Question: Problem 7-7 Expected return and standard deviation A game of chance offers the following odds and payoffs. Each play of the game costs $200. so

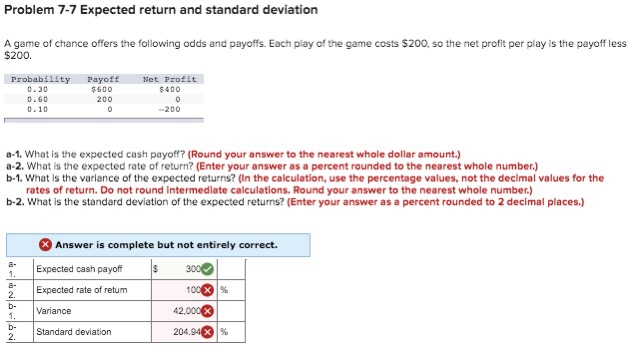

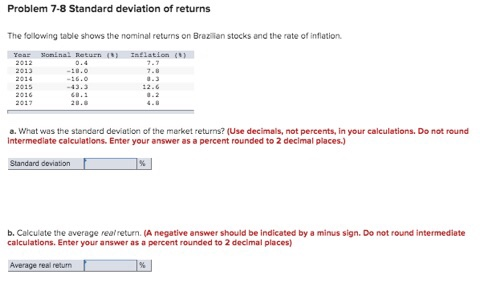

Problem 7-7 Expected return and standard deviation A game of chance offers the following odds and payoffs. Each play of the game costs $200. so the net profit per play is the payoff less $200. Payoff $600 Net Profit $ 400 Probability 0.30 0.60 0.10 200 -200 a-1. What is the expected cash payoff? (Round your answer to the nearest whole dollar amount.) a-2. What is the expected rate of return? (Enter your answer as a percent rounded to the nearest whole number.) b-1. What is the variance of the expected returns? (In the calculation, use the percentage values, not the decimal values for the rates of return. Do not round Intermediate calculations. Round your answer to the nearest whole number.) b-2. What is the standard deviation of the expected returns? (Enter your answer as a percent rounded to 2 decimal places.) Answer is complete but not entirely correct. Expected cash payoff $ 300 Expected rate of retum 100 % Variance 42,000 Standard deviation 204.94 % illo Problem 7-8 Standard deviation of returns The following table shows the nominal returns on Brazilian Stocks and the rate of inflation Inflation ) Year Sonial Return (8) 2012 a. What was the standard deviation of the market returns? (Use decimals, not percents, in your calculations. Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places) Standard deviation b. Calculate the average rearretum (A negative answer should be indicated by a minus sign. Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places) Average real retum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts