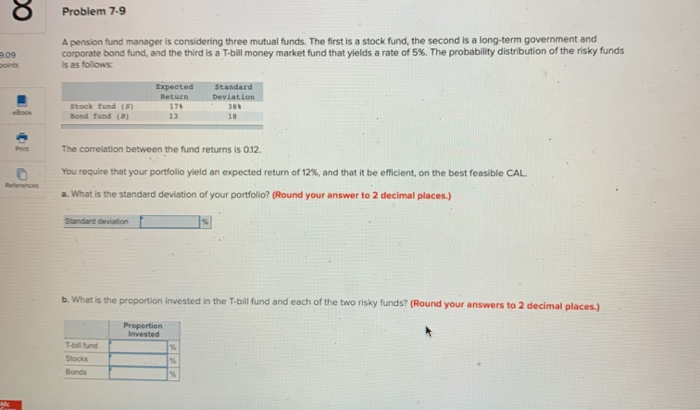

Question: Problem 7-9 . 18 oC 209 points A pension fund manager is considering three mutual funds. The first is a stock fund, the second is

Problem 7-9 . 18 oC 209 points A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 5%. The probability distribution of the risky funds is as follows: Expected Return Standard Deviation Stock fund (5) Bond fund (3) The correlation between the fund returns is 0.12. You require that your portfolio yield an expected return of 12%, and that it be efficient, on the best feasible CAL. l a. What is the standard deviation of your portfolio? (Round your answer to 2 decimal places.) Standard deviation b. What is the proportion invested in the T-bill fund and each of the two risky funds? (Round your answers to 2 decimal places.) Proportion Invested Tund Stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts