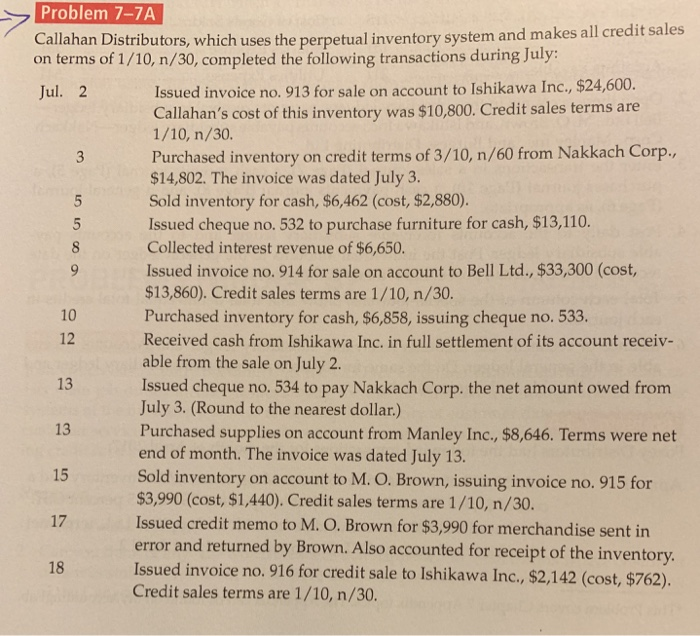

Question: Problem 7-7A Problem 7-7A Callahan Distributors, which uses the perpetual inventory system and makes all credi on terms of 1/10, n/30, completed the following transactions

Problem 7-7A Callahan Distributors, which uses the perpetual inventory system and makes all credi on terms of 1/10, n/30, completed the following transactions during July t sales Jul. 2 Issued invoice no. 913 for sale on account to Ishikawa Inc, $24,600. Callahan's cost of this inventory was $10,800. Credit sales terms are 1/10, n/30 Purchased inventory on credit terms of 3/10, n/60 from Nakkach Corp., $14,802. The invoice was dated July 3. Sold inventory for cash, $6,462 (cost, $2,880) Issued cheque no. 532 to purchase furniture for cash, $13,110. Collected interest revenue of $6,650. Issued invoice no. 914 for sale on account to Bell Ltd., $33,300 (cost, $13,860). Credit sales terms are 1/10, n/30 Purchased inventory for cash, $6,858, issuing cheque no. 533 Received cash from Ishikawa Inc. in full settlement of its account receiv- able from the sale on July 2. Issued cheque no. 534 to pay Nakkach Corp. the net amount owed from July 3. (Round to the nearest dollar.) Purchased supplies on account from Manley Inc., $8,646. Terms were net end of month. The invoice was dated July 13. Sold inventory on account to M. O. Brown, issuing invoice no. 915 for $3,990 (cost, $1,440). Credit sales terms are 1/10, n/30. Issued credit memo to M. O. Brown for $3,990 for merchandise sent in error and returned by Brown. Also accounted for receipt of the inventory Issued invoice no. 916 for credit sale to Ishikawa Inc., $2,142 (cost, $762) Credit sales terms are 1/10, n/30 10 12 13 13 15 17 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts