Question: Problem 8 - 1 1 ( Algorithmic ) Modified Accelerated Cost Recovery System ( MACRS ) and Bonus Depreciation, Listed Property ( LO 8 .

Problem Algorithmic

Modified Accelerated Cost Recovery System MACRS and Bonus Depreciation, Listed Property LO

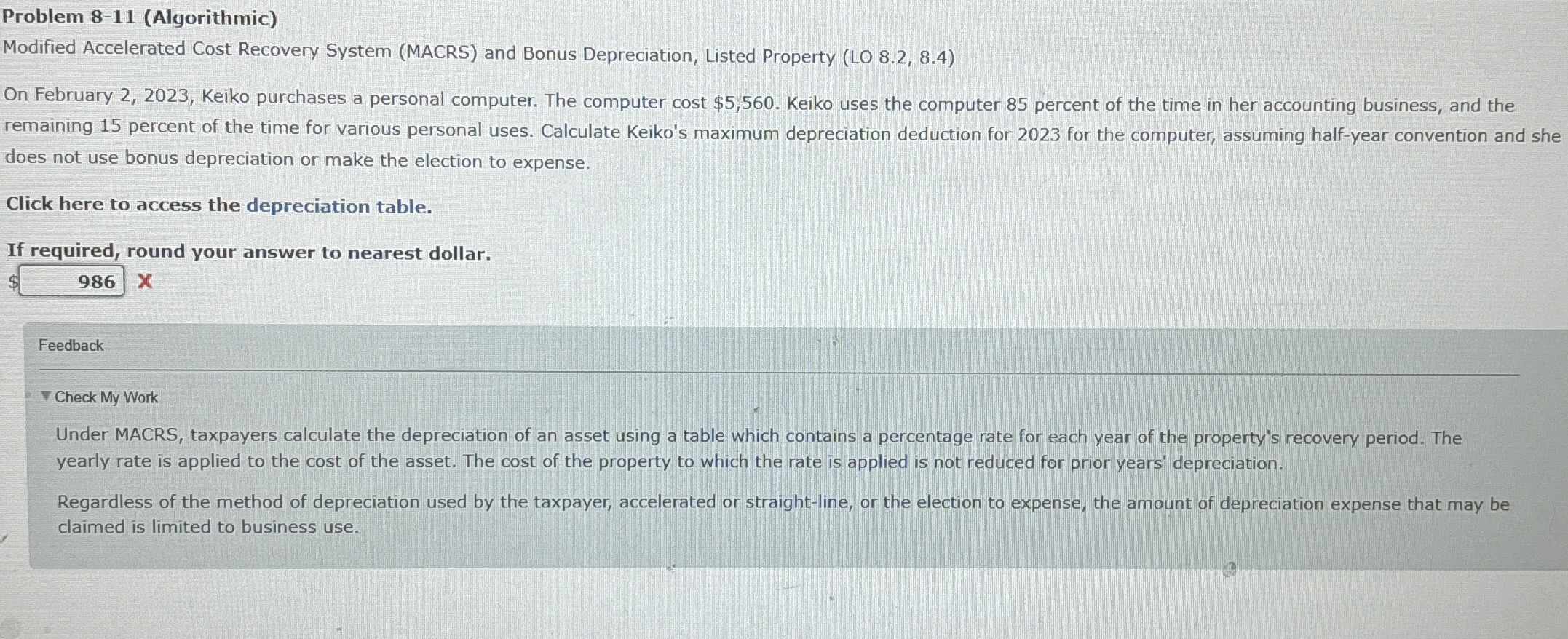

On February Keiko purchases a personal computer. The computer cost $ Keiko uses the computer percent of the time in her accounting business, and the remaining percent of the time for various personal uses. Calculate Keiko's maximum depreciation deduction for for the computer, assuming halfyear convention and she does not use bonus depreciation or make the election to expense.

Click here to access the depreciation table.

If required, round your answer to nearest dollar.

$

Feedback

Check My Work

Under MACRS, taxpayers calculate the depreciation of an asset using a table which contains a percentage rate for each year of the property's recovery period. The yearly rate is applied to the cost of the asset. The cost of the property to which the rate is applied is not reduced for prior years' depreciation.

Regardless of the method of depreciation used by the taxpayer, accelerated or straightline, or the election to expense, the amount of depreciation expense that may be claimed is limited to business use.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock