Question: Problem 8 - 1 3 An all - equity financed company has a cost of capital of 1 0 percent It owns one asset a

Problem

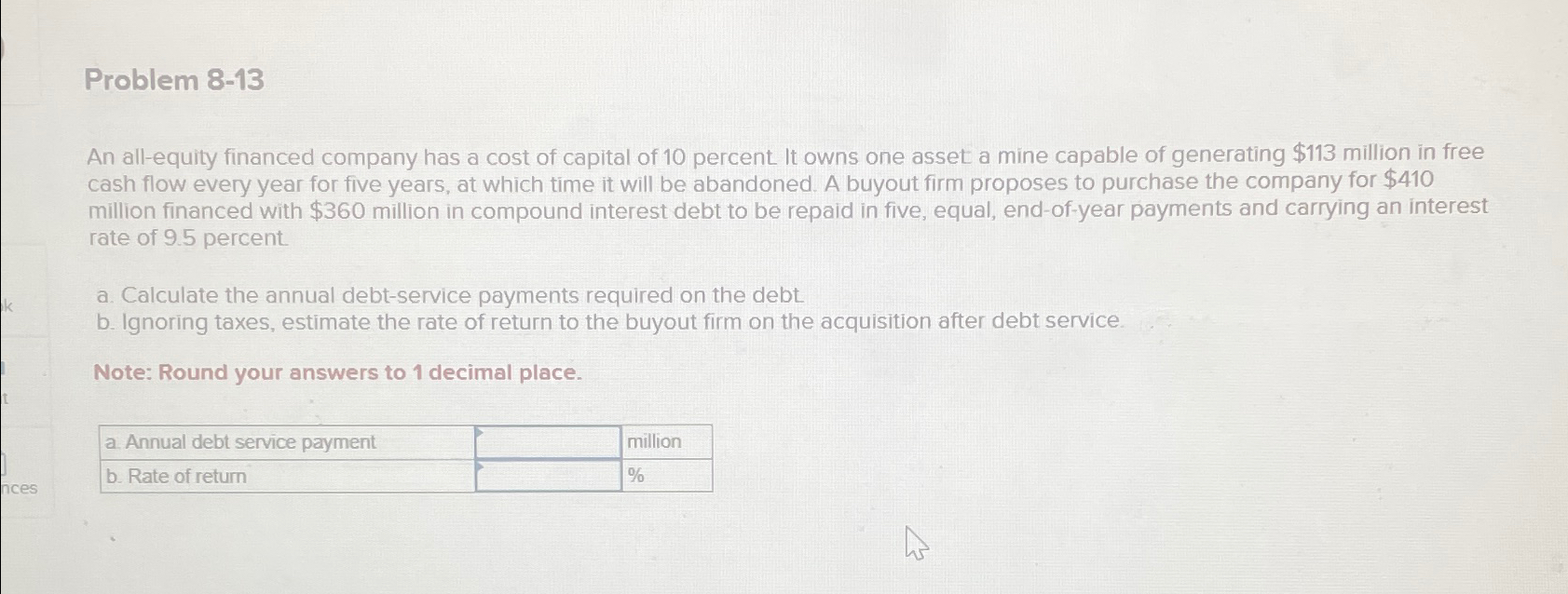

An allequity financed company has a cost of capital of percent It owns one asset a mine capable of generating $ million in free cash flow every year for five years, at which time it will be abandoned. A buyout firm proposes to purchase the company for $ million financed with $ million in compound interest debt to be repaid in five, equal, endof year payments and carrying an interest rate of percent.

a Calculate the annual debtservice payments required on the debt.

b Ignoring taxes, estimate the rate of return to the buyout firm on the acquisition after debt service.

Note: Round your answers to decimal place.

tablea Annual debt service payment,,millionb Rate of return,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock