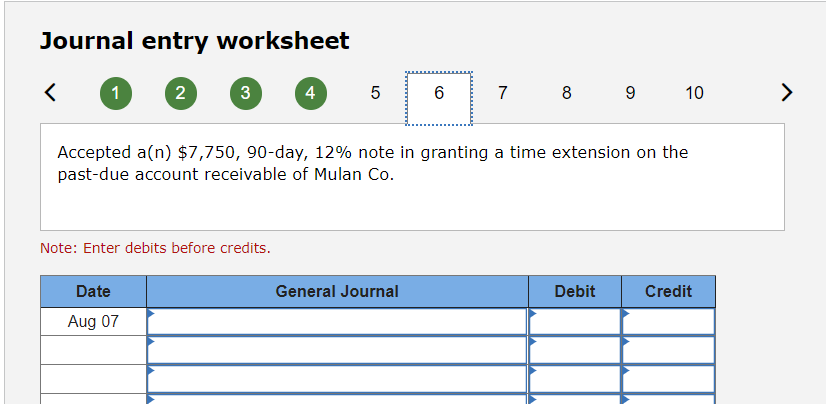

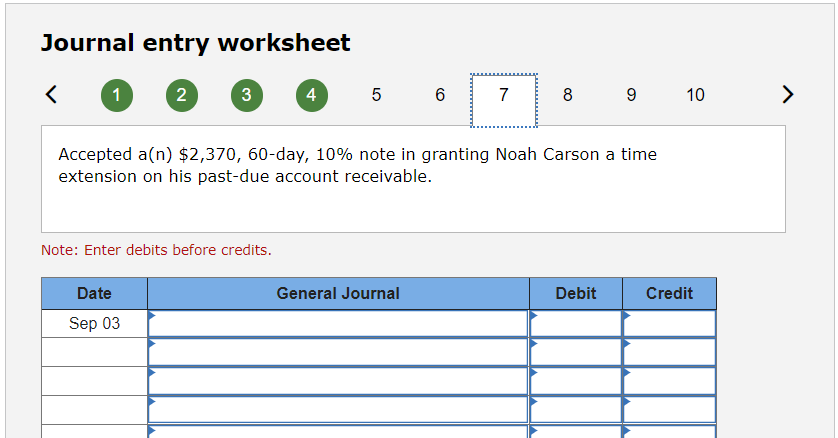

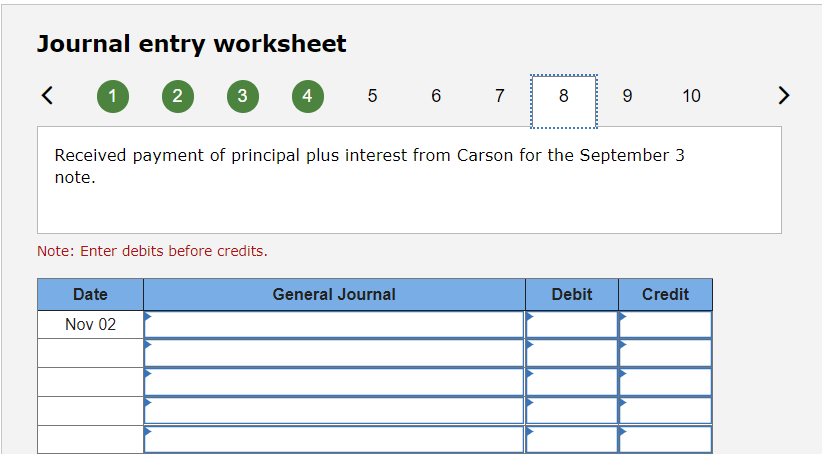

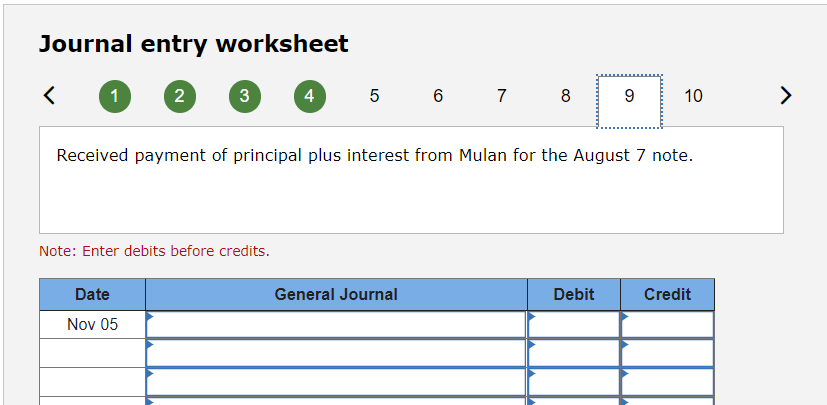

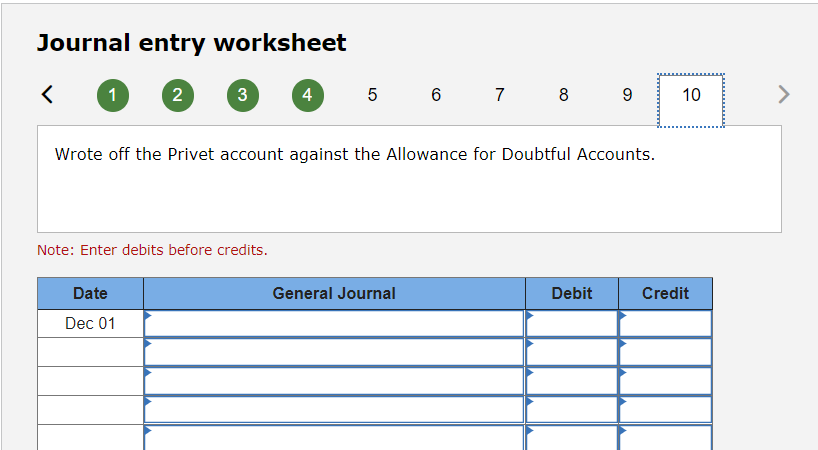

Problem 7-5A (Algo) Analyzing and journalizing notes receivable transactions LO C2, C3, P4 The following transactions are from Ohlm Company. (Use 360 days a year.) Year 1 Dec. 16 Accepted a(n) $14,600, 60-day, 9% note in granting Danny Todd a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 Feb. 14 Received Todd's payment of principal and interest on the note dated December 16. Mar. 2 Accepted a(n) $7,200, 9%, 90-day note in granting a time extension on the past-due account receivable from Midnight Co. 17 Accepted a $2,600, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Apr. 16 Privet dishonored her note. May 31 Midnight Co. dishonored its note. Aug. 7 Accepted a(n) $7,750, 90-day, 12% note in granting a time extension on the past-due account receivable of Mulan Co. 3 Accepted a $2,370, 60-day, 10% note in granting Noah Carson a time extension on his past-due account receivable. Nov. 2 Received payment of principal plus interest from Carson for the September 3 note. Nov. 5 Received payment of principal plus interest from Mulan for the August 7 note. 1 Wrote off the Privet account against the Allowance for Doubtful Accounts. Sep. Dec. Required: 1-a. First, complete the table below to calculate the interest amount at December 31, Year 1. 1-b. Use the calculated value to prepare your journal entries for Year 1 transactions. 1-c. First, complete the table below to calculate the interest amounts. 1-d. Use those calculated values to prepare your journal entries for Year 2 transactions. 2. If Ohlm pledged its receivables as security for a loan from the bank, where on the financial statements does it disclose this pledge of receivables? Required 1A Required 1B Required 10 Required 10 Required 2 Use those calculated values to prepare your journal entries for Year 2 transactions. View transaction list Journal entry worksheet Privet dishonored her note. Note: Enter debits before credits. Date General Journal Debit Credit Apr 16 Journal entry worksheet Midnight Co. dishonored its note. Note: Enter debits before credits. General Journal Debit Credit Date May 31 Journal entry worksheet Accepted a(n) $7,750, 90-day, 12% note in granting a time extension on the past-due account receivable of Mulan Co. Note: Enter debits before credits. Date General Journal Debit Credit Aug 07 Journal entry worksheet Accepted a(n) $2,370, 60-day, 10% note in granting Noah Carson a time extension on his past-due account receivable. Note: Enter debits before credits. Date General Journal Debit Credit Sep 03 Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 > Received payment of principal plus interest from Carson for the September 3 note. Note: Enter debits before credits. General Journal Debit Credit Date Nov 02 Journal entry worksheet Received payment of principal plus interest from Mulan for the August 7 note. Note: Enter debits before credits. General Journal Debit Credit Date Nov 05 Journal entry worksheet Wrote off the Privet account against the Allowance for Doubtful Accounts. Note: Enter debits before credits. General Journal Debit Credit Date Dec 01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts