Question: Problem 8 - 0 2 The Clipper Salboat Company is expected to earn $ 3 per share next year. The company will have a return

Problem

The Clipper Salboat Company is expected to earn $ per share next year. The company will have a return on equity of percent and the company will

percent in the future. The company has a cost of equity of percent. Given that information, answer the following questions.

a What is the value of the company's stock? Do not round intermediate calculations. Round your answer to the nearest cent.

$

b What is the present value of the growth opportunity? Do not round intermediate calculations. Round your answer to the nearest cent.

$

c Assume that the growth rate is only percent. What would the appropriate PE multiple be for this stock? Do not round intermediate calculations.

Round your answer to two decimal places.

Problem

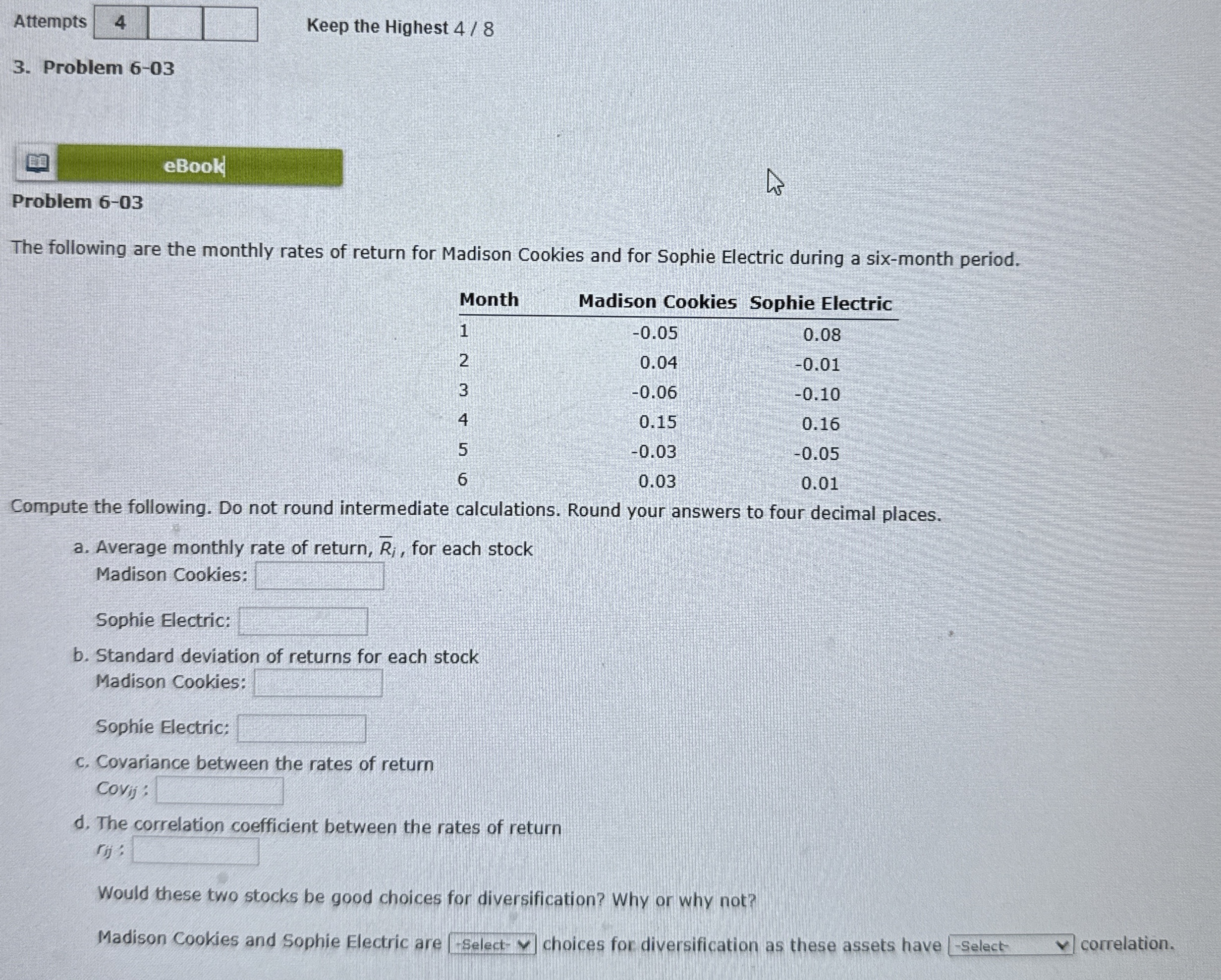

The following are the monthly rates of return for Madison Cookies and for Sophie Electric during a sixmonth period.

Compute the following. Do not round intermediate calculations. Round your answers to four decimal places.

a Average monthly rate of return, for each stock

Madison Cookies:

Sophie Electric:

b Standard deviation of returns for each stock

Madison Cookies:

Sophie Electric:

c Covariance between the rates of return

Cov :

d The correlation coefficient between the rates of return

:

Would these two stocks be good choices for diversification? Why or why not?

Madison Cookies and Sophie Electric are

choices for diversification as these assets have

correlation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock